Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE WINNING SPIRIT ST <strong>Engineering</strong> AR <strong>2006</strong> 180<br />

Notes to the Financial Statements 31 DECEMBER <strong>2006</strong><br />

(Currency – <strong>Singapore</strong> dollars unless otherwise stated)<br />

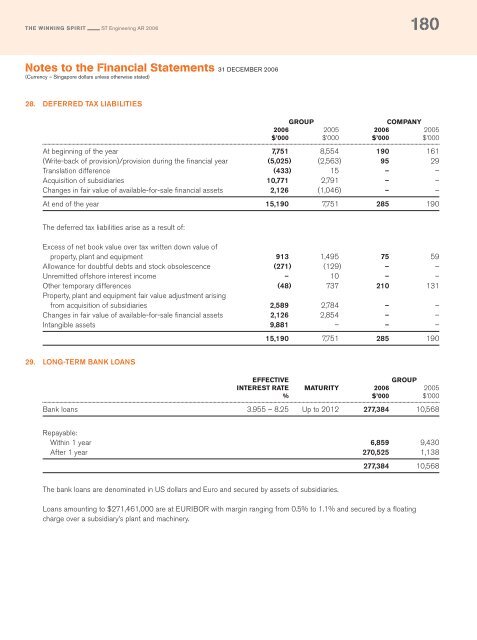

28. DEFERRED TAX LIABILITIES<br />

GROUP<br />

COMPANY<br />

<strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

$’000 $’000 $’000 $’000<br />

At beginning of the year 7,751 8,554 190 161<br />

(Write-back of provision)/provision during the financial year (5,025) (2,563) 95 29<br />

Translation difference (433) 15 – –<br />

Acquisition of subsidiaries 10,771 2,791 – –<br />

Changes in fair value of available-for-sale financial assets 2,126 (1,046) – –<br />

At end of the year 15,190 7,751 285 190<br />

The deferred tax liabilities arise as a result of:<br />

Excess of net book value over tax written down value of<br />

property, plant and equipment 913 1,495 75 59<br />

Allowance for doubtful debts and stock obsolescence (271) (129) – –<br />

Unremitted offshore interest income – 10 – –<br />

Other temporary differences (48) 737 210 131<br />

Property, plant and equipment fair value adjustment arising<br />

from acquisition of subsidiaries 2,589 2,784 – –<br />

Changes in fair value of available-for-sale financial assets 2,126 2,854 – –<br />

Intangible assets 9,881 – – –<br />

15,190 7,751 285 190<br />

29. LONG-TERM BANK LOANS<br />

EFFECTIVE<br />

GROUP<br />

INTEREST RATE MATURITY <strong>2006</strong> 2005<br />

% $’000 $’000<br />

Bank loans 3.955 – 8.25 Up to 2012 277,384 10,568<br />

Repayable:<br />

Within 1 year 6,859 9,430<br />

After 1 year 270,525 1,138<br />

277,384 10,568<br />

The bank loans are denominated in US dollars and Euro and secured by assets of subsidiaries.<br />

Loans amounting to $271,461,000 are at EURIBOR with margin ranging from 0.5% to 1.1% and secured by a floating<br />

charge over a subsidiary’s plant and machinery.