PDF [4833KB] - Sony

PDF [4833KB] - Sony

PDF [4833KB] - Sony

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

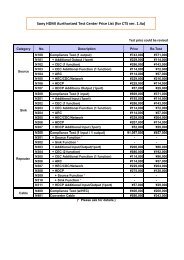

CONDENSED BALANCE SHEETS SEPARATING OUT THE FINANCIAL SERVICES SEGMENT<br />

As at March 31<br />

All other Segments<br />

Financial Services excluding Financial Services Consolidated<br />

(Yen in millions) 2003 2004 2003 2004 2003 2004<br />

Assets<br />

Current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 684,945 699,698 2,503,940 2,692,436 3,154,214 3,363,355<br />

Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . 274,543 256,316 438,515 592,895 713,058 849,211<br />

Marketable securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 236,621 270,676 4,899 4,072 241,520 274,748<br />

Notes and accounts receivable, trade . . . . . . . . . . . . . . . . . 68,188 72,273 943,073 943,590 1,007,395 1,011,189<br />

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105,593 100,433 1,117,453 1,151,879 1,192,241 1,228,207<br />

Film costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . – – 287,778 256,740 287,778 256,740<br />

Investments and advances . . . . . . . . . . . . . . . . . . . . . . . 1,731,415 2,274,510 383,004 358,629 1,994,123 2,512,950<br />

Investments in Financial Services, at cost . . . . . . . . . . . – – 166,905 176,905 – –<br />

Property, plant and equipment . . . . . . . . . . . . . . . . . . . 45,990 40,833 1,232,359 1,324,211 1,278,350 1,365,044<br />

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 434,769 459,998 1,251,810 1,251,901 1,656,080 1,592,573<br />

Deferred insurance acquisition costs . . . . . . . . . . . . . . . . . . 327,869 349,194 – – 327,869 349,194<br />

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106,900 110,804 1,251,810 1,251,901 1,328,211 1,243,379<br />

2,897,119 3,475,039 5,825,796 6,060,822 8,370,545 9,090,662<br />

Liabilities and stockholders’ equity<br />

Current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 415,877 648,803 2,065,854 2,373,550 2,435,048 2,982,215<br />

Short-term borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72,753 86,748 126,687 409,766 158,745 475,017<br />

Notes and accounts payable, trade . . . . . . . . . . . . . . . . . . . 5,417 7,847 693,589 773,221 697,385 778,773<br />

Deposits from customers in the banking business . . . . . . . . 248,721 378,851 – – 248,721 378,851<br />

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88,986 175,357 1,245,578 1,190,563 1,330,197 1,349,574<br />

Long-term liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,168,476 2,450,969 1,600,484 1,482,378 3,632,580 3,707,587<br />

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 140,908 135,811 802,911 775,233 807,439 777,649<br />

Accrued pension and severance costs . . . . . . . . . . . . . . . . . 8,737 10,183 487,437 358,199 496,174 368,382<br />

Future insurance policy benefits and other . . . . . . . . . . . . . 1,914,410 2,178,626 – – 1,914,410 2,178,626<br />

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 104,421 126,349 310,136 348,946 414,557 382,930<br />

Minority interest in consolidated subsidiaries . . . . . . . – – 16,288 17,554 22,022 22,858<br />

Stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . 312,766 375,267 2,143,170 2,187,340 2,280,895 2,378,002<br />

2,897,119 3,475,039 5,825,796 6,060,822 8,370,545 9,090,662<br />

INVESTMENTS<br />

<strong>Sony</strong> regularly evaluates its investment portfolio<br />

to identify other-than-temporary impairments<br />

of individual securities. Factors that are<br />

considered by <strong>Sony</strong> in determining whether an<br />

other-than-temporary decline in value has<br />

occurred include: the length of time and extent<br />

to which the market value of the security<br />

has been less than its original cost, the financial<br />

condition, operating results, business plans<br />

and estimated future cash flows of the issuer<br />

of the security, other specific factors affecting<br />

the market value, deterioration of issuer’s<br />

credit condition, sovereign risk, and whether<br />

or not <strong>Sony</strong> is able to retain the investment for<br />

a period of time sufficient to allow for the<br />

anticipated recovery in market value.<br />

In evaluating the factors for available-for-sale<br />

securities with readily determinable fair values,<br />

management presumes a decline in value to be<br />

other-than-temporary if the fair value of the<br />

security is 20 percent or more below its original<br />

cost for an extended period of time (generally<br />

a period of up to six to twelve months). The<br />

presumption of an other-than-temporary impairment<br />

in such cases may be overcome if<br />

there is evidence to support that the decline is<br />

temporary in nature due to the existence of<br />

other factors which overcome the duration or<br />

magnitude of the decline. On the other hand,<br />

there may be cases where impairment losses<br />

are recognized when the decline in the fair<br />

value of the security is not more than 20 percent<br />

or such decline has not existed for an extended<br />

period of time, as a result of considering<br />

specific factors which may indicate the decline<br />

in the fair value is other-than-temporary.<br />

The assessment of whether a decline in the<br />

value of an investment is other-than-temporary<br />

is often judgmental in nature and involves<br />

certain assumptions and estimates concerning<br />

the expected operating results, business plans<br />

and future cash flows of the issuer of the security.<br />

Accordingly, it is possible that investments<br />

in <strong>Sony</strong>’s portfolio that have had a decline in<br />

value that <strong>Sony</strong> currently believes to be temporary<br />

may be determined to be other-thantemporary<br />

in the future based on <strong>Sony</strong>’s<br />

evaluation of additional information such as<br />

continued poor operating results, future broad<br />

declines in value of worldwide equity markets<br />

and the effect of world wide interest rate fluctuations.<br />

As a result, unrealized losses recorded<br />

for investments may be recognized into<br />

income in future periods.<br />

The following table contains available for<br />

sale and held to maturity securities, breaking<br />

out the unrealized gains and losses by investment<br />

category.<br />

The most significant portion of these unre-<br />

74

![PDF [4833KB] - Sony](https://img.yumpu.com/26420643/76/500x640/pdf-4833kb-sony.jpg)