Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

Child Support Enforcement - Sarpy County Nebraska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

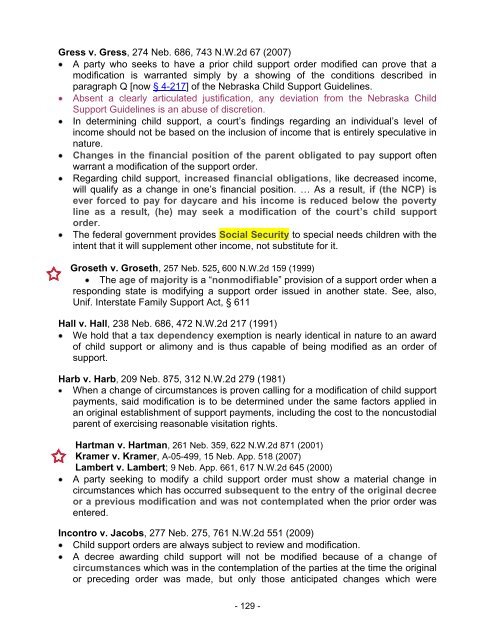

Gress v. Gress, 274 Neb. 686, 743 N.W.2d 67 (2007)<br />

A party who seeks to have a prior child support order modified can prove that a<br />

modification is warranted simply by a showing of the conditions described in<br />

paragraph Q [now § 4-217] of the <strong>Nebraska</strong> <strong>Child</strong> <strong>Support</strong> Guidelines.<br />

Absent a clearly articulated justification, any deviation from the <strong>Nebraska</strong> <strong>Child</strong><br />

<strong>Support</strong> Guidelines is an abuse of discretion.<br />

In determining child support, a court’s findings regarding an individual’s level of<br />

income should not be based on the inclusion of income that is entirely speculative in<br />

nature.<br />

Changes in the financial position of the parent obligated to pay support often<br />

warrant a modification of the support order.<br />

Regarding child support, increased financial obligations, like decreased income,<br />

will qualify as a change in one’s financial position. … As a result, if (the NCP) is<br />

ever forced to pay for daycare and his income is reduced below the poverty<br />

line as a result, (he) may seek a modification of the court’s child support<br />

order.<br />

The federal government provides Social Security to special needs children with the<br />

intent that it will supplement other income, not substitute for it.<br />

Groseth v. Groseth, 257 Neb. 525, 600 N.W.2d 159 (1999)<br />

The age of majority is a “nonmodifiable” provision of a support order when a<br />

responding state is modifying a support order issued in another state. See, also,<br />

Unif. Interstate Family <strong>Support</strong> Act, § 611<br />

Hall v. Hall, 238 Neb. 686, 472 N.W.2d 217 (1991)<br />

We hold that a tax dependency exemption is nearly identical in nature to an award<br />

of child support or alimony and is thus capable of being modified as an order of<br />

support.<br />

Harb v. Harb, 209 Neb. 875, 312 N.W.2d 279 (1981)<br />

When a change of circumstances is proven calling for a modification of child support<br />

payments, said modification is to be determined under the same factors applied in<br />

an original establishment of support payments, including the cost to the noncustodial<br />

parent of exercising reasonable visitation rights.<br />

Hartman v. Hartman, 261 Neb. 359, 622 N.W.2d 871 (2001)<br />

Kramer v. Kramer, A-05-499, 15 Neb. App. 518 (2007)<br />

Lambert v. Lambert; 9 Neb. App. 661, 617 N.W.2d 645 (2000)<br />

A party seeking to modify a child support order must show a material change in<br />

circumstances which has occurred subsequent to the entry of the original decree<br />

or a previous modification and was not contemplated when the prior order was<br />

entered.<br />

Incontro v. Jacobs, 277 Neb. 275, 761 N.W.2d 551 (2009)<br />

<strong>Child</strong> support orders are always subject to review and modification.<br />

A decree awarding child support will not be modified because of a change of<br />

circumstances which was in the contemplation of the parties at the time the original<br />

or preceding order was made, but only those anticipated changes which were<br />

- 129 -