Read the full Annual Report in PDF format - CSIR

Read the full Annual Report in PDF format - CSIR

Read the full Annual Report in PDF format - CSIR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

20<br />

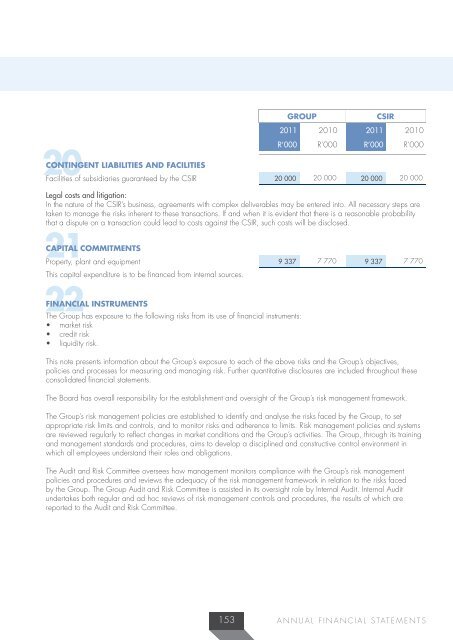

CONTINGENT LIABILITIES AND FACILITIES<br />

Legal costs and litigation:<br />

In <strong>the</strong> nature of <strong>the</strong> <strong>CSIR</strong>’s bus<strong>in</strong>ess, agreements with complex deliverables may be entered <strong>in</strong>to. All necessary steps are<br />

taken to manage <strong>the</strong> risks <strong>in</strong>herent to <strong>the</strong>se transactions. If and when it is evident that <strong>the</strong>re is a reasonable probability<br />

that a dispute on a transaction could lead to costs aga<strong>in</strong>st <strong>the</strong> <strong>CSIR</strong>, such costs will be disclosed.<br />

21<br />

22<br />

FINANCIAL INSTRUMENTS<br />

GROUP<br />

<strong>CSIR</strong><br />

2011 2010 2011 2010<br />

R’000 R’000 R’000 R’000<br />

Facilities of subsidiaries guaranteed by <strong>the</strong> <strong>CSIR</strong> 20 000 20 000 20 000 20 000<br />

CAPITAL COMMITMENTS<br />

Property, plant and equipment 9 337 7 770 9 337 7 770<br />

This capital expenditure is to be fi nanced from <strong>in</strong>ternal sources.<br />

The Group has exposure to <strong>the</strong> follow<strong>in</strong>g risks from its use of fi nancial <strong>in</strong>struments:<br />

• market risk<br />

• credit risk<br />

• liquidity risk.<br />

This note presents <strong>in</strong><strong>format</strong>ion about <strong>the</strong> Group’s exposure to each of <strong>the</strong> above risks and <strong>the</strong> Group’s objectives,<br />

policies and processes for measur<strong>in</strong>g and manag<strong>in</strong>g risk. Fur<strong>the</strong>r quantitative disclosures are <strong>in</strong>cluded throughout <strong>the</strong>se<br />

consolidated fi nancial statements.<br />

The Board has overall responsibility for <strong>the</strong> establishment and oversight of <strong>the</strong> Group’s risk management framework.<br />

The Group’s risk management policies are established to identify and analyse <strong>the</strong> risks faced by <strong>the</strong> Group, to set<br />

appropriate risk limits and controls, and to monitor risks and adherence to limits. Risk management policies and systems<br />

are reviewed regularly to refl ect changes <strong>in</strong> market conditions and <strong>the</strong> Group’s activities. The Group, through its tra<strong>in</strong><strong>in</strong>g<br />

and management standards and procedures, aims to develop a discipl<strong>in</strong>ed and constructive control environment <strong>in</strong><br />

which all employees understand <strong>the</strong>ir roles and obligations.<br />

The Audit and Risk Committee oversees how management monitors compliance with <strong>the</strong> Group’s risk management<br />

policies and procedures and reviews <strong>the</strong> adequacy of <strong>the</strong> risk management framework <strong>in</strong> relation to <strong>the</strong> risks faced<br />

by <strong>the</strong> Group. The Group Audit and Risk Committee is assisted <strong>in</strong> its oversight role by Internal Audit. Internal Audit<br />

undertakes both regular and ad hoc reviews of risk management controls and procedures, <strong>the</strong> results of which are<br />

reported to <strong>the</strong> Audit and Risk Committee.<br />

153<br />

ANNUAL FINANCIAL STATEMENTS

![National Research Foundation Annual Report 2008 / 2009 [Part 2]](https://img.yumpu.com/49774036/1/177x260/national-research-foundation-annual-report-2008-2009-part-2.jpg?quality=85)