Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE WINNING SPIRIT ST <strong>Engineering</strong> AR <strong>2006</strong> 194<br />

Notes to the Financial Statements 31 DECEMBER <strong>2006</strong><br />

(Currency – <strong>Singapore</strong> dollars unless otherwise stated)<br />

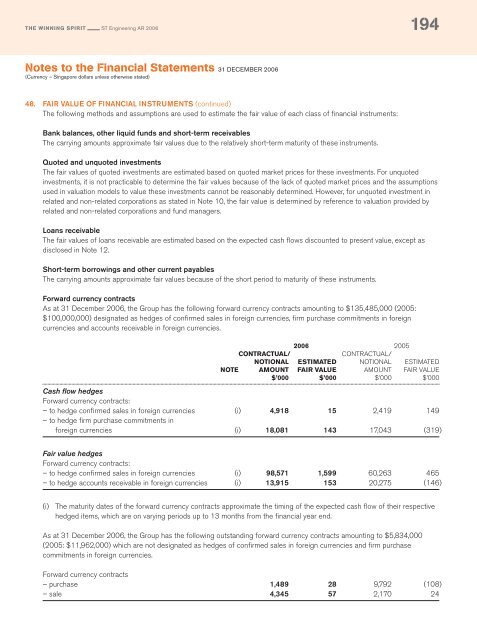

48. FAIR VALUE OF FINANCIAL INSTRUMENTS (continued)<br />

The following methods and assumptions are used to estimate the fair value of each class of financial instruments:<br />

Bank balances, other liquid funds and short-term receivables<br />

The carrying amounts approximate fair values due to the relatively short-term maturity of these instruments.<br />

Quoted and unquoted investments<br />

The fair values of quoted investments are estimated based on quoted market prices for these investments. For unquoted<br />

investments, it is not practicable to determine the fair values because of the lack of quoted market prices and the assumptions<br />

used in valuation models to value these investments cannot be reasonably determined. However, for unquoted investment in<br />

related and non-related corporations as stated in Note 10, the fair value is determined by reference to valuation provided by<br />

related and non-related corporations and fund managers.<br />

Loans receivable<br />

The fair values of loans receivable are estimated based on the expected cash flows discounted to present value, except as<br />

disclosed in Note 12.<br />

Short-term borrowings and other current payables<br />

The carrying amounts approximate fair values because of the short period to maturity of these instruments.<br />

Forward currency contracts<br />

As at 31 December <strong>2006</strong>, the Group has the following forward currency contracts amounting to $135,485,000 (2005:<br />

$100,000,000) designated as hedges of confirmed sales in foreign currencies, firm purchase commitments in foreign<br />

currencies and accounts receivable in foreign currencies.<br />

<strong>2006</strong> 2005<br />

CONTRACTUAL/<br />

CONTRACTUAL/<br />

NOTIONAL ESTIMATED NOTIONAL ESTIMATED<br />

NOTE AMOUNT FAIR VALUE AMOUNT FAIR VALUE<br />

$’000 $’000 $’000 $’000<br />

Cash flow hedges<br />

Forward currency contracts:<br />

– to hedge confirmed sales in foreign currencies (i) 4,918 15 2,419 149<br />

– to hedge firm purchase commitments in<br />

foreign currencies (i) 18,081 143 17,043 (319)<br />

Fair value hedges<br />

Forward currency contracts:<br />

– to hedge confirmed sales in foreign currencies (i) 98,571 1,599 60,263 465<br />

– to hedge accounts receivable in foreign currencies (i) 13,915 153 20,275 (146)<br />

(i) The maturity dates of the forward currency contracts approximate the timing of the expected cash flow of their respective<br />

hedged items, which are on varying periods up to 13 months from the financial year end.<br />

As at 31 December <strong>2006</strong>, the Group has the following outstanding forward currency contracts amounting to $5,834,000<br />

(2005: $11,962,000) which are not designated as hedges of confirmed sales in foreign currencies and firm purchase<br />

commitments in foreign currencies.<br />

Forward currency contracts<br />

– purchase 1,489 28 9,792 (108)<br />

– sale 4,345 57 2,170 24