PDF [4833KB] - Sony

PDF [4833KB] - Sony

PDF [4833KB] - Sony

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

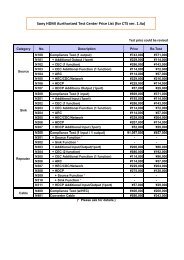

Quarterly Financial and Stock Information<br />

<strong>Sony</strong> Corporation and Consolidated Subsidiaries – Year ended March 31<br />

(Unaudited)<br />

Yen in billions except per share amounts<br />

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter<br />

2003 2004 2003 2004 2003 2004 2003 2004<br />

Sales and operating revenue . . . . . . . . . . . . . ¥1,721.8 ¥1,603.8 ¥1,789.7 ¥1,797.0 ¥2,307.7 ¥2,323.4 ¥1,654.4 ¥1,772.2<br />

Operating income (loss) . . . . . . . . . . . . . . . . 51.9 16.7 50.5 33.2 199.5 158.8 (116.5) (109.8)<br />

Income (loss) before income taxes . . . . . . . . 116.6 35.8 48.8 44.1 201.9 157.8 (119.7) (93.6)<br />

Income taxes . . . . . . . . . . . . . . . . . . . . . . . . 53.6 25.4 (14.9) 10.3 65.5 67.6 (23.4) (50.5)<br />

Income (loss) before cumulative effect of<br />

accounting changes . . . . . . . . . . . . . . . . . . 57.2 1.1 44.1 35.0 125.4 92.6 (111.1) (38.2)<br />

Net income (loss) . . . . . . . . . . . . . . . . . . . . . 57.2 1.1 44.1 32.9 125.4 92.6 (111.1) (38.2)<br />

Per share data of common stock<br />

Income (loss) before cumulative effect of accounting changes<br />

—Basic . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 62.23 ¥ 1.24 ¥ 47.89 ¥ 37.99 ¥ 136.19 ¥ 100.16 ¥(120.47) ¥ (41.23)<br />

—Diluted . . . . . . . . . . . . . . . . . . . . . . . 57.90 1.24 44.70 35.60 126.05 93.14 (120.47) (41.23)<br />

Net income (loss) . . . . . . . . . . . . . . . . . . .<br />

—Basic . . . . . . . . . . . . . . . . . . . . . . . . . 62.23 1.24 47.89 35.69 136.19 100.16 (120.47) (41.23)<br />

—Diluted . . . . . . . . . . . . . . . . . . . . . . . 57.90 1.24 44.70 33.48 126.05 93.14 (120.47) (41.23)<br />

Depreciation and amortization*. . . . . . . . . . . ¥ 83.3 ¥ 84.3 ¥ 83.7 ¥ 87.4 ¥ 88.7 ¥ 95.2 ¥ 96.2 ¥ 99.3<br />

Capital expenditures<br />

(additions to fixed assets) . . . . . . . . . . . . . . 60.7 81.0 67.0 90.0 56.9 97.6 76.6 109.6<br />

R&D expenses. . . . . . . . . . . . . . . . . . . . . . . . 97.9 114.2 108.3 136.2 105.6 123.8 131.4 140.4<br />

Tokyo Stock Exchange price per share of common stock**:<br />

High . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 7,450 ¥ 4,190 ¥ 6,300 ¥ 4,410 ¥ 5,540 ¥ 4,200 ¥ 5,110 ¥ 4,660<br />

Low . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,810 2,720 4,850 3,430 4,870 3,520 4,080 3,780<br />

New York Stock Exchange price per American Depositary Share**:<br />

High . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 59.70 $ 35.51 $ 53.17 $ 38.30 $ 45.29 $ 37.96 $ 43.31 $ 42.36<br />

Low . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48.63 23.92 40.51 29.23 39.88 32.59 34.86 34.98<br />

* Including amortization expenses for intangible assets and for deferred insurance acquisition costs.<br />

** Stock price data are based on daily closing prices.<br />

Notes: 1. U.S. dollar amounts have been translated from yen, for convenience only, at the rate of ¥104=U.S.$1, the approximate Tokyo foreign exchange market rate as of March 31, 2004.<br />

2. In January 2003, the FASB issued FIN No. 46, “Consolidation of Variable Interest Entities — an Interpretation of ARB No. 51”. FIN No. 46 addresses consolidation by a primary beneficiary<br />

of a VIE. For VIEs created or acquired prior to February 1, 2003, <strong>Sony</strong> early adopted the provisions of FIN No. 46 on July 1, 2003. Under FIN No. 46, any difference between the net<br />

amount added to the balance sheet and the amount of any previously recognized interest in the VIE shall be recognized as a cumulative effect of accounting changes. As a result of<br />

adopting the original FIN No. 46, <strong>Sony</strong> recognized a one-time charge with no tax effect of ¥2,117 million ($20 million) as a cumulative effect of accounting change in the consolidated<br />

statement of income, and <strong>Sony</strong>’s assets and liabilities increased by ¥95,255 million ($916 million) and ¥97,950 million ($942 million), respectively. These increases were treated as noncash<br />

transactions in the consolidated statement of cash flows. In addition, cash and cash equivalents increased by ¥1,521 million ($15 million). In December 2003, the FASB issued FIN<br />

No. 46R, which replaces FIN No. 46. <strong>Sony</strong> early adopted the provisions of FIN No. 46R upon its issuance. The adoption of FIN No. 46R did not have an impact on <strong>Sony</strong>’s results of<br />

operations and financial position or impact the way <strong>Sony</strong> had previously accounted for VIEs.<br />

3. In November 2002, the FASB issued EITF Issue No. 00-21, “Accounting for Revenue Arrangements with Multiple Deliverables”. <strong>Sony</strong> adopted EITF Issue No. 00-21 on July 1, 2003. The<br />

adoption of EITF Issue No. 00-21 did not have a material impact on <strong>Sony</strong>’s results of operations and financial position for the year ended March 31, 2004.<br />

4. In May 2003, the FASB issued Statement of FAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity”. <strong>Sony</strong> adopted FAS No. 150 on<br />

April 1, 2003. The adoption of FAS No. 150 did not have an impact on <strong>Sony</strong>’s results of operations and financial position for the year ended March 31, 2004.<br />

5. In June 2002, the FASB issued FAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities” which nullifies EITF Issue No.94-3, “Liability Recognition for Certain<br />

Employee Termination Benefits and Other Costs to Exit an activity (including Certain Costs Incurred in a Restructuring)”. <strong>Sony</strong> adopted FAS No. 146 on January 1, 2003. The adoption of<br />

this statement did not have a material effect on <strong>Sony</strong>’s results of operations and financial position.<br />

6. In April 2003, the FASB issued FAS No. 149, “Amendment of Statement 133 on Derivative Instruments and Hedging Activities”. <strong>Sony</strong> adopted FAS No. 149 on July 1, 2003. The adoption<br />

of FAS No. 149 did not have an impact on <strong>Sony</strong>’s results of operations and financial position.<br />

91

![PDF [4833KB] - Sony](https://img.yumpu.com/26420643/93/500x640/pdf-4833kb-sony.jpg)