PDF [4833KB] - Sony

PDF [4833KB] - Sony

PDF [4833KB] - Sony

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

der recent conditions, management considers<br />

that it is possible that <strong>Sony</strong> Corporation’s future<br />

results may yield sufficient negative evidence<br />

to support the conclusion that it is more<br />

likely than not that <strong>Sony</strong> Corporation will not<br />

realize the tax benefit of all these deferred tax<br />

assets. If this is the case, subject to review of<br />

relevant qualitative factors and uncertainties,<br />

<strong>Sony</strong> may establish a valuation allowance<br />

against part or all of the deferred tax assets of<br />

<strong>Sony</strong> Corporation that would be charged to<br />

income as an increase in tax expense.<br />

As of March 31, 2004, the U.S. subsidiaries<br />

of <strong>Sony</strong> had a valuation allowance of 81.0<br />

billion yen against deferred tax assets for<br />

federal and certain state taxes. Since the U.S.<br />

subsidiaries did not have a sufficient history of<br />

taxable income at this time to conclude that it<br />

is more likely than not that the tax benefit from<br />

these deferred tax assets would be realized, a<br />

valuation allowance was established. Management<br />

believes this lack of sufficient earnings<br />

history, when evaluated in connection with<br />

relevant qualitative factors and uncertainties<br />

concerning the U.S. subsidiaries’ businesses<br />

and industries, provided substantial negative<br />

evidence, which outweighs any positive evidence,<br />

regarding the eventual realizability of<br />

the tax benefit of the deferred tax assets as of<br />

March 31, 2004. However, under recent<br />

conditions, management considers that it is<br />

possible that the U.S. subsidiaries’ future<br />

results may yield sufficient positive evidence to<br />

support the conclusion that it is more likely<br />

than not that the U.S. subsidiaries could realize<br />

the tax benefit of these deferred tax assets and<br />

that such a conclusion may be reached as early<br />

as during the fiscal year ending March 31,<br />

2005. If this is the case, subject to review of<br />

relevant qualitative factors and uncertainties,<br />

<strong>Sony</strong> may reverse part or all of the valuation<br />

allowance that would be recognized into<br />

income as a reduction to tax expense.<br />

FILM ACCOUNTING<br />

An aspect of film accounting that requires the<br />

exercise of judgment relates to the process of<br />

estimating the total revenues to be received<br />

throughout a film’s life cycle. Such estimate of<br />

a film’s ultimate revenue is important for two<br />

reasons. First, while a film is being produced<br />

and the related costs are being capitalized, it is<br />

necessary for management to estimate the<br />

ultimate revenue, less additional costs to be<br />

incurred, including exploitation costs which are<br />

expensed as incurred, in order to determine<br />

whether the value of a film has been impaired<br />

and thus requires an immediate write off of<br />

unrecoverable film costs. Second, the amount<br />

of film costs recognized as cost of sales for a<br />

given film as it is exhibited in various markets<br />

throughout its life cycle is based upon the<br />

proportion that current period actual revenues<br />

bear to the estimated ultimate total revenues.<br />

Management bases its estimates of ultimate<br />

revenue for each film on several factors including<br />

the historical performance of similar genre<br />

films, the star power of the lead actors and<br />

actresses, the expected number of theaters at<br />

which the film will be released, anticipated<br />

performance in the home entertainment,<br />

television and other ancillary markets, and<br />

agreements for future sales. Management<br />

updates such estimates based on the actual<br />

results to date of each film. For example, a film<br />

that has resulted in lower than expected theatrical<br />

revenues in its initial weeks of release<br />

would generally have its theatrical, home video<br />

and distribution ultimate revenues adjusted<br />

downward; a failure to do so would result in<br />

the understatement of amortized film costs<br />

for the period. Since the total film cost to be<br />

amortized for a given film is fixed, the estimate<br />

of ultimate revenues impacts only the timing<br />

of film cost amortization.<br />

FUTURE INSURANCE POLICY BENEFITS<br />

Long-term liabilities for future policy benefits<br />

are established in amounts adequate to meet<br />

the estimated future obligations of policies in<br />

force. These liabilities are computed by the net<br />

level premium method based upon estimates<br />

as to future investment yield, mortality, morbidity,<br />

withdrawals and other factors. Future<br />

policy benefits are computed using interest<br />

rates ranging from approximately 1.00 percent<br />

to 5.50 percent. Mortality, morbidity and withdrawal<br />

assumptions for all policies are based<br />

on either the life insurance subsidiary’s own<br />

experience or various actuarial tables. Generally<br />

these assumptions are “locked-in” upon the<br />

issuance of new insurance. While management<br />

believes that the assumptions used are appropriate,<br />

differences in actual experience or<br />

changes in assumptions may affect <strong>Sony</strong>’s<br />

future insurance policy benefits.<br />

For a summary of <strong>Sony</strong>’s significant accounting<br />

policies, including the critical accounting<br />

policies discussed above, please see Note 2 of<br />

Notes to the Consolidated Financial Statements.<br />

RECENTLY ADOPTED ACCOUNTING<br />

STANDARDS<br />

EMPLOYERS’ DISCLOSURES ABOUT PENSIONS<br />

AND OTHER POSTRETIREMENT BENEFITS<br />

In December 2003, the FASB revised Statement<br />

of Financial Accounting Standards (“FAS”)<br />

No. 132, “Employers’ Disclosures about Pensions<br />

and Other Postretirement Benefits”, an amendment<br />

of FAS No. 87, “Employers’ Accounting<br />

for Pensions”, FAS No. 88, “Employers’<br />

Accounting for Settlements and Curtailments of<br />

Defined Benefit Pension Plans and for Termination<br />

Benefits”, and FAS No. 106, “Employers’<br />

Accounting for Postretirement Benefits Other<br />

Than Pensions”. The new FAS No. 132 revised<br />

employers’ disclosures about pension plans and<br />

other postretirement benefit plans. It did not<br />

change the measurement or recognition of<br />

those plans required by FAS No. 87, 88 and<br />

106. While retaining the disclosure requirements<br />

of FAS No. 132, the new FAS No. 132<br />

requires additional disclosures about assets,<br />

obligations, cash flows, and net periodic benefit<br />

costs of defined benefit plans and other defined<br />

benefit postretirement plans. The provisions of<br />

the new FAS No. 132 are generally effective for<br />

financial statements with fiscal years ending<br />

after December 15, 2003, excluding the disclosure<br />

of certain information about foreign plans,<br />

which shall be effective for fiscal years ending<br />

after June 15, 2004. In accordance with the<br />

transition provisions of the new FAS No. 132,<br />

the disclosure provisions have been adopted in<br />

the consolidated financial statements.<br />

87

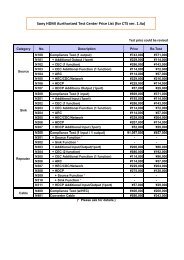

![PDF [4833KB] - Sony](https://img.yumpu.com/26420643/89/500x640/pdf-4833kb-sony.jpg)