Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE WINNING SPIRIT ST <strong>Engineering</strong> AR <strong>2006</strong> 168<br />

Notes to the Financial Statements 31 DECEMBER <strong>2006</strong><br />

(Currency – <strong>Singapore</strong> dollars unless otherwise stated)<br />

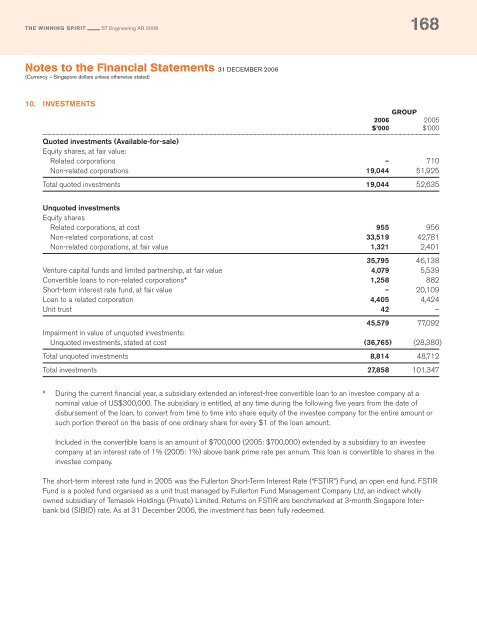

10. INVESTMENTS<br />

GROUP<br />

<strong>2006</strong> 2005<br />

$’000 $’000<br />

Quoted investments (Available-for-sale)<br />

Equity shares, at fair value:<br />

Related corporations – 710<br />

Non-related corporations 19,044 51,925<br />

Total quoted investments 19,044 52,635<br />

Unquoted investments<br />

Equity shares<br />

Related corporations, at cost 955 956<br />

Non-related corporations, at cost 33,519 42,781<br />

Non-related corporations, at fair value 1,321 2,401<br />

35,795 46,138<br />

Venture capital funds and limited partnership, at fair value 4,079 5,539<br />

Convertible loans to non-related corporations # 1,258 882<br />

Short-term interest rate fund, at fair value – 20,109<br />

Loan to a related corporation 4,405 4,424<br />

Unit trust 42 –<br />

45,579 77,092<br />

Impairment in value of unquoted investments:<br />

Unquoted investments, stated at cost (36,765) (28,380)<br />

Total unquoted investments 8,814 48,712<br />

Total investments 27,858 101,347<br />

#<br />

During the current financial year, a subsidiary extended an interest-free convertible loan to an investee company at a<br />

nominal value of US$300,000. The subsidiary is entitled, at any time during the following five years from the date of<br />

disbursement of the loan, to convert from time to time into share equity of the investee company for the entire amount or<br />

such portion thereof on the basis of one ordinary share for every $1 of the loan amount.<br />

Included in the convertible loans is an amount of $700,000 (2005: $700,000) extended by a subsidiary to an investee<br />

company at an interest rate of 1% (2005: 1%) above bank prime rate per annum. This loan is convertible to shares in the<br />

investee company.<br />

The short-term interest rate fund in 2005 was the <strong>Full</strong>erton Short-Term Interest Rate (“FSTIR”) Fund, an open end fund. FSTIR<br />

Fund is a pooled fund organised as a unit trust managed by <strong>Full</strong>erton Fund Management Company Ltd, an indirect wholly<br />

owned subsidiary of Temasek Holdings (Private) Limited. Returns on FSTIR are benchmarked at 3-month <strong>Singapore</strong> Interbank<br />

bid (SIBID) rate. As at 31 December <strong>2006</strong>, the investment has been fully redeemed.