Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

175<br />

Notes to the Financial Statements 31 DECEMBER <strong>2006</strong><br />

(Currency – <strong>Singapore</strong> dollars unless otherwise stated)<br />

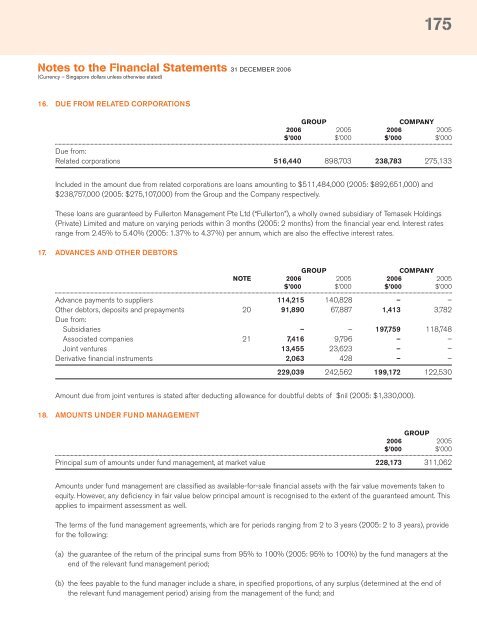

16. DUE FROM RELATED CORPORATIONS<br />

GROUP<br />

COMPANY<br />

<strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

$’000 $’000 $’000 $’000<br />

Due from:<br />

Related corporations 516,440 898,703 238,783 275,133<br />

Included in the amount due from related corporations are loans amounting to $511,484,000 (2005: $892,651,000) and<br />

$238,757,000 (2005: $275,107,000) from the Group and the Company respectively.<br />

These loans are guaranteed by <strong>Full</strong>erton Management Pte Ltd (“<strong>Full</strong>erton”), a wholly owned subsidiary of Temasek Holdings<br />

(Private) Limited and mature on varying periods within 3 months (2005: 2 months) from the financial year end. Interest rates<br />

range from 2.45% to 5.40% (2005: 1.37% to 4.37%) per annum, which are also the effective interest rates.<br />

17. ADVANCES AND OTHER DEBTORS<br />

GROUP<br />

COMPANY<br />

NOTE <strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

$’000 $’000 $’000 $’000<br />

Advance payments to suppliers 114,215 140,828 – –<br />

Other debtors, deposits and prepayments 20 91,890 67,887 1,413 3,782<br />

Due from:<br />

Subsidiaries – – 197,759 118,748<br />

Associated companies 21 7,416 9,796 – –<br />

Joint ventures 13,455 23,623 – –<br />

Derivative financial instruments 2,063 428 – –<br />

229,039 242,562 199,172 122,530<br />

Amount due from joint ventures is stated after deducting allowance for doubtful debts of $nil (2005: $1,330,000).<br />

18. AMOUNTS UNDER FUND MANAGEMENT<br />

GROUP<br />

<strong>2006</strong> 2005<br />

$’000 $’000<br />

Principal sum of amounts under fund management, at market value 228,173 311,062<br />

Amounts under fund management are classified as available-for-sale financial assets with the fair value movements taken to<br />

equity. However, any deficiency in fair value below principal amount is recognised to the extent of the guaranteed amount. This<br />

applies to impairment assessment as well.<br />

The terms of the fund management agreements, which are for periods ranging from 2 to 3 years (2005: 2 to 3 years), provide<br />

for the following:<br />

(a) the guarantee of the return of the principal sums from 95% to 100% (2005: 95% to 100%) by the fund managers at the<br />

end of the relevant fund management period;<br />

(b) the fees payable to the fund manager include a share, in specified proportions, of any surplus (determined at the end of<br />

the relevant fund management period) arising from the management of the fund; and