ANNUAL REPORT 2005 - Lukoil

ANNUAL REPORT 2005 - Lukoil

ANNUAL REPORT 2005 - Lukoil

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Capital expenditures, including non-cash transactions, during <strong>2005</strong> amounted to $4,177 million, $730 million more than<br />

in the previous year. The growth was mainly caused by expenditures in our exploration and production segment, which<br />

increased by $629 million compared to 2004. The growth in exploration and production capital expenditures in new<br />

regions amounted to $367 million. The capital expenditures in traditional exploration regions of the Western Siberia<br />

increased by $110 million.<br />

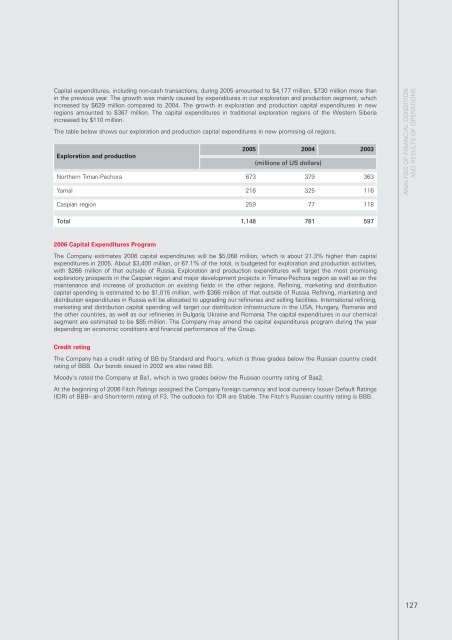

The table below shows our exploration and production capital expenditures in new promising oil regions.<br />

Exploration and production<br />

<strong>2005</strong> 2004 2003<br />

(millions of US dollars)<br />

Northern Timan-Pechora 673 379 363<br />

Yamal 216 325 116<br />

ANALYSIS OF FINANCIAL CONDITION<br />

AND RESULTS OF OPERATIONS<br />

Caspian region 259 77 118<br />

Total 1,148 781 597<br />

2006 Capital Expenditures Program<br />

The Company estimates 2006 capital expenditures will be $5,068 million, which is about 21.3% higher than capital<br />

expenditures in <strong>2005</strong>. About $3,400 million, or 67.1% of the total, is budgeted for exploration and production activities,<br />

with $266 million of that outside of Russia. Exploration and production expenditures will target the most promising<br />

exploratory prospects in the Caspian region and major development projects in Timano-Pechora region as well as on the<br />

maintenance and increase of production on existing fields in the other regions. Refining, marketing and distribution<br />

capital spending is estimated to be $1,015 million, with $366 million of that outside of Russia. Refining, marketing and<br />

distribution expenditures in Russia will be allocated to upgrading our refineries and selling facilities. International refining,<br />

marketing and distribution capital spending will target our distribution infrastructure in the USA, Hungary, Romania and<br />

the other countries, as well as our refineries in Bulgaria, Ukraine and Romania. The capital expenditures in our chemical<br />

segment are estimated to be $85 million. The Company may amend the capital expenditures program during the year<br />

depending on economic conditions and financial performance of the Group.<br />

Credit rating<br />

The Company has a credit rating of BB by Standard and Poor's, which is three grades below the Russian country credit<br />

rating of BBB. Our bonds issued in 2002 are also rated BB.<br />

Moody's rated the Company at Ba1, which is two grades below the Russian country rating of Baa2.<br />

At the beginning of 2006 Fitch Ratings assigned the Company foreign currency and local currency Issuer Default Ratings<br />

(IDR) of BBB– and Short-term rating of F3. The outlooks for IDR are Stable. The Fitch's Russian country rating is BBB.<br />

127