ANNUAL REPORT 2005 - Lukoil

ANNUAL REPORT 2005 - Lukoil

ANNUAL REPORT 2005 - Lukoil

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL ACCOUNTS<br />

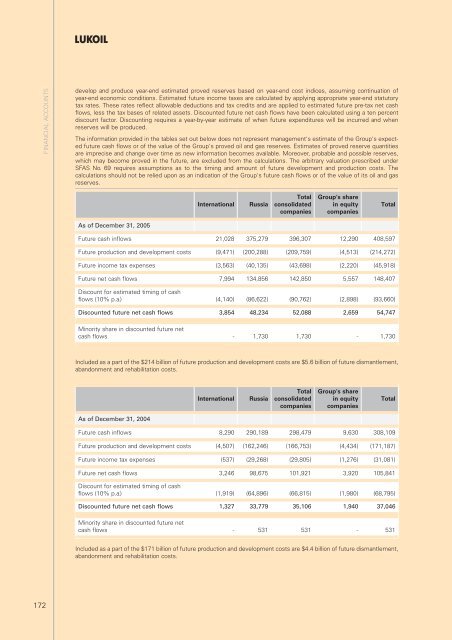

develop and produce year-end estimated proved reserves based on year-end cost indices, assuming continuation of<br />

year-end economic conditions. Estimated future income taxes are calculated by applying appropriate year-end statutory<br />

tax rates. These rates reflect allowable deductions and tax credits and are applied to estimated future pre-tax net cash<br />

flows, less the tax bases of related assets. Discounted future net cash flows have been calculated using a ten percent<br />

discount factor. Discounting requires a year-by-year estimate of when future expenditures will be incurred and when<br />

reserves will be produced.<br />

The information provided in the tables set out below does not represent management's estimate of the Group's expected<br />

future cash flows or of the value of the Group's proved oil and gas reserves. Estimates of proved reserve quantities<br />

are imprecise and change over time as new information becomes available. Moreover, probable and possible reserves,<br />

which may become proved in the future, are excluded from the calculations. The arbitrary valuation prescribed under<br />

SFAS No. 69 requires assumptions as to the timing and amount of future development and production costs. The<br />

calculations should not be relied upon as an indication of the Group's future cash flows or of the value of its oil and gas<br />

reserves.<br />

International<br />

Russia<br />

Total<br />

consolidated<br />

companies<br />

Group's share<br />

in equity<br />

companies<br />

Total<br />

As of December 31, <strong>2005</strong><br />

Future cash inflows 21,028 375,279 396,307 12,290 408,597<br />

Future production and development costs (9,471) (200,288) (209,759) (4,513) (214,272)<br />

Future income tax expenses (3,563) (40,135) (43,698) (2,220) (45,918)<br />

Future net cash flows 7,994 134,856 142,850 5,557 148,407<br />

Discount for estimated timing of cash<br />

flows (10% p.a.) (4,140) (86,622) (90,762) (2,898) (93,660)<br />

Discounted future net cash flows 3,854 48,234 52,088 2,659 54,747<br />

Minority share in discounted future net<br />

cash flows - 1,730 1,730 - 1,730<br />

Included as a part of the $214 billion of future production and development costs are $5.6 billion of future dismantlement,<br />

abandonment and rehabilitation costs.<br />

International<br />

Russia<br />

Total<br />

consolidated<br />

companies<br />

Group's share<br />

in equity<br />

companies<br />

Total<br />

As of December 31, 2004<br />

Future cash inflows 8,290 290,189 298,479 9,630 308,109<br />

Future production and development costs (4,507) (162,246) (166,753) (4,434) (171,187)<br />

Future income tax expenses (537) (29,268) (29,805) (1,276) (31,081)<br />

Future net cash flows 3,246 98,675 101,921 3,920 105,841<br />

Discount for estimated timing of cash<br />

flows (10% p.a.) (1,919) (64,896) (66,815) (1,980) (68,795)<br />

Discounted future net cash flows 1,327 33,779 35,106 1,940 37,046<br />

Minority share in discounted future net<br />

cash flows - 531 531 - 531<br />

Included as a part of the $171 billion of future production and development costs are $4.4 billion of future dismantlement,<br />

abandonment and rehabilitation costs.<br />

172