Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

strategies<br />

www.tradersonline-mag.com 04.2014<br />

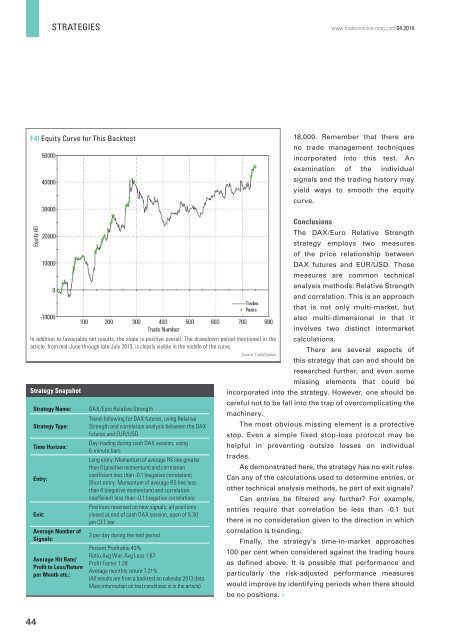

F4) Equity Curve for This Backtest<br />

18,000. Remember that there are<br />

no trade management techniques<br />

incorporated into this test. An<br />

examination of the individual<br />

signals and the trading history may<br />

yield ways to smooth the equity<br />

curve.<br />

In addition to favourable net results, the slope is positive overall. The drawdown period mentioned in the<br />

article, from mid-June through late July 2013, is clearly visible in the middle of the curve.<br />

Strategy Snapshot<br />

Strategy Name:<br />

Strategy Type:<br />

Time Horizon:<br />

Entry:<br />

Exit:<br />

Average Number of<br />

Signals:<br />

Average Hit Rate/<br />

Profit to Loss/Return<br />

per Month etc.:<br />

DAX/Euro Relative Strength<br />

Trend-following for DAX futures, using Relative<br />

Strength and correlation analysis between the DAX<br />

futures and EUR/USD<br />

Day-trading during cash DAX session, using<br />

6-minute bars<br />

Long entry: Momentum of average RS line greater<br />

than 0 (positive momentum) and correlation<br />

coefficient less than -0.1 (negative correlation)<br />

Short entry: Momentum of average RS line less<br />

than 0 (negative momentum) and correlation<br />

coefficient less than -0.1 (negative correlation)<br />

Positions reversed on new signals; all positions<br />

closed at end of cash DAX session, open of 5.30<br />

pm CET bar<br />

3 per day during the test period<br />

Percent Profitable 43%<br />

Ratio Avg Win: Avg Loss 1.67<br />

Profit Factor 1.28<br />

Average monthly return 7.21%<br />

(All results are from a backtest on calendar 2013 data.<br />

More information on test conditions is in the article)<br />

Conclusions<br />

The DAX/Euro Relative Strength<br />

strategy employs two measures<br />

of the price relationship between<br />

DAX futures and EUR/USD. Those<br />

measures are common technical<br />

analysis methods: Relative Strength<br />

and correlation. This is an approach<br />

that is not only multi-market, but<br />

also multi-dimensional in that it<br />

involves two distinct intermarket<br />

calculations.<br />

There are several aspects of<br />

Source: TradeStation<br />

this strategy that can and should be<br />

researched further, and even some<br />

missing elements that could be<br />

incorporated into the strategy. However, one should be<br />

careful not to be fall into the trap of overcomplicating the<br />

machinery.<br />

The most obvious missing element is a protective<br />

stop. Even a simple fixed stop-loss protocol may be<br />

helpful in preventing outsize losses on individual<br />

trades.<br />

As demonstrated here, the strategy has no exit rules.<br />

Can any of the calculations used to determine entries, or<br />

other technical analysis methods, be part of exit signals<br />

Can entries be filtered any further For example,<br />

entries require that correlation be less than -0.1 but<br />

there is no consideration given to the direction in which<br />

correlation is trending.<br />

Finally, the strategy’s time-in-market approaches<br />

100 per cent when considered against the trading hours<br />

as defined above. It is possible that performance and<br />

particularly the risk-adjusted performance measures<br />

would improve by identifying periods when there should<br />

be no positions. «<br />

44