Sterlite Industries (India) Limited - Sterlite Industries India Ltd.

Sterlite Industries (India) Limited - Sterlite Industries India Ltd.

Sterlite Industries (India) Limited - Sterlite Industries India Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

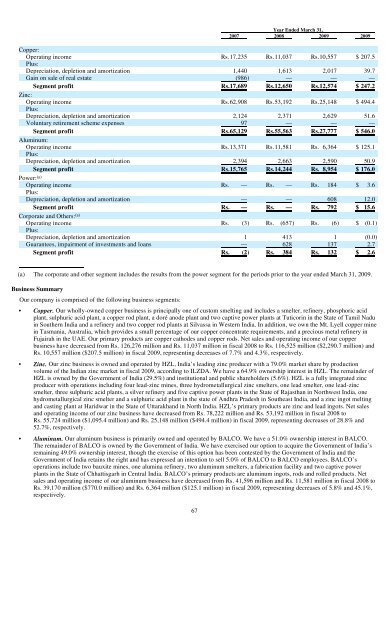

Year Ended March 31,<br />

2007 2008 2009 2009<br />

Copper:<br />

Operating income Rs.17,235 Rs.11,037 Rs.10,557 $ 207.5<br />

Plus:<br />

Depreciation, depletion and amortization 1,440 1,613 2,017 39.7<br />

Gain on sale of real estate (986) — —<br />

Segment profit Rs.17,689 Rs.12,650 Rs.12,574<br />

—<br />

$ 247.2<br />

Operating income<br />

Zinc:<br />

Rs.62,908 Rs.53,192 Rs.25,148 $ 494.4<br />

Plus:<br />

Depreciation, depletion and amortization 2,124 2,371 2,629 51.6<br />

Voluntary retirement scheme expenses 97 — —<br />

Segment profit Rs.65,129 Rs.55,563 Rs.27,777<br />

—<br />

$ 546.0<br />

Operating income<br />

Aluminum:<br />

Rs.13,371 Rs.11,581 Rs. 6,364 $ 125.1<br />

Plus:<br />

Depreciation, depletion and amortization 2,394 2,663 2,590 50.9<br />

Segment profit Rs.15,765 Rs.14,244 Rs. 8,954 $ 176.0<br />

Power: (a)<br />

Operating income Rs. — Rs. — Rs. 184 $ 3.6<br />

Plus:<br />

Depreciation, depletion and amortization — — 608<br />

Segment profit Rs. — Rs. — Rs. 792 $<br />

12.0<br />

15.6<br />

Corporate and Others: (a)<br />

Operating income Rs. (3) Rs. (657) Rs. (6) $ (0.1)<br />

Plus:<br />

Depreciation, depletion and amortization 1 413 1 (0.0)<br />

Guarantees, impairment of investments and loans — 628 137<br />

Segment profit Rs. (2) Rs. 384 Rs. 132 $<br />

2.7<br />

2.6<br />

(a) The corporate and other segment includes the results from the power segment for the periods prior to the year ended March 31, 2009.<br />

Business Summary<br />

Our company is comprised of the following business segments:<br />

• Copper. Our wholly-owned copper business is principally one of custom smelting and includes a smelter, refinery, phosphoric acid<br />

plant, sulphuric acid plant, a copper rod plant, a doré anode plant and two captive power plants at Tuticorin in the State of Tamil Nadu<br />

in Southern <strong>India</strong> and a refinery and two copper rod plants at Silvassa in Western <strong>India</strong>. In addition, we own the Mt. Lyell copper mine<br />

in Tasmania, Australia, which provides a small percentage of our copper concentrate requirements, and a precious metal refinery in<br />

Fujairah in the UAE. Our primary products are copper cathodes and copper rods. Net sales and operating income of our copper<br />

business have decreased from Rs. 126,276 million and Rs. 11,037 million in fiscal 2008 to Rs. 116,525 million ($2,290.7 million) and<br />

Rs. 10,557 million ($207.5 million) in fiscal 2009, representing decreases of 7.7% and 4.3%, respectively.<br />

• Zinc. Our zinc business is owned and operated by HZL, <strong>India</strong>’s leading zinc producer with a 79.0% market share by production<br />

volume of the <strong>India</strong>n zinc market in fiscal 2009, according to ILZDA. We have a 64.9% ownership interest in HZL. The remainder of<br />

HZL is owned by the Government of <strong>India</strong> (29.5%) and institutional and public shareholders (5.6%). HZL is a fully integrated zinc<br />

producer with operations including four lead-zinc mines, three hydrometallurgical zinc smelters, one lead smelter, one lead-zinc<br />

smelter, three sulphuric acid plants, a silver refinery and five captive power plants in the State of Rajasthan in Northwest <strong>India</strong>, one<br />

hydrometallurgical zinc smelter and a sulphuric acid plant in the state of Andhra Pradesh in Southeast <strong>India</strong>, and a zinc ingot melting<br />

and casting plant at Haridwar in the State of Uttarakhand in North <strong>India</strong>. HZL’s primary products are zinc and lead ingots. Net sales<br />

and operating income of our zinc business have decreased from Rs. 78,222 million and Rs. 53,192 million in fiscal 2008 to<br />

Rs. 55,724 million ($1,095.4 million) and Rs. 25,148 million ($494.4 million) in fiscal 2009, representing decreases of 28.8% and<br />

52.7%, respectively.<br />

• Aluminum. Our aluminum business is primarily owned and operated by BALCO. We have a 51.0% ownership interest in BALCO.<br />

The remainder of BALCO is owned by the Government of <strong>India</strong>. We have exercised our option to acquire the Government of <strong>India</strong>’s<br />

remaining 49.0% ownership interest, though the exercise of this option has been contested by the Government of <strong>India</strong> and the<br />

Government of <strong>India</strong> retains the right and has expressed an intention to sell 5.0% of BALCO to BALCO employees. BALCO’s<br />

operations include two bauxite mines, one alumina refinery, two aluminum smelters, a fabrication facility and two captive power<br />

plants in the State of Chhattisgarh in Central <strong>India</strong>. BALCO’s primary products are aluminum ingots, rods and rolled products. Net<br />

sales and operating income of our aluminum business have decreased from Rs. 41,596 million and Rs. 11,581 million in fiscal 2008 to<br />

Rs. 39,170 million ($770.0 million) and Rs. 6,364 million ($125.1 million) in fiscal 2009, representing decreases of 5.8% and 45.1%,<br />

respectively.<br />

67