Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

Full Annual Report 2006 - Singapore Technologies Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE WINNING SPIRIT ST <strong>Engineering</strong> AR <strong>2006</strong> 126<br />

Notes to the Financial Statements 31 DECEMBER <strong>2006</strong><br />

(Currency – <strong>Singapore</strong> dollars unless otherwise stated)<br />

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)<br />

(aa) Significant accounting estimates and judgements (continued)<br />

• Income taxes<br />

The Group has exposure to income taxes in numerous jurisdictions. Significant judgement is involved in<br />

determining the group-wide provision for income taxes. There are certain transactions and computations for which<br />

the ultimate tax determination is uncertain during the ordinary course of business. The Group recognises liabilities<br />

for expected tax issues based on estimates of whether additional taxes will be due. Where the final tax outcome of<br />

these matters is different from the amounts that were initially recognised, such differences will impact the income<br />

tax and deferred tax provisions in the period in which such determination is made. The carrying amount of the<br />

Group’s tax payables at 31 December <strong>2006</strong> was $213,931,000 (2005: $208,764,000).<br />

(ii) Critical judgements made in applying accounting policies<br />

In the process of applying the Group’s accounting policies, management has made certain judgements, apart from<br />

those involving estimations, which have significant effect on the amounts recognised in the financial statements.<br />

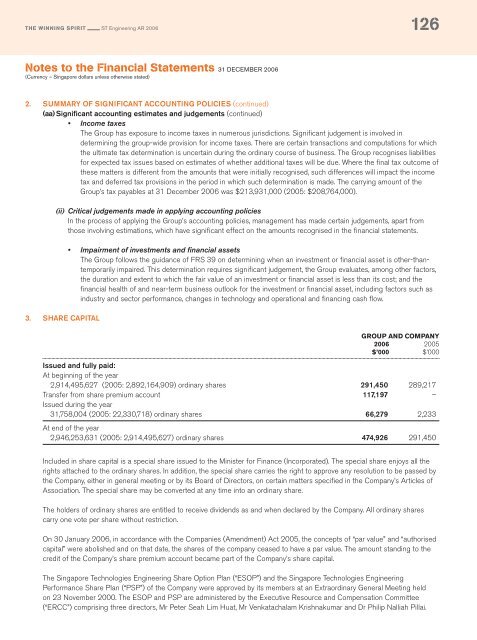

3. SHARE CAPITAL<br />

• Impairment of investments and financial assets<br />

The Group follows the guidance of FRS 39 on determining when an investment or financial asset is other-thantemporarily<br />

impaired. This determination requires significant judgement, the Group evaluates, among other factors,<br />

the duration and extent to which the fair value of an investment or financial asset is less than its cost; and the<br />

financial health of and near-term business outlook for the investment or financial asset, including factors such as<br />

industry and sector performance, changes in technology and operational and financing cash flow.<br />

GROUP AND COMPANY<br />

<strong>2006</strong> 2005<br />

$’000 $’000<br />

Issued and fully paid:<br />

At beginning of the year<br />

2,914,495,627 (2005: 2,892,164,909) ordinary shares 291,450 289,217<br />

Transfer from share premium account 117,197 –<br />

Issued during the year<br />

31,758,004 (2005: 22,330,718) ordinary shares 66,279 2,233<br />

At end of the year<br />

2,946,253,631 (2005: 2,914,495,627) ordinary shares 474,926 291,450<br />

Included in share capital is a special share issued to the Minister for Finance (Incorporated). The special share enjoys all the<br />

rights attached to the ordinary shares. In addition, the special share carries the right to approve any resolution to be passed by<br />

the Company, either in general meeting or by its Board of Directors, on certain matters specified in the Company’s Articles of<br />

Association. The special share may be converted at any time into an ordinary share.<br />

The holders of ordinary shares are entitled to receive dividends as and when declared by the Company. All ordinary shares<br />

carry one vote per share without restriction.<br />

On 30 January <strong>2006</strong>, in accordance with the Companies (Amendment) Act 2005, the concepts of “par value” and “authorised<br />

capital” were abolished and on that date, the shares of the company ceased to have a par value. The amount standing to the<br />

credit of the Company’s share premium account became part of the Company’s share capital.<br />

The <strong>Singapore</strong> <strong>Technologies</strong> <strong>Engineering</strong> Share Option Plan (“ESOP”) and the <strong>Singapore</strong> <strong>Technologies</strong> <strong>Engineering</strong><br />

Performance Share Plan (“PSP”) of the Company were approved by its members at an Extraordinary General Meeting held<br />

on 23 November 2000. The ESOP and PSP are administered by the Executive Resource and Compensation Committee<br />

(“ERCC”) comprising three directors, Mr Peter Seah Lim Huat, Mr Venkatachalam Krishnakumar and Dr Philip Nalliah Pillai.