Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

125<br />

Notes to the Financial Statements 31 DECEMBER <strong>2006</strong><br />

(Currency – <strong>Singapore</strong> dollars unless otherwise stated)<br />

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)<br />

(z) Changes in accounting policies (continued)<br />

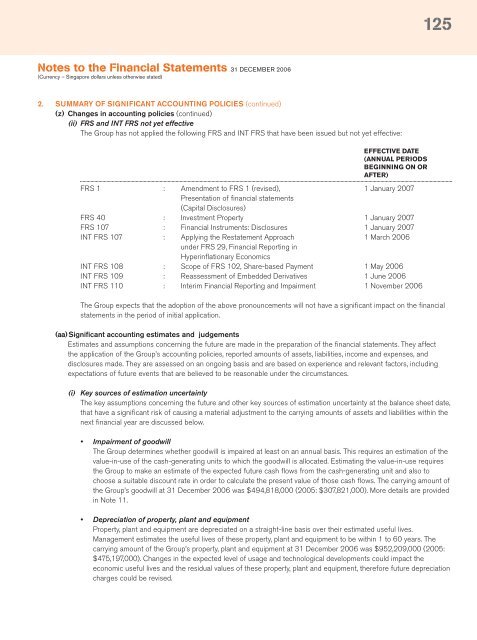

(ii) FRS and INT FRS not yet effective<br />

The Group has not applied the following FRS and INT FRS that have been issued but not yet effective:<br />

EFFECTIVE DATE<br />

(ANNUAL PERIODS<br />

BEGINNING ON OR<br />

AFTER)<br />

FRS 1 : Amendment to FRS 1 (revised), 1 January 2007<br />

Presentation of financial statements<br />

(Capital Disclosures)<br />

FRS 40 : Investment Property 1 January 2007<br />

FRS 107 : Financial Instruments: Disclosures 1 January 2007<br />

INT FRS 107 : Applying the Restatement Approach 1 March <strong>2006</strong><br />

under FRS 29, Financial <strong>Report</strong>ing in<br />

Hyperinflationary Economics<br />

INT FRS 108 : Scope of FRS 102, Share-based Payment 1 May <strong>2006</strong><br />

INT FRS 109 : Reassessment of Embedded Derivatives 1 June <strong>2006</strong><br />

INT FRS 110 : Interim Financial <strong>Report</strong>ing and Impairment 1 November <strong>2006</strong><br />

The Group expects that the adoption of the above pronouncements will not have a significant impact on the financial<br />

statements in the period of initial application.<br />

(aa) Significant accounting estimates and judgements<br />

Estimates and assumptions concerning the future are made in the preparation of the financial statements. They affect<br />

the application of the Group’s accounting policies, reported amounts of assets, liabilities, income and expenses, and<br />

disclosures made. They are assessed on an ongoing basis and are based on experience and relevant factors, including<br />

expectations of future events that are believed to be reasonable under the circumstances.<br />

(i) Key sources of estimation uncertainty<br />

The key assumptions concerning the future and other key sources of estimation uncertainty at the balance sheet date,<br />

that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the<br />

next financial year are discussed below.<br />

• Impairment of goodwill<br />

The Group determines whether goodwill is impaired at least on an annual basis. This requires an estimation of the<br />

value-in-use of the cash-generating units to which the goodwill is allocated. Estimating the value-in-use requires<br />

the Group to make an estimate of the expected future cash flows from the cash-generating unit and also to<br />

choose a suitable discount rate in order to calculate the present value of those cash flows. The carrying amount of<br />

the Group’s goodwill at 31 December <strong>2006</strong> was $494,818,000 (2005: $307,821,000). More details are provided<br />

in Note 11.<br />

• Depreciation of property, plant and equipment<br />

Property, plant and equipment are depreciated on a straight-line basis over their estimated useful lives.<br />

Management estimates the useful lives of these property, plant and equipment to be within 1 to 60 years. The<br />

carrying amount of the Group’s property, plant and equipment at 31 December <strong>2006</strong> was $952,209,000 (2005:<br />

$475,197,000). Changes in the expected level of usage and technological developments could impact the<br />

economic useful lives and the residual values of these property, plant and equipment, therefore future depreciation<br />

charges could be revised.