Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

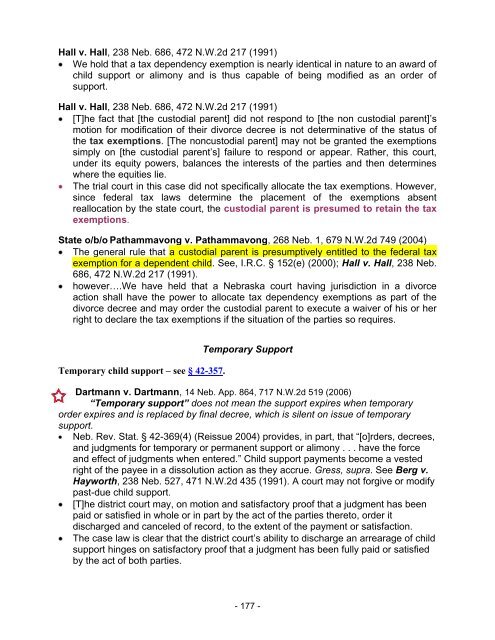

Hall v. Hall, 238 Neb. 686, 472 N.W.2d 217 (1991)<br />

We hold that a tax dependency exemption is nearly identical in nature to an award of<br />

child support or alimony and is thus capable of being modified as an order of<br />

support.<br />

Hall v. Hall, 238 Neb. 686, 472 N.W.2d 217 (1991)<br />

[T]he fact that [the custodial parent] did not respond to [the non custodial parent]’s<br />

motion for modification of their divorce decree is not determinative of the status of<br />

the tax exemptions. [The noncustodial parent] may not be granted the exemptions<br />

simply on [the custodial parent’s] failure to respond or appear. Rather, this court,<br />

under its equity powers, balances the interests of the parties and then determines<br />

where the equities lie.<br />

The trial court in this case did not specifically allocate the tax exemptions. However,<br />

since federal tax laws determine the placement of the exemptions absent<br />

reallocation by the state court, the custodial parent is presumed to retain the tax<br />

exemptions.<br />

State o/b/o Pathammavong v. Pathammavong, 268 Neb. 1, 679 N.W.2d 749 (2004)<br />

The general rule that a custodial parent is presumptively entitled to the federal tax<br />

exemption for a dependent child. See, I.R.C. § 152(e) (2000); Hall v. Hall, 238 Neb.<br />

686, 472 N.W.2d 217 (1991).<br />

however….We have held that a <strong>Nebraska</strong> court having jurisdiction in a divorce<br />

action shall have the power to allocate tax dependency exemptions as part of the<br />

divorce decree and may order the custodial parent to execute a waiver of his or her<br />

right to declare the tax exemptions if the situation of the parties so requires.<br />

Temporary child support – see § 42-357.<br />

Temporary <strong>Support</strong><br />

Dartmann v. Dartmann, 14 Neb. App. 864, 717 N.W.2d 519 (2006)<br />

“Temporary support” does not mean the support expires when temporary<br />

order expires and is replaced by final decree, which is silent on issue of temporary<br />

support.<br />

Neb. Rev. Stat. § 42-369(4) (Reissue 2004) provides, in part, that “[o]rders, decrees,<br />

and judgments for temporary or permanent support or alimony . . . have the force<br />

and effect of judgments when entered.” <strong>Child</strong> support payments become a vested<br />

right of the payee in a dissolution action as they accrue. Gress, supra. See Berg v.<br />

Hayworth, 238 Neb. 527, 471 N.W.2d 435 (1991). A court may not forgive or modify<br />

past-due child support.<br />

[T]he district court may, on motion and satisfactory proof that a judgment has been<br />

paid or satisfied in whole or in part by the act of the parties thereto, order it<br />

discharged and canceled of record, to the extent of the payment or satisfaction.<br />

The case law is clear that the district court’s ability to discharge an arrearage of child<br />

support hinges on satisfactory proof that a judgment has been fully paid or satisfied<br />

by the act of both parties.<br />

- 177 -