Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE WINNING SPIRIT ST <strong>Engineering</strong> AR <strong>2006</strong> 116<br />

Notes to the Financial Statements 31 DECEMBER <strong>2006</strong><br />

(Currency – <strong>Singapore</strong> dollars unless otherwise stated)<br />

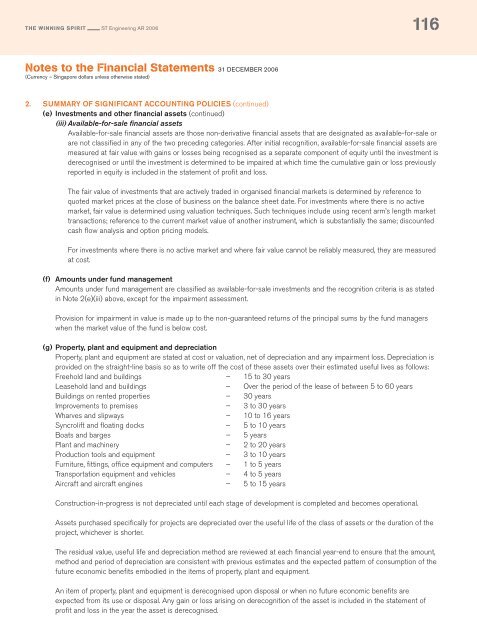

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)<br />

(e) Investments and other financial assets (continued)<br />

(iii) Available-for-sale financial assets<br />

Available-for-sale financial assets are those non-derivative financial assets that are designated as available-for-sale or<br />

are not classified in any of the two preceding categories. After initial recognition, available-for-sale financial assets are<br />

measured at fair value with gains or losses being recognised as a separate component of equity until the investment is<br />

derecognised or until the investment is determined to be impaired at which time the cumulative gain or loss previously<br />

reported in equity is included in the statement of profit and loss.<br />

The fair value of investments that are actively traded in organised financial markets is determined by reference to<br />

quoted market prices at the close of business on the balance sheet date. For investments where there is no active<br />

market, fair value is determined using valuation techniques. Such techniques include using recent arm’s length market<br />

transactions; reference to the current market value of another instrument, which is substantially the same; discounted<br />

cash flow analysis and option pricing models.<br />

For investments where there is no active market and where fair value cannot be reliably measured, they are measured<br />

at cost.<br />

(f) Amounts under fund management<br />

Amounts under fund management are classified as available-for-sale investments and the recognition criteria is as stated<br />

in Note 2(e)(iii) above, except for the impairment assessment.<br />

Provision for impairment in value is made up to the non-guaranteed returns of the principal sums by the fund managers<br />

when the market value of the fund is below cost.<br />

(g) Property, plant and equipment and depreciation<br />

Property, plant and equipment are stated at cost or valuation, net of depreciation and any impairment loss. Depreciation is<br />

provided on the straight-line basis so as to write off the cost of these assets over their estimated useful lives as follows:<br />

Freehold land and buildings – 15 to 30 years<br />

Leasehold land and buildings – Over the period of the lease of between 5 to 60 years<br />

Buildings on rented properties – 30 years<br />

Improvements to premises – 3 to 30 years<br />

Wharves and slipways – 10 to 16 years<br />

Syncrolift and floating docks – 5 to 10 years<br />

Boats and barges – 5 years<br />

Plant and machinery – 2 to 20 years<br />

Production tools and equipment – 3 to 10 years<br />

Furniture, fittings, office equipment and computers – 1 to 5 years<br />

Transportation equipment and vehicles – 4 to 5 years<br />

Aircraft and aircraft engines – 5 to 15 years<br />

Construction-in-progress is not depreciated until each stage of development is completed and becomes operational.<br />

Assets purchased specifically for projects are depreciated over the useful life of the class of assets or the duration of the<br />

project, whichever is shorter.<br />

The residual value, useful life and depreciation method are reviewed at each financial year-end to ensure that the amount,<br />

method and period of depreciation are consistent with previous estimates and the expected pattern of consumption of the<br />

future economic benefits embodied in the items of property, plant and equipment.<br />

An item of property, plant and equipment is derecognised upon disposal or when no future economic benefits are<br />

expected from its use or disposal. Any gain or loss arising on derecognition of the asset is included in the statement of<br />

profit and loss in the year the asset is derecognised.