You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

strategies<br />

www.tradersonline-mag.com 04.2014<br />

above +.7 and below -.7 are usually considered to be<br />

strong correlations and may be useful when interpreting<br />

market dynamics.<br />

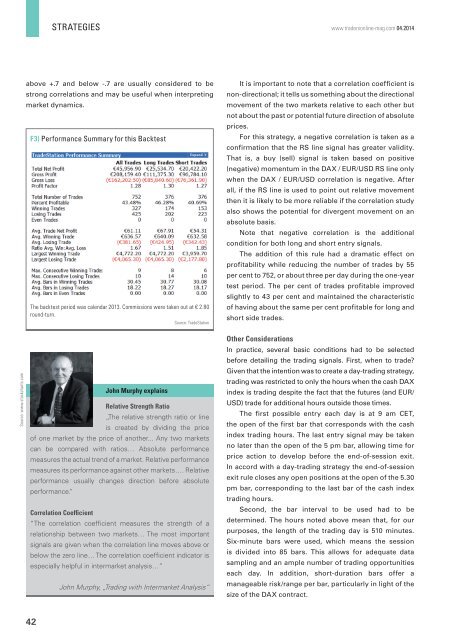

F3) Performance Summary for this Backtest<br />

The backtest period was calendar 2013. Commissions were taken out at € 2.80<br />

round-turn.<br />

Source: TradeStation<br />

It is important to note that a correlation coefficient is<br />

non-directional; it tells us something about the directional<br />

movement of the two markets relative to each other but<br />

not about the past or potential future direction of absolute<br />

prices.<br />

For this strategy, a negative correlation is taken as a<br />

confirmation that the RS line signal has greater validity.<br />

That is, a buy (sell) signal is taken based on positive<br />

(negative) momentum in the DAX / EUR/USD RS line only<br />

when the DAX / EUR/USD correlation is negative. After<br />

all, if the RS line is used to point out relative movement<br />

then it is likely to be more reliable if the correlation study<br />

also shows the potential for divergent movement on an<br />

absolute basis.<br />

Note that negative correlation is the additional<br />

condition for both long and short entry signals.<br />

The addition of this rule had a dramatic effect on<br />

profitability while reducing the number of trades by 55<br />

per cent to 752, or about three per day during the one-year<br />

test period. The per cent of trades profitable improved<br />

slightly to 43 per cent and maintained the characteristic<br />

of having about the same per cent profitable for long and<br />

short side trades.<br />

Source: www.stockcharts.com<br />

John Murphy explains<br />

Relative Strength Ratio<br />

„The relative strength ratio or line<br />

is created by dividing the price<br />

of one market by the price of another... Any two markets<br />

can be compared with ratios… Absolute performance<br />

measures the actual trend of a market. Relative performance<br />

measures its performance against other markets…. Relative<br />

performance usually changes direction before absolute<br />

performance.“<br />

Correlation Coefficient<br />

“The correlation coefficient measures the strength of a<br />

relationship between two markets… The most important<br />

signals are given when the correlation line moves above or<br />

below the zero line… The correlation coefficient indicator is<br />

especially helpful in intermarket analysis…”<br />

John Murphy, „Trading with Intermarket Analysis“<br />

Other Considerations<br />

In practice, several basic conditions had to be selected<br />

before detailing the trading signals. First, when to trade<br />

Given that the intention was to create a day-trading strategy,<br />

trading was restricted to only the hours when the cash DAX<br />

index is trading despite the fact that the futures (and EUR/<br />

USD) trade for additional hours outside those times.<br />

The first possible entry each day is at 9 am CET,<br />

the open of the first bar that corresponds with the cash<br />

index trading hours. The last entry signal may be taken<br />

no later than the open of the 5 pm bar, allowing time for<br />

price action to develop before the end-of-session exit.<br />

In accord with a day-trading strategy the end-of-session<br />

exit rule closes any open positions at the open of the 5.30<br />

pm bar, corresponding to the last bar of the cash index<br />

trading hours.<br />

Second, the bar interval to be used had to be<br />

determined. The hours noted above mean that, for our<br />

purposes, the length of the trading day is 510 minutes.<br />

Six-minute bars were used, which means the session<br />

is divided into 85 bars. This allows for adequate data<br />

sampling and an ample number of trading opportunities<br />

each day. In addition, short-duration bars offer a<br />

manageable risk/range per bar, particularly in light of the<br />

size of the DAX contract.<br />

42