Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

173<br />

Notes to the Financial Statements 31 DECEMBER <strong>2006</strong><br />

(Currency – <strong>Singapore</strong> dollars unless otherwise stated)<br />

12. LONG-TERM RECEIVABLES (continued)<br />

(b) Included in the loans to third parties are:<br />

(i) an amount of $2,010,000 (2005: $2,954,000) which is secured by the third party’s investment in a unit trust and<br />

the loan is repayable over a period of 12 years commencing from 1996. Interest is chargeable at 15% per annum<br />

calculated on the reducing balance basis.<br />

(ii) an amount of approximately $8,312,000 (2005: $8,312,000) secured by intellectual property rights of that entity<br />

and is not expected to be repaid within the next 12 months. Interest is repriced every month and chargeable at the<br />

US dollar prime rate plus 2% (2005: 2%) per annum, which is also the effective interest rate. The loan is convertible<br />

to shares of that entity, subject to certain terms and conditions. In the prior year, a notice was given to that entity to<br />

convert the loan to shares of that entity but the conversion has not been effected as at the end of the year.<br />

No interest income has been accrued for this financial year for the loans stated due to the uncertainty over the<br />

collectibility of the interest income.<br />

(iii) a bridging loan of $768,150 (US$500,000) (2005: $830,650 (US$500,000)) extended to a third party. The bridging<br />

loan is secured by way of a Deed of Debenture which creates a floating charge over the assets of the third party.<br />

This loan is treated as a net investment in the third party and is not expected to be repaid and is fully provided since<br />

financial year 2005. The loan is stated at cost and has been fully provided for due to uncertainty of collectibility.<br />

Therefore, it is not practicable to determine its fair value.<br />

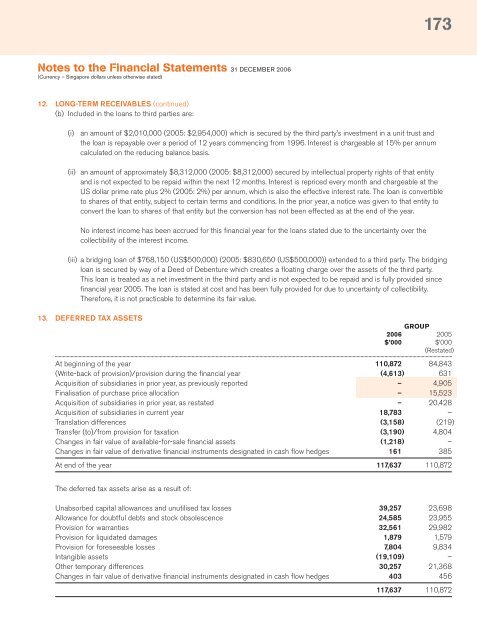

13. DEFERRED TAX ASSETS<br />

GROUP<br />

<strong>2006</strong> 2005<br />

$’000 $’000<br />

(Restated)<br />

At beginning of the year 110,872 84,843<br />

(Write-back of provision)/provision during the financial year (4,613) 631<br />

Acquisition of subsidiaries in prior year, as previously reported – 4,905<br />

Finalisation of purchase price allocation – 15,523<br />

Acquisition of subsidiaries in prior year, as restated – 20,428<br />

Acquisition of subsidiaries in current year 18,783 –<br />

Translation differences (3,158) (219)<br />

Transfer (to)/from provision for taxation (3,190) 4,804<br />

Changes in fair value of available-for-sale financial assets (1,218) –<br />

Changes in fair value of derivative financial instruments designated in cash flow hedges 161 385<br />

At end of the year 117,637 110,872<br />

The deferred tax assets arise as a result of:<br />

Unabsorbed capital allowances and unutilised tax losses 39,257 23,698<br />

Allowance for doubtful debts and stock obsolescence 24,585 23,955<br />

Provision for warranties 32,561 29,982<br />

Provision for liquidated damages 1,879 1,579<br />

Provision for foreseeable losses 7,804 9,834<br />

Intangible assets (19,109) –<br />

Other temporary differences 30,257 21,368<br />

Changes in fair value of derivative financial instruments designated in cash flow hedges 403 456<br />

117,637 110,872