Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ASICS<br />

www.tradersonline-mag.com 04.2014<br />

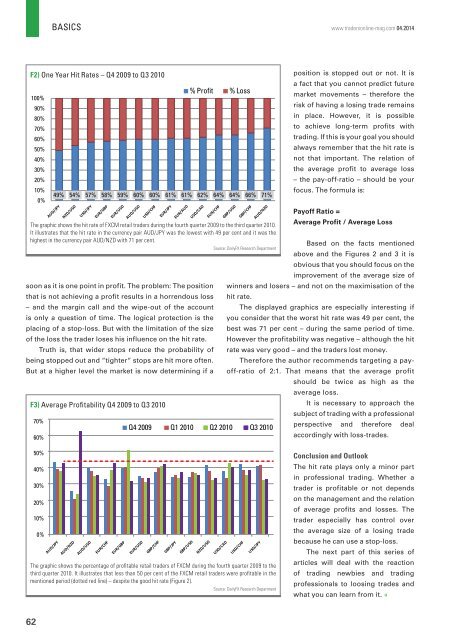

F2) One Year Hit Rates – Q4 2009 to Q3 2010<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

% Profit % Loss<br />

49% 54% 57% 58% 59% 60% 60% 61% 61% 62% 64% 64% 66% 71%<br />

position is stopped out or not. It is<br />

a fact that you cannot predict future<br />

market movements – therefore the<br />

risk of having a losing trade remains<br />

in place. However, it is possible<br />

to achieve long-term profits with<br />

trading. If this is your goal you should<br />

always remember that the hit rate is<br />

not that important. The relation of<br />

the average profit to average loss<br />

– the pay-off-ratio – should be your<br />

focus. The formula is:<br />

0%<br />

Payoff Ratio =<br />

The graphic shows the hit rate of FXCM retail traders during the fourth quarter 2009 to the third quarter 2010.<br />

Average Profit / Average Loss<br />

It illustrates that the hit rate in the currency pair AUD/JPY was the lowest with 49 per cent and it was the<br />

highest in the currency pair AUD/NZD with 71 per cent.<br />

Based on the facts mentioned<br />

Source: DailyFX Research Department<br />

above and the Figures 2 and 3 it is<br />

obvious that you should focus on the<br />

improvement of the average size of<br />

soon as it is one point in profit. The problem: The position<br />

that is not achieving a profit results in a horrendous loss<br />

– and the margin call and the wipe-out of the account<br />

is only a question of time. The logical protection is the<br />

placing of a stop-loss. But with the limitation of the size<br />

of the loss the trader loses his influence on the hit rate.<br />

Truth is, that wider stops reduce the probability of<br />

being stopped out and “tighter“ stops are hit more often.<br />

But at a higher level the market is now determining if a<br />

winners and losers – and not on the maximisation of the<br />

hit rate.<br />

The displayed graphics are especially interesting if<br />

you consider that the worst hit rate was 49 per cent, the<br />

best was 71 per cent – during the same period of time.<br />

However the profitability was negative – although the hit<br />

rate was very good – and the traders lost money.<br />

Therefore the author recommends targeting a payoff-ratio<br />

of 2:1. That means that the average profit<br />

should be twice as high as the<br />

average loss.<br />

F3) Average Profitability Q4 2009 to Q3 2010<br />

It is necessary to approach the<br />

subject of trading with a professional<br />

70%<br />

Q4 2009 Q1 2010 Q2 2010 Q3 2010<br />

perspective and therefore deal<br />

60%<br />

accordingly with loss-trades.<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

The graphic shows the percentage of profitable retail traders of FXCM during the fourth quarter 2009 to the<br />

third quarter 2010. It illustrates that less than 50 per cent of the FXCM retail traders were profitable in the<br />

mentioned period (dotted red line) – despite the good hit rate (Figure 2).<br />

Source: DailyFX Research Department<br />

Conclusion and Outlook<br />

The hit rate plays only a minor part<br />

in professional trading. Whether a<br />

trader is profitable or not depends<br />

on the management and the relation<br />

of average profits and losses. The<br />

trader especially has control over<br />

the average size of a losing trade<br />

because he can use a stop-loss.<br />

The next part of this series of<br />

articles will deal with the reaction<br />

of trading newbies and trading<br />

professionals to loosing trades and<br />

what you can learn from it. «<br />

62