You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

strategies<br />

With a little observation and<br />

a bit of experimentation you can<br />

create a simple trading strategy.<br />

assumes that the “blind“ following of the standard<br />

parameters is not successful. The same goes with the<br />

RSI – ultimately the market can stay in extremes for a<br />

long time if it is a strong trend – and that can lead to<br />

losses in trading.<br />

Modification of the Standard Parameters<br />

With a little observation and a bit of experimentation you<br />

can easily create a simple trading strategy even with old<br />

indicators. In our case the RSI is calculated based on 21<br />

candles instead of 14. Therefore the oscillator becomes<br />

slower and less volatile. Below 40 is oversold and the<br />

overbought-level is reached at the RSI-value of 80. We<br />

trade this system only long in the hourly chart. We hold a<br />

position overnight if necessary.<br />

Entry, Stop and Re-Entry<br />

Signal-generating is very easy with<br />

the RSI return strategy: If the RSI<br />

is below 40 at the close of a 1-hour<br />

candle a long-signal is generated.<br />

But it is only activated if the RSI then<br />

closes above this line on the 1-hour<br />

basis. The results of past years<br />

confirm that the return of the RSI –<br />

hence the name “RSI Return“ – is a<br />

wise approach compared to direct<br />

entry upon reaching the extremes.<br />

Therefore you avoid to “catching a<br />

falling knife”.<br />

There is no profit target with this<br />

strategy. You close the long-position,<br />

if the RSI climbs above 80 and then<br />

drops below.<br />

A trading strategy is only<br />

complete if the stop-loss is defined<br />

to limit the losses and to secure<br />

the book profits. In this strategy<br />

we use a 21-period ATR stop. At<br />

the entry we place the stop at the<br />

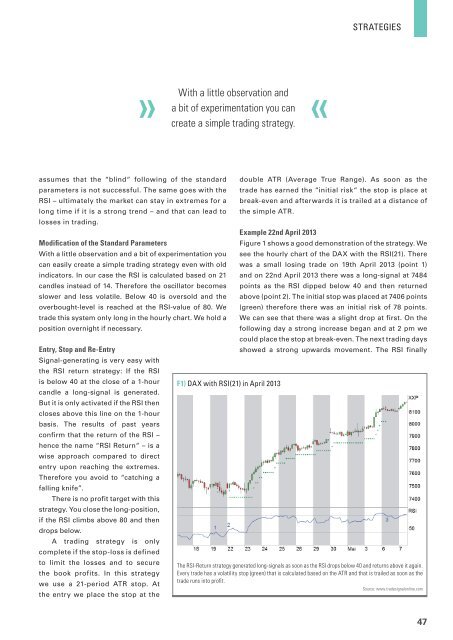

F1) DAX with RSI(21) in April 2013<br />

double ATR (Average True Range). As soon as the<br />

trade has earned the “initial risk“ the stop is place at<br />

break-even and afterwards it is trailed at a distance of<br />

the simple ATR.<br />

Example 22nd April 2013<br />

Figure 1 shows a good demonstration of the strategy. We<br />

see the hourly chart of the DAX with the RSI(21). There<br />

was a small losing trade on 19th April 2013 (point 1)<br />

and on 22nd April 2013 there was a long-signal at 7484<br />

points as the RSI dipped below 40 and then returned<br />

above (point 2). The initial stop was placed at 7406 points<br />

(green) therefore there was an initial risk of 78 points.<br />

We can see that there was a slight drop at first. On the<br />

following day a strong increase began and at 2 pm we<br />

could place the stop at break-even. The next trading days<br />

showed a strong upwards movement. The RSI finally<br />

The RSI-Return strategy generated long-signals as soon as the RSI drops below 40 and returns above it again.<br />

Every trade has a volatility stop (green) that is calculated based on the ATR and that is trailed as soon as the<br />

trade runs into profit.<br />

Source: www.tradesignalonline.com<br />

47