You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

strategies<br />

markets, Relative Strength (RS) and correlation, to<br />

find and filter trading signals.<br />

Simplicity is considered a desirable trait in a trading<br />

strategy and this style of analysis does carry the risk of<br />

having rules that are overly complex. A guiding principle<br />

in developing this idea was to fall on the side of simple<br />

and straightforward in the calculations and signals by<br />

restricting them to these two relationships.<br />

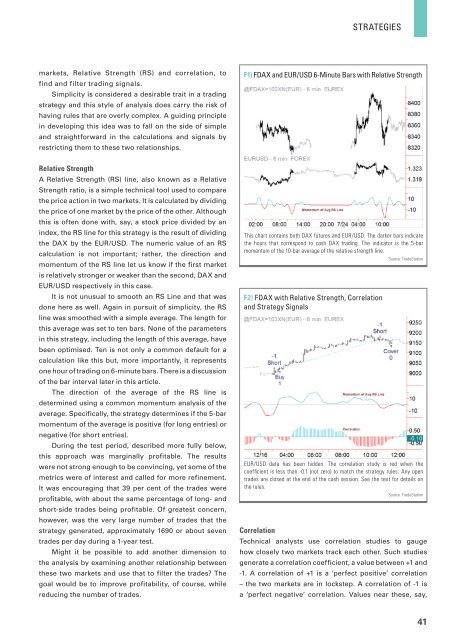

F1) FDAX and EUR/USD 6-Minute Bars with Relative Strength<br />

Relative Strength<br />

A Relative Strength (RS) line, also known as a Relative<br />

Strength ratio, is a simple technical tool used to compare<br />

the price action in two markets. It is calculated by dividing<br />

the price of one market by the price of the other. Although<br />

this is often done with, say, a stock price divided by an<br />

index, the RS line for this strategy is the result of dividing<br />

the DAX by the EUR/USD. The numeric value of an RS<br />

calculation is not important; rather, the direction and<br />

momentum of the RS line let us know if the first market<br />

is relatively stronger or weaker than the second, DAX and<br />

EUR/USD respectively in this case.<br />

It is not unusual to smooth an RS Line and that was<br />

done here as well. Again in pursuit of simplicity, the RS<br />

line was smoothed with a simple average. The length for<br />

this average was set to ten bars. None of the parameters<br />

in this strategy, including the length of this average, have<br />

been optimised. Ten is not only a common default for a<br />

calculation like this but, more importantly, it represents<br />

one hour of trading on 6-minute bars. There is a discussion<br />

of the bar interval later in this article.<br />

The direction of the average of the RS line is<br />

determined using a common momentum analysis of the<br />

average. Specifically, the strategy determines if the 5-bar<br />

momentum of the average is positive (for long entries) or<br />

negative (for short entries).<br />

During the test period, described more fully below,<br />

this approach was marginally profitable. The results<br />

were not strong enough to be convincing, yet some of the<br />

metrics were of interest and called for more refinement.<br />

It was encouraging that 39 per cent of the trades were<br />

profitable, with about the same percentage of long- and<br />

short-side trades being profitable. Of greatest concern,<br />

however, was the very large number of trades that the<br />

strategy generated, approximately 1690 or about seven<br />

trades per day during a 1-year test.<br />

Might it be possible to add another dimension to<br />

the analysis by examining another relationship between<br />

these two markets and use that to filter the trades The<br />

goal would be to improve profitability, of course, while<br />

reducing the number of trades.<br />

This chart contains both DAX futures and EUR/USD. The darker bars indicate<br />

the hours that correspond to cash DAX trading. The indicator is the 5-bar<br />

momentum of the 10-bar average of the relative strength line.<br />

Source: TradeStation<br />

F2) FDAX with Relative Strength, Correlation<br />

and Strategy Signals<br />

EUR/USD data has been hidden. The correlation study is red when the<br />

coefficient is less than -0.1 (not zero) to match the strategy rules. Any open<br />

trades are closed at the end of the cash session. See the text for details on<br />

the rules.<br />

Source: TradeStation<br />

Correlation<br />

Technical analysts use correlation studies to gauge<br />

how closely two markets track each other. Such studies<br />

generate a correlation coefficient, a value between +1 and<br />

-1. A correlation of +1 is a ‘perfect positive’ correlation<br />

– the two markets are in lockstep. A correlation of -1 is<br />

a ‘perfect negative’ correlation. Values near these, say,<br />

41