WESTERN RAILWAY GOVERNMENT OF INDIA TENDER ...

WESTERN RAILWAY GOVERNMENT OF INDIA TENDER ...

WESTERN RAILWAY GOVERNMENT OF INDIA TENDER ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

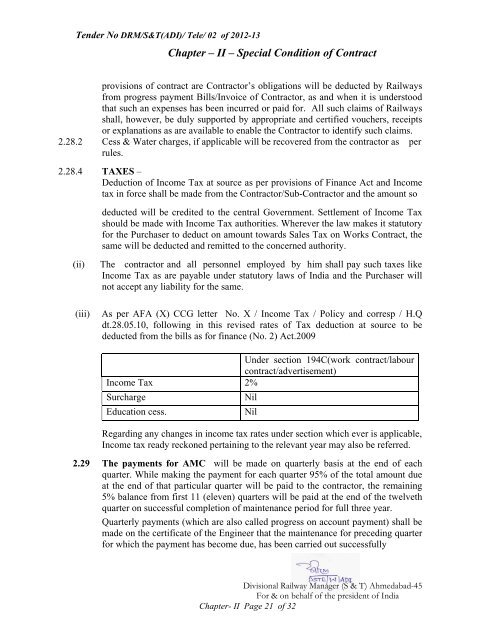

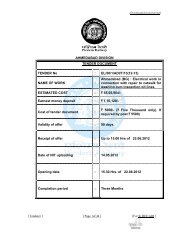

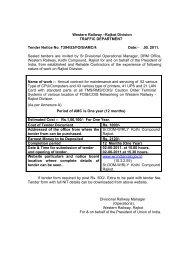

Tender No DRM/S&T(ADI)/ Tele/ 02 of 2012-13<br />

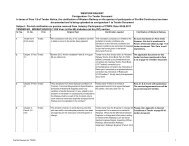

Chapter – II – Special Condition of Contract<br />

provisions of contract are Contractor’s obligations will be deducted by Railways<br />

from progress payment Bills/Invoice of Contractor, as and when it is understood<br />

that such an expenses has been incurred or paid for. All such claims of Railways<br />

shall, however, be duly supported by appropriate and certified vouchers, receipts<br />

or explanations as are available to enable the Contractor to identify such claims.<br />

2.28.2 Cess & Water charges, if applicable will be recovered from the contractor as per<br />

rules.<br />

2.28.4 TAXES –<br />

Deduction of Income Tax at source as per provisions of Finance Act and Income<br />

tax in force shall be made from the Contractor/Sub-Contractor and the amount so<br />

deducted will be credited to the central Government. Settlement of Income Tax<br />

should be made with Income Tax authorities. Wherever the law makes it statutory<br />

for the Purchaser to deduct on amount towards Sales Tax on Works Contract, the<br />

same will be deducted and remitted to the concerned authority.<br />

(ii)<br />

The contractor and all personnel employed by him shall pay such taxes like<br />

Income Tax as are payable under statutory laws of India and the Purchaser will<br />

not accept any liability for the same.<br />

(iii)<br />

As per AFA (X) CCG letter No. X / Income Tax / Policy and corresp / H.Q<br />

dt.28.05.10, following in this revised rates of Tax deduction at source to be<br />

deducted from the bills as for finance (No. 2) Act.2009<br />

Under section 194C(work contract/labour<br />

contract/advertisement)<br />

Income Tax 2%<br />

Surcharge<br />

Nil<br />

Education cess.<br />

Nil<br />

Regarding any changes in income tax rates under section which ever is applicable,<br />

Income tax ready reckoned pertaining to the relevant year may also be referred.<br />

2.29 The payments for AMC will be made on quarterly basis at the end of each<br />

quarter. While making the payment for each quarter 95% of the total amount due<br />

at the end of that particular quarter will be paid to the contractor, the remaining<br />

5% balance from first 11 (eleven) quarters will be paid at the end of the twelveth<br />

quarter on successful completion of maintenance period for full three year.<br />

Quarterly payments (which are also called progress on account payment) shall be<br />

made on the certificate of the Engineer that the maintenance for preceding quarter<br />

for which the payment has become due, has been carried out successfully<br />

Divisional Railway Manager (S & T) Ahmedabad-45<br />

For & on behalf of the president of India<br />

Chapter- II Page 21 of 32