SwissInfo

SwissInfo

SwissInfo

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CONSOLIDATED FINANCIALSTATEMENTS<br />

BarryCallebaut<br />

Annual Report2010/11<br />

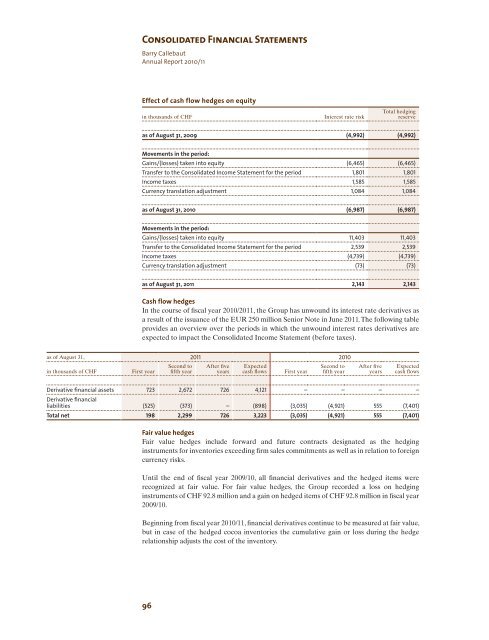

Effect of cash flow hedges on equity<br />

in thousands of CHF<br />

Interest rate risk<br />

Total hedging<br />

reserve<br />

as of August 31, 2009 (4,992) (4,992)<br />

Movements in the period:<br />

Gains/(losses)taken into equity (6,465) (6,465)<br />

Transfer to the Consolidated Income Statementfor the period 1,801 1,801<br />

Income taxes 1,585 1,585<br />

Currency translation adjustment 1,084 1,084<br />

as of August 31, 2010 (6,987) (6,987)<br />

Movements in the period:<br />

Gains/(losses)taken into equity 11,403 11,403<br />

Transfer to the Consolidated Income Statementfor the period 2,539 2,539<br />

Income taxes (4,739) (4,739)<br />

Currency translation adjustment (73) (73)<br />

as of August 31, 2011 2,143 2,143<br />

Cash flowhedges<br />

In the course of fiscal year 2010/2011, the Group has unwound its interest rate derivatives as<br />

aresult of the issuance of the EUR 250 million Senior Note in June 2011.The following table<br />

provides an overview over the periods in which the unwound interest rates derivatives are<br />

expected to impact the Consolidated Income Statement (beforetaxes).<br />

as of August 31, 2011 2010<br />

in thousands of CHF<br />

First year<br />

Second to<br />

fifth year<br />

After five<br />

years<br />

Expected<br />

cash flows<br />

First year<br />

Second to<br />

fifth year<br />

After five<br />

years<br />

Expected<br />

cash flows<br />

Derivative financial assets 723 2,672 726 4,121 – – – –<br />

Derivative financial<br />

liabilities (525) (373) – (898) (3,035) (4,921) 555 (7,401)<br />

Total net 198 2,299 726 3,223 (3,035) (4,921) 555 (7,401)<br />

Fair value hedges<br />

Fair value hedges include forward and future contracts designated as the hedging<br />

instruments for inventories exceeding firm sales commitments as well as in relation to foreign<br />

currency risks.<br />

Until the end of fiscal year 2009/10, all financial derivatives and the hedged items were<br />

recognized at fair value. For fair value hedges, the Group recorded aloss on hedging<br />

instruments of CHF 92.8 million and again on hedged items of CHF 92.8 million in fiscal year<br />

2009/10.<br />

Beginning from fiscal year 2010/11, financial derivatives continue to be measured at fair value,<br />

but in case of the hedged cocoa inventories the cumulative gain or loss during the hedge<br />

relationship adjusts the cost of the inventory.<br />

96