Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE WINNING SPIRIT ST <strong>Engineering</strong> AR <strong>2006</strong> 178<br />

Notes to the Financial Statements 31 DECEMBER <strong>2006</strong><br />

(Currency – <strong>Singapore</strong> dollars unless otherwise stated)<br />

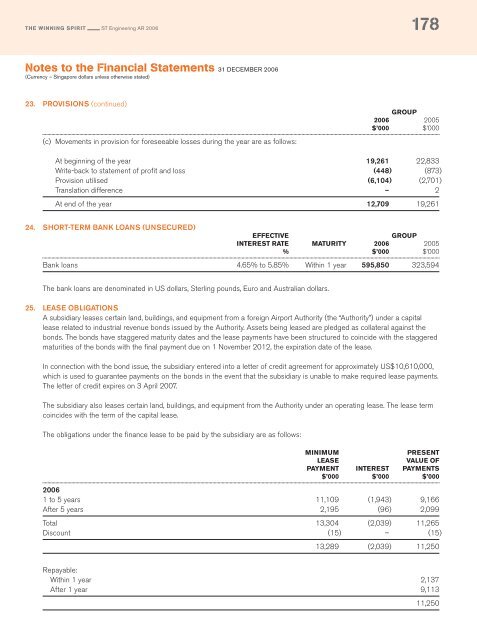

23. PROVISIONS (continued)<br />

(c) Movements in provision for foreseeable losses during the year are as follows:<br />

GROUP<br />

<strong>2006</strong> 2005<br />

$’000 $’000<br />

At beginning of the year 19,261 22,833<br />

Write-back to statement of profit and loss (448) (873)<br />

Provision utilised (6,104) (2,701)<br />

Translation difference – 2<br />

At end of the year 12,709 19,261<br />

24. SHORT-TERM BANK LOANS (UNSECURED)<br />

EFFECTIVE<br />

GROUP<br />

INTEREST RATE MATURITY <strong>2006</strong> 2005<br />

% $’000 $’000<br />

Bank loans 4.65% to 5.85% Within 1 year 595,850 323,594<br />

The bank loans are denominated in US dollars, Sterling pounds, Euro and Australian dollars.<br />

25. LEASE OBLIGATIONS<br />

A subsidiary leases certain land, buildings, and equipment from a foreign Airport Authority (the “Authority”) under a capital<br />

lease related to industrial revenue bonds issued by the Authority. Assets being leased are pledged as collateral against the<br />

bonds. The bonds have staggered maturity dates and the lease payments have been structured to coincide with the staggered<br />

maturities of the bonds with the final payment due on 1 November 2012, the expiration date of the lease.<br />

In connection with the bond issue, the subsidiary entered into a letter of credit agreement for approximately US$10,610,000,<br />

which is used to guarantee payments on the bonds in the event that the subsidiary is unable to make required lease payments.<br />

The letter of credit expires on 3 April 2007.<br />

The subsidiary also leases certain land, buildings, and equipment from the Authority under an operating lease. The lease term<br />

coincides with the term of the capital lease.<br />

The obligations under the finance lease to be paid by the subsidiary are as follows:<br />

MINIMUM<br />

PRESENT<br />

LEASE<br />

VALUE OF<br />

PAYMENT INTEREST PAYMENTS<br />

$’000 $’000 $’000<br />

<strong>2006</strong><br />

1 to 5 years 11,109 (1,943) 9,166<br />

After 5 years 2,195 (96) 2,099<br />

Total 13,304 (2,039) 11,265<br />

Discount (15) – (15)<br />

13,289 (2,039) 11,250<br />

Repayable:<br />

Within 1 year 2,137<br />

After 1 year 9,113<br />

11,250