You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PEOPLE<br />

too conservative for some investors, but it’s another case<br />

of the turtle and the hare.<br />

TRADERS´: Many Hedge Funds tend to hire more and more<br />

PhDs of physics, statistics, biology, cybernetics. In my own<br />

trading, however, I still find the easy methods do work best.<br />

What do you think about that<br />

Kaufman: That’s a sensitive issue in the Hedge Fund<br />

business. Firms that allocate money to hedge funds seem<br />

to hold value in the number of PhDs in the company,<br />

assuming they are going to keep the strategies on the<br />

“cutting edge.” My personal experience is that’s not<br />

true. You need someone with solid math skills but also<br />

market experience. You can’t create a good strategy by<br />

discovering it on a computer. It must be a sound premise,<br />

and that will only come from observing the market and<br />

understanding the fundamentals. So a new PhD is not likely<br />

to be productive until she gets real market knowledge.<br />

On the other hand, an experienced floor trader can tell a<br />

quant an idea about the way the market reacts to, say an<br />

earnings shock, and the quant can then implement that.<br />

But then so could a regular smart programmer. So it’s the<br />

concept, not the math, that’s most important.<br />

TRADERS´: If you were handling $100 million in trading<br />

capital, how would you manage it in order to produce<br />

absolute returns Which markets, strategies, time frames<br />

Kaufman: You must know that’s proprietary information!<br />

If I tell you how I would manage that now, I would no longer<br />

have a competitive edge. I will say that large amounts of<br />

capital require either many fast trading systems or a few<br />

slow trading ones. That’s why probably more than 60 per<br />

cent of all systems traded are long term trend following.<br />

It works over time and you can trade large amounts on it.<br />

The faster the system, the less liquidity, so if you’re a firm<br />

with $20 billion under management, you’ll favour slow<br />

and concentrate on risk management.<br />

TRADERS´: Is there any other piece of advice you’d like to<br />

share<br />

Kaufman: Yes, I want everyone to remember that the<br />

market keeps changing and that there are patterns that<br />

will occur in the future that we’ve not seen in the past. I<br />

highly recommend a book by Dietrich Doerner, “The Logic<br />

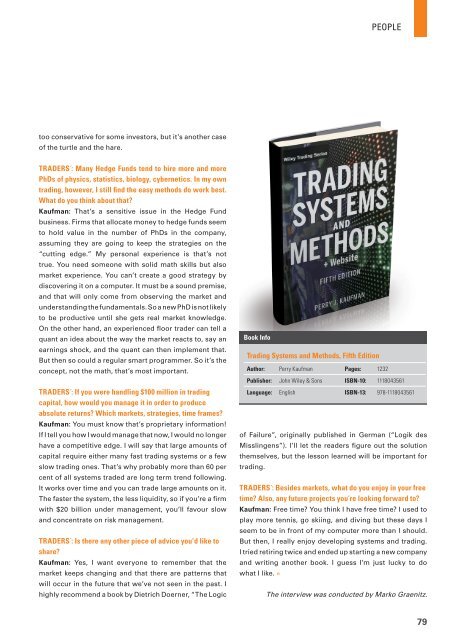

Book Info<br />

Trading Systems and Methods, Fifth Edition<br />

Author: Perry Kaufman Pages: 1232<br />

Publisher: John Wiley & Sons ISBN-10: 1118043561<br />

Language: English ISBN-13: 978-1118043561<br />

of Failure”, originally published in German (“Logik des<br />

Misslingens”). I’ll let the readers figure out the solution<br />

themselves, but the lesson learned will be important for<br />

trading.<br />

TRADERS´: Besides markets, what do you enjoy in your free<br />

time Also, any future projects you’re looking forward to<br />

Kaufman: Free time You think I have free time I used to<br />

play more tennis, go skiing, and diving but these days I<br />

seem to be in front of my computer more than I should.<br />

But then, I really enjoy developing systems and trading.<br />

I tried retiring twice and ended up starting a new company<br />

and writing another book. I guess I’m just lucky to do<br />

what I like. «<br />

The interview was conducted by Marko Graenitz.<br />

79