Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE WINNING SPIRIT ST <strong>Engineering</strong> AR <strong>2006</strong> 132<br />

Notes to the Financial Statements 31 DECEMBER <strong>2006</strong><br />

(Currency – <strong>Singapore</strong> dollars unless otherwise stated)<br />

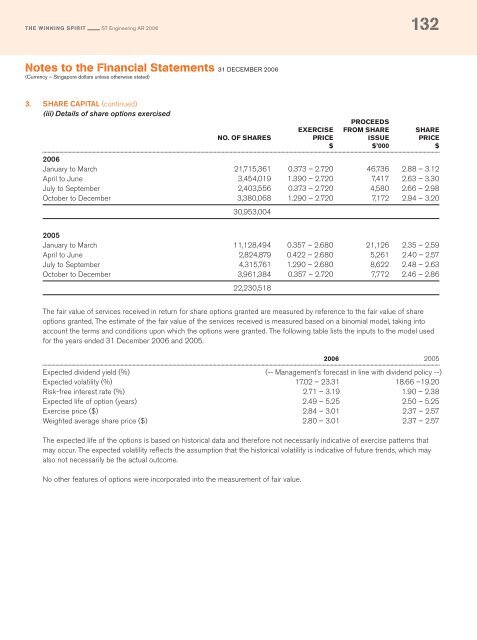

3. SHARE CAPITAL (continued)<br />

(iii) Details of share options exercised<br />

PROCEEDS<br />

EXERCISE FROM SHARE SHARE<br />

NO. OF SHARES PRICE ISSUE PRICE<br />

$ $’000 $<br />

<strong>2006</strong><br />

January to March 21,715,361 0.373 – 2.720 46,736 2.88 – 3.12<br />

April to June 3,454,019 1.390 – 2.720 7,417 2.63 – 3.30<br />

July to September 2,403,556 0.373 – 2.720 4,580 2.66 – 2.98<br />

October to December 3,380,068 1.290 – 2.720 7,172 2.94 – 3.20<br />

30,953,004<br />

2005<br />

January to March 11,128,494 0.357 – 2.680 21,126 2.35 – 2.59<br />

April to June 2,824,879 0.422 – 2.680 5,261 2.40 – 2.57<br />

July to September 4,315,761 1.290 – 2.680 8,622 2.48 – 2.63<br />

October to December 3,961,384 0.357 – 2.720 7,772 2.46 – 2.86<br />

22,230,518<br />

The fair value of services received in return for share options granted are measured by reference to the fair value of share<br />

options granted. The estimate of the fair value of the services received is measured based on a binomial model, taking into<br />

account the terms and conditions upon which the options were granted. The following table lists the inputs to the model used<br />

for the years ended 31 December <strong>2006</strong> and 2005.<br />

<strong>2006</strong> 2005<br />

Expected dividend yield (%) (-- Management’s forecast in line with dividend policy --)<br />

Expected volatility (%) 17.02 – 23.31 18.66 –19.20<br />

Risk-free interest rate (%) 2.71 – 3.19 1.90 – 2.38<br />

Expected life of option (years) 2.49 – 5.25 2.50 – 5.25<br />

Exercise price ($) 2.84 – 3.01 2.37 – 2.57<br />

Weighted average share price ($) 2.80 – 3.01 2.37 – 2.57<br />

The expected life of the options is based on historical data and therefore not necessarily indicative of exercise patterns that<br />

may occur. The expected volatility reflects the assumption that the historical volatility is indicative of future trends, which may<br />

also not necessarily be the actual outcome.<br />

No other features of options were incorporated into the measurement of fair value.