Sterlite Industries (India) Limited - Sterlite Industries India Ltd.

Sterlite Industries (India) Limited - Sterlite Industries India Ltd.

Sterlite Industries (India) Limited - Sterlite Industries India Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

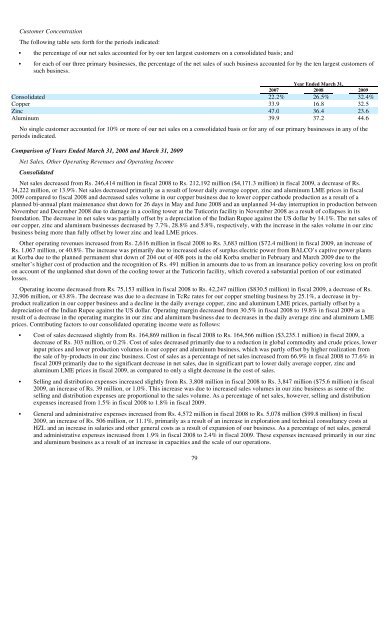

Customer Concentration<br />

The following table sets forth for the periods indicated:<br />

• the percentage of our net sales accounted for by our ten largest customers on a consolidated basis; and<br />

• for each of our three primary businesses, the percentage of the net sales of such business accounted for by the ten largest customers of<br />

such business.<br />

Year Ended March 31,<br />

2007 2008 2009<br />

Consolidated 22.2% 26.5% 32.4%<br />

Copper 33.9 16.8 32.5<br />

Zinc 47.0 36.4 23.6<br />

Aluminum 39.9 37.2 44.6<br />

No single customer accounted for 10% or more of our net sales on a consolidated basis or for any of our primary businesses in any of the<br />

periods indicated.<br />

Comparison of Years Ended March 31, 2008 and March 31, 2009<br />

Net Sales, Other Operating Revenues and Operating Income<br />

Consolidated<br />

Net sales decreased from Rs. 246,414 million in fiscal 2008 to Rs. 212,192 million ($4,171.3 million) in fiscal 2009, a decrease of Rs.<br />

34,222 million, or 13.9%. Net sales decreased primarily as a result of lower daily average copper, zinc and aluminum LME prices in fiscal<br />

2009 compared to fiscal 2008 and decreased sales volume in our copper business due to lower copper cathode production as a result of a<br />

planned bi-annual plant maintenance shut down for 26 days in May and June 2008 and an unplanned 34-day interruption in production between<br />

November and December 2008 due to damage in a cooling tower at the Tuticorin facility in November 2008 as a result of collapses in its<br />

foundation. The decrease in net sales was partially offset by a depreciation of the <strong>India</strong>n Rupee against the US dollar by 14.1%. The net sales of<br />

our copper, zinc and aluminum businesses decreased by 7.7%, 28.8% and 5.8%, respectively, with the increase in the sales volume in our zinc<br />

business being more than fully offset by lower zinc and lead LME prices.<br />

Other operating revenues increased from Rs. 2,616 million in fiscal 2008 to Rs. 3,683 million ($72.4 million) in fiscal 2009, an increase of<br />

Rs. 1,067 million, or 40.8%. The increase was primarily due to increased sales of surplus electric power from BALCO’s captive power plants<br />

at Korba due to the planned permanent shut down of 204 out of 408 pots in the old Korba smelter in February and March 2009 due to the<br />

smelter’s higher cost of production and the recognition of Rs. 491 million in amounts due to us from an insurance policy covering loss on profit<br />

on account of the unplanned shut down of the cooling tower at the Tuticorin facility, which covered a substantial portion of our estimated<br />

losses.<br />

Operating income decreased from Rs. 75,153 million in fiscal 2008 to Rs. 42,247 million ($830.5 million) in fiscal 2009, a decrease of Rs.<br />

32,906 million, or 43.8%. The decrease was due to a decrease in TcRc rates for our copper smelting business by 25.1%, a decrease in byproduct<br />

realization in our copper business and a decline in the daily average copper, zinc and aluminum LME prices, partially offset by a<br />

depreciation of the <strong>India</strong>n Rupee against the US dollar. Operating margin decreased from 30.5% in fiscal 2008 to 19.8% in fiscal 2009 as a<br />

result of a decrease in the operating margins in our zinc and aluminum business due to decreases in the daily average zinc and aluminum LME<br />

prices. Contributing factors to our consolidated operating income were as follows:<br />

• Cost of sales decreased slightly from Rs. 164,869 million in fiscal 2008 to Rs. 164,566 million ($3,235.1 million) in fiscal 2009, a<br />

decrease of Rs. 303 million, or 0.2%. Cost of sales decreased primarily due to a reduction in global commodity and crude prices, lower<br />

input prices and lower production volumes in our copper and aluminum business, which was partly offset by higher realization from<br />

the sale of by-products in our zinc business. Cost of sales as a percentage of net sales increased from 66.9% in fiscal 2008 to 77.6% in<br />

fiscal 2009 primarily due to the significant decrease in net sales, due in significant part to lower daily average copper, zinc and<br />

aluminum LME prices in fiscal 2009, as compared to only a slight decrease in the cost of sales.<br />

• Selling and distribution expenses increased slightly from Rs. 3,808 million in fiscal 2008 to Rs. 3,847 million ($75.6 million) in fiscal<br />

2009, an increase of Rs. 39 million, or 1.0%. This increase was due to increased sales volumes in our zinc business as some of the<br />

selling and distribution expenses are proportional to the sales volume. As a percentage of net sales, however, selling and distribution<br />

expenses increased from 1.5% in fiscal 2008 to 1.8% in fiscal 2009.<br />

• General and administrative expenses increased from Rs. 4,572 million in fiscal 2008 to Rs. 5,078 million ($99.8 million) in fiscal<br />

2009, an increase of Rs. 506 million, or 11.1%, primarily as a result of an increase in exploration and technical consultancy costs at<br />

HZL and an increase in salaries and other general costs as a result of expansion of our business. As a percentage of net sales, general<br />

and administrative expenses increased from 1.9% in fiscal 2008 to 2.4% in fiscal 2009. These expenses increased primarily in our zinc<br />

and aluminum business as a result of an increase in capacities and the scale of our operations.<br />

79