Wine Investment in South Africa - Cape Wine Academy

Wine Investment in South Africa - Cape Wine Academy

Wine Investment in South Africa - Cape Wine Academy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

after seller’s premium ) giv<strong>in</strong>g the owner not only all of his money back with €156 (R1,560)<br />

profit but also eight bottles of Latour to dr<strong>in</strong>k for free.<br />

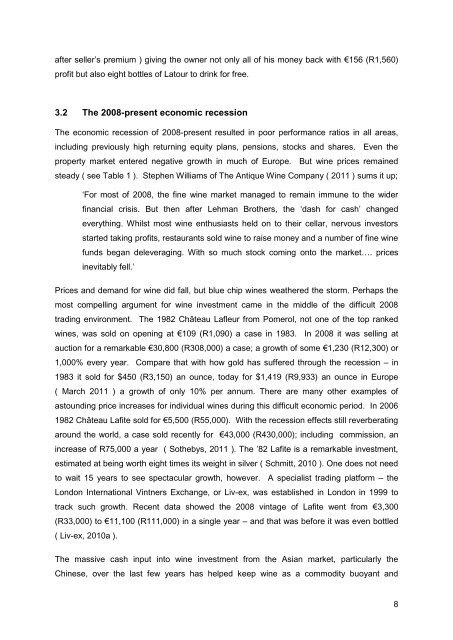

3.2 The 2008-present economic recession<br />

The economic recession of 2008-present resulted <strong>in</strong> poor performance ratios <strong>in</strong> all areas,<br />

<strong>in</strong>clud<strong>in</strong>g previously high return<strong>in</strong>g equity plans, pensions, stocks and shares. Even the<br />

property market entered negative growth <strong>in</strong> much of Europe. But w<strong>in</strong>e prices rema<strong>in</strong>ed<br />

steady ( see Table 1 ). Stephen Williams of The Antique <strong>W<strong>in</strong>e</strong> Company ( 2011 ) sums it up;<br />

‘For most of 2008, the f<strong>in</strong>e w<strong>in</strong>e market managed to rema<strong>in</strong> immune to the wider<br />

f<strong>in</strong>ancial crisis. But then after Lehman Brothers, the ‘dash for cash’ changed<br />

everyth<strong>in</strong>g. Whilst most w<strong>in</strong>e enthusiasts held on to their cellar, nervous <strong>in</strong>vestors<br />

started tak<strong>in</strong>g profits, restaurants sold w<strong>in</strong>e to raise money and a number of f<strong>in</strong>e w<strong>in</strong>e<br />

funds began deleverag<strong>in</strong>g. With so much stock com<strong>in</strong>g onto the market…. prices<br />

<strong>in</strong>evitably fell.’<br />

Prices and demand for w<strong>in</strong>e did fall, but blue chip w<strong>in</strong>es weathered the storm. Perhaps the<br />

most compell<strong>in</strong>g argument for w<strong>in</strong>e <strong>in</strong>vestment came <strong>in</strong> the middle of the difficult 2008<br />

trad<strong>in</strong>g environment. The 1982 Château Lafleur from Pomerol, not one of the top ranked<br />

w<strong>in</strong>es, was sold on open<strong>in</strong>g at €109 (R1,090) a case <strong>in</strong> 1983. In 2008 it was sell<strong>in</strong>g at<br />

auction for a remarkable €30,800 (R308,000) a case; a growth of some €1,230 (R12,300) or<br />

1,000% every year. Compare that with how gold has suffered through the recession – <strong>in</strong><br />

1983 it sold for $450 (R3,150) an ounce, today for $1,419 (R9,933) an ounce <strong>in</strong> Europe<br />

( March 2011 ) a growth of only 10% per annum. There are many other examples of<br />

astound<strong>in</strong>g price <strong>in</strong>creases for <strong>in</strong>dividual w<strong>in</strong>es dur<strong>in</strong>g this difficult economic period. In 2006<br />

1982 Château Lafite sold for €5,500 (R55,000). With the recession effects still reverberat<strong>in</strong>g<br />

around the world, a case sold recently for €43,000 (R430,000); <strong>in</strong>clud<strong>in</strong>g commission, an<br />

<strong>in</strong>crease of R75,000 a year ( Sothebys, 2011 ). The ’82 Lafite is a remarkable <strong>in</strong>vestment,<br />

estimated at be<strong>in</strong>g worth eight times its weight <strong>in</strong> silver ( Schmitt, 2010 ). One does not need<br />

to wait 15 years to see spectacular growth, however. A specialist trad<strong>in</strong>g platform – the<br />

London International V<strong>in</strong>tners Exchange, or Liv-ex, was established <strong>in</strong> London <strong>in</strong> 1999 to<br />

track such growth. Recent data showed the 2008 v<strong>in</strong>tage of Lafite went from €3,300<br />

(R33,000) to €11,100 (R111,000) <strong>in</strong> a s<strong>in</strong>gle year – and that was before it was even bottled<br />

( Liv-ex, 2010a ).<br />

The massive cash <strong>in</strong>put <strong>in</strong>to w<strong>in</strong>e <strong>in</strong>vestment from the Asian market, particularly the<br />

Ch<strong>in</strong>ese, over the last few years has helped keep w<strong>in</strong>e as a commodity buoyant and<br />

8