PDF [4833KB] - Sony

PDF [4833KB] - Sony

PDF [4833KB] - Sony

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

operating income, the positive impact of the<br />

depreciation of the yen against the euro exceeded<br />

the negative impact of the appreciation<br />

of the yen against the U.S. dollar, resulting in a<br />

52 percent decrease in operating income on a<br />

local currency basis.<br />

By region, sales decreased in Japan, the<br />

U.S. and Europe. In Japan, hardware sales<br />

declined due to a strategic price reduction of<br />

PlayStation 2 hardware, despite higher unit<br />

sales of PlayStation 2 hardware. Software sales<br />

in Japan also decreased due to lower unit<br />

sales. In the U.S., sales declined due to a de-<br />

In terms of profitability, operating income<br />

decreased compared with the previous fiscal<br />

year. This decrease was due to an increase in<br />

research and development costs for future<br />

businesses and a decrease in hardware sales.<br />

Research and development costs increased by<br />

21.9 billion yen to 83.4 billion yen compared<br />

with the previous fiscal year. Although research<br />

and development costs for software<br />

development increased only slightly, costs for<br />

the development of semiconductors and<br />

process technologies increased significantly.<br />

Cost of sales in the Game segment decreased<br />

due to the decrease in hardware unit sales and<br />

reductions in the cost of producing hardware.<br />

The cost of sales to sales ratio, however,<br />

remained unchanged as the cost of producing<br />

PlayStation 2 hardware decreased in line with<br />

the decrease in hardware sales. Selling, general<br />

and administrative expenses decreased as a<br />

result of a decline in advertising and promo-<br />

crease in unit sales of PlayStation 2 hardware,<br />

a strategic price reduction of PlayStation 2<br />

hardware and a decrease in software unit<br />

sales. In Europe, although hardware unit sales<br />

increased as the market penetration of<br />

PlayStation 2 hardware continued to expand,<br />

hardware sales declined due to a strategic<br />

price reduction of PlayStation 2 hardware.<br />

Software unit sales and software sales in<br />

Europe both increased.<br />

Total worldwide production shipments of<br />

hardware and software were as follows:<br />

tion expenses, reflecting the decrease in hardware<br />

units sold. However, the ratio of selling,<br />

general and administrative expenses to sales<br />

rose compared to the previous fiscal year as<br />

the ratio of personnel related costs and advertising<br />

and promotion expenses to sales rose<br />

compared with the previous fiscal year.<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

8.3%<br />

(Million units)<br />

Cumulative as<br />

Year ended March 31 of March 31,<br />

2003 2004 2004<br />

Total Production Shipments of Hardware<br />

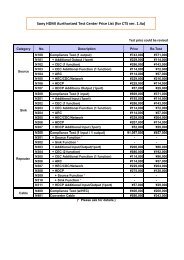

PlayStation + PS one . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.78 3.31 99.72<br />

PlayStation 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22.52 20.10 71.30<br />

Total Production Shipments of Software*<br />

PlayStation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61.00 32.00 949.00<br />

PlayStation 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 189.90 222.00 572.00<br />

* Including those both from <strong>Sony</strong> and third parties under <strong>Sony</strong> licenses.<br />

Sales and operating income in the Game segment<br />

(Billion ¥) (Billion ¥)<br />

11.8%<br />

02 03 04<br />

Sales (left)<br />

Operating income (right)<br />

Operating margin<br />

* Year ended March 31<br />

8.7%<br />

300<br />

200<br />

100<br />

0<br />

–100<br />

MUSIC<br />

Sales for the fiscal year ended March 31, 2004<br />

decreased by 37.6 billion yen, or 6.3 percent,<br />

to 559.9 billion yen compared with the previous<br />

fiscal year. Compared to an operating loss<br />

of 7.9 billion yen in the previous fiscal year,<br />

operating income of 19.0 billion yen was<br />

recorded this year.<br />

On a local currency basis, sales in the Music<br />

segment were flat while the Music segment<br />

recorded operating income as compared to an<br />

operating loss in the previous fiscal year.<br />

Sales at <strong>Sony</strong> Music Entertainment Inc.<br />

(“SMEI”), a U.S. based subsidiary, were flat on<br />

a U.S. dollar basis (refer to “Foreign Exchange<br />

Fluctuations and Risk Hedging” below). In<br />

terms of profitability, SMEI recorded operating<br />

income in the fiscal year as compared to an<br />

operating loss in the previous fiscal year. The<br />

appreciation of European currencies against<br />

the U.S. dollar contributed to higher sales outside<br />

of the U.S. which were offset by lower<br />

sales in the U.S. On a worldwide basis, total<br />

album sales at SMEI decreased due to the continued<br />

contraction of the global music industry<br />

and the lack of hit releases. Although unit<br />

sales in various markets such as the U.S. have<br />

begun to reverse their downward trend, the<br />

global music market has continued to experience<br />

an overall contraction primarily due to<br />

piracy (i.e. unauthorized file sharing and CD<br />

burning) and competition from other entertainment<br />

sectors.<br />

The increase in profitability resulted in operating<br />

income at SMEI, compared to an operating<br />

loss recorded in the previous fiscal year.<br />

The improvement in profitability primarily<br />

resulted from the benefits realized from the<br />

worldwide restructuring activities implemented<br />

over the past two years to reduce costs in response<br />

to the downward trend of the market.<br />

These activities included the rationalization of<br />

manufacturing, distribution and support<br />

functions including record label shared services<br />

through elimination of redundancy. Operating<br />

income also benefited from lower restructuring<br />

charges as compared to the prior year. The<br />

total cost of restructuring for the fiscal year<br />

ended March 31, 2004 was 95 million U.S.<br />

dollars or 10.7 billion yen, a decrease of 95<br />

million U.S. dollars from the prior year (refer to<br />

“Restructuring” above for details.) A third<br />

67

![PDF [4833KB] - Sony](https://img.yumpu.com/26420643/69/500x640/pdf-4833kb-sony.jpg)