ANNUAL REPORT 2005 - Lukoil

ANNUAL REPORT 2005 - Lukoil

ANNUAL REPORT 2005 - Lukoil

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ANNUAL</strong> <strong>REPORT</strong>, <strong>2005</strong><br />

The company's resource base has high levels of productivity, as confirmed by rapid production growth<br />

rates in recent years. According to forecasts, daily oil production by Nelson Resources will increase to<br />

75,000 barrels by 2009.<br />

Acquisition of Nelson Resources for $1,951 million (the company also had net debt of $60 million at<br />

the time of the acquisition) was the biggest deal in LUKOIL's history and enabled the Company to rise<br />

from 9th to 4th place among the biggest hydrocarbon producers in Kazakhstan.<br />

TRANSPORT PROJECTS IN THE CASPIAN REGION<br />

Company management is aware that LUKOIL's strategically important position in the Caspian region<br />

depends on development of transport infrastructure. LUKOIL is therefore taking an active part in transport<br />

projects, particularly that being implemented by the Caspian Pipeline Consortium (CPC).<br />

The CPC is 1,510-kilometer oil pipeline linking the Tengiz field with South Ozereyevka sea terminal<br />

near Novorossiysk. The first framework agreement on construction of the CPC was signed in mid-<br />

1992 between Kazakhstan, Oman and Russia. The first phase of the pipeline with annual throughput<br />

capacity of 28.2 million tonnes was launched at the end of 2001. In October 2004 it was decided<br />

to increase the CPC capacity to 67 million tonnes by 2008. The first oil tanker, supplied via the<br />

CPC, was loaded with oil in October 2001.<br />

LUKOIL's share of production at the Tengiz oil field has been transported via the CPC since its commissioning<br />

in 2001. In October 2003 LUKOIL and Petrokazakhstan completed construction of the<br />

Kumkol–Dzhusali pipeline, which enables deliveries of oil from the Kumkol field via the CPC (oil is transported<br />

to Dzhusali by pipeline and from there by railway to the CPC). In May 2004 the<br />

Karachaganak–Atyrau pipeline was completed, allowing LUKOIL's stable gas condensate from Karachaganak<br />

to be pumped via the CPC. Finally, in November 2004 completion of a railway oil terminal adjacent<br />

to the Kropotkinskaya Pumping Station made it possible to feed LUKOIL crude from Volga and Western<br />

Siberian fields into the CPC (1.4 million tonnes of crude were transported by these means during <strong>2005</strong>).<br />

In addition to the CPC and associated pipeline projects in Kazakhstan LUKOIL has built an oil export terminal<br />

at Ilinka in Astrakhan Region. The first phase of the terminal was commissioned in October 2003.<br />

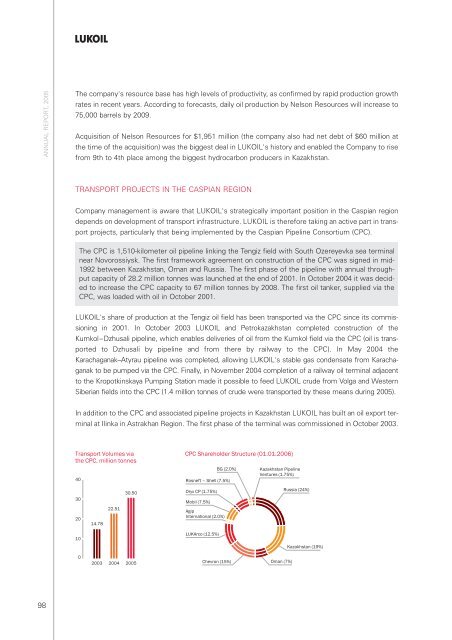

Transport Volumes via<br />

the CPC, million tonnes<br />

40<br />

CPC Shareholder Structure (01.01.2006)<br />

BG (2.0%)<br />

Rosneft – Shell (7.5%)<br />

Kazakhstan Pipeline<br />

Ventures (1.75%)<br />

30<br />

20<br />

14.78<br />

22.51<br />

30.50<br />

Oryx CP (1.75%)<br />

Mobil (7.5%)<br />

Agip<br />

International (2.0%)<br />

Russia (24%)<br />

10<br />

LUKArco (12.5%)<br />

Kazakhstan (19%)<br />

0<br />

2003<br />

2004<br />

<strong>2005</strong><br />

Chevron (15%)<br />

Oman (7%)<br />

98