Wine Investment in South Africa - Cape Wine Academy

Wine Investment in South Africa - Cape Wine Academy

Wine Investment in South Africa - Cape Wine Academy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

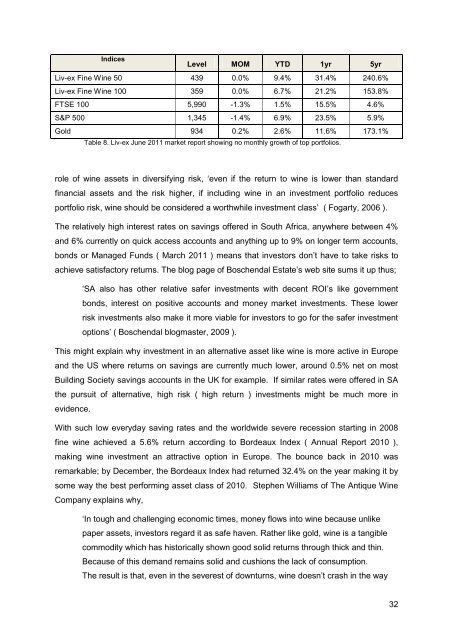

Indices<br />

Level MOM YTD 1yr 5yr<br />

Liv-ex F<strong>in</strong>e <strong>W<strong>in</strong>e</strong> 50 439 0.0% 9.4% 31.4% 240.6%<br />

Liv-ex F<strong>in</strong>e <strong>W<strong>in</strong>e</strong> 100 359 0.0% 6.7% 21.2% 153.8%<br />

FTSE 100 5,990 -1.3% 1.5% 15.5% 4.6%<br />

S&P 500 1,345 -1.4% 6.9% 23.5% 5.9%<br />

Gold 934 0.2% 2.6% 11.6% 173.1%<br />

Table 8. Liv-ex June 2011 market report show<strong>in</strong>g no monthly growth of top portfolios.<br />

role of w<strong>in</strong>e assets <strong>in</strong> diversify<strong>in</strong>g risk, ‘even if the return to w<strong>in</strong>e is lower than standard<br />

f<strong>in</strong>ancial assets and the risk higher, if <strong>in</strong>clud<strong>in</strong>g w<strong>in</strong>e <strong>in</strong> an <strong>in</strong>vestment portfolio reduces<br />

portfolio risk, w<strong>in</strong>e should be considered a worthwhile <strong>in</strong>vestment class’ ( Fogarty, 2006 ).<br />

The relatively high <strong>in</strong>terest rates on sav<strong>in</strong>gs offered <strong>in</strong> <strong>South</strong> <strong>Africa</strong>, anywhere between 4%<br />

and 6% currently on quick access accounts and anyth<strong>in</strong>g up to 9% on longer term accounts,<br />

bonds or Managed Funds ( March 2011 ) means that <strong>in</strong>vestors don’t have to take risks to<br />

achieve satisfactory returns. The blog page of Boschendal Estate’s web site sums it up thus;<br />

‘SA also has other relative safer <strong>in</strong>vestments with decent ROI’s like government<br />

bonds, <strong>in</strong>terest on positive accounts and money market <strong>in</strong>vestments. These lower<br />

risk <strong>in</strong>vestments also make it more viable for <strong>in</strong>vestors to go for the safer <strong>in</strong>vestment<br />

options’ ( Boschendal blogmaster, 2009 ).<br />

This might expla<strong>in</strong> why <strong>in</strong>vestment <strong>in</strong> an alternative asset like w<strong>in</strong>e is more active <strong>in</strong> Europe<br />

and the US where returns on sav<strong>in</strong>gs are currently much lower, around 0.5% net on most<br />

Build<strong>in</strong>g Society sav<strong>in</strong>gs accounts <strong>in</strong> the UK for example. If similar rates were offered <strong>in</strong> SA<br />

the pursuit of alternative, high risk ( high return ) <strong>in</strong>vestments might be much more <strong>in</strong><br />

evidence.<br />

With such low everyday sav<strong>in</strong>g rates and the worldwide severe recession start<strong>in</strong>g <strong>in</strong> 2008<br />

f<strong>in</strong>e w<strong>in</strong>e achieved a 5.6% return accord<strong>in</strong>g to Bordeaux Index ( Annual Report 2010 ),<br />

mak<strong>in</strong>g w<strong>in</strong>e <strong>in</strong>vestment an attractive option <strong>in</strong> Europe. The bounce back <strong>in</strong> 2010 was<br />

remarkable; by December, the Bordeaux Index had returned 32.4% on the year mak<strong>in</strong>g it by<br />

some way the best perform<strong>in</strong>g asset class of 2010. Stephen Williams of The Antique <strong>W<strong>in</strong>e</strong><br />

Company expla<strong>in</strong>s why,<br />

‘In tough and challeng<strong>in</strong>g economic times, money flows <strong>in</strong>to w<strong>in</strong>e because unlike<br />

paper assets, <strong>in</strong>vestors regard it as safe haven. Rather like gold, w<strong>in</strong>e is a tangible<br />

commodity which has historically shown good solid returns through thick and th<strong>in</strong>.<br />

Because of this demand rema<strong>in</strong>s solid and cushions the lack of consumption.<br />

The result is that, even <strong>in</strong> the severest of downturns, w<strong>in</strong>e doesn’t crash <strong>in</strong> the way<br />

32