Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

strategies<br />

trading day. These trading decisions F1) The Cable Gains Stamina<br />

can have impact on our financial<br />

welfare: Therefore we want to be<br />

sure that we are making rational<br />

decisions as intraday traders.<br />

We have always been fascinated<br />

by the lines of the least resistance<br />

and ways of pinpointing them early.<br />

You probably know that there are no<br />

guarantees in the markets, but there<br />

are stages of breakthroughs in the<br />

trading career of serious traders.<br />

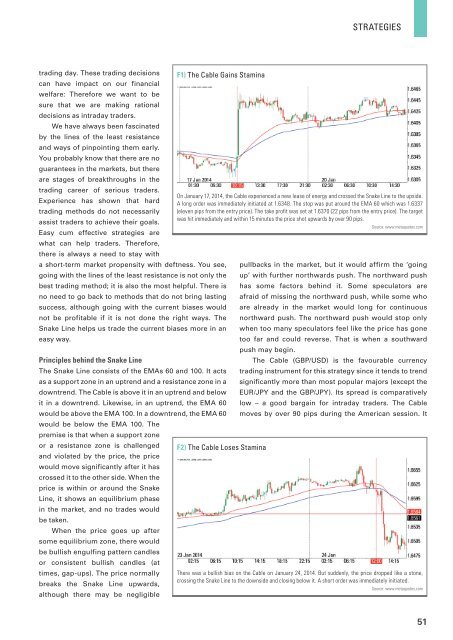

On January 17, 2014, the Cable experienced a new lease of energy and crossed the Snake Line to the upside.<br />

Experience has shown that hard A long order was immediately initiated at 1.6348. The stop was put around the EMA 60 which was 1.6337<br />

trading methods do not necessarily (eleven pips from the entry price). The take profit was set at 1.6370 (22 pips from the entry price). The target<br />

was hit immediately and within 15 minutes the price shot upwards by over 90 pips.<br />

assist traders to achieve their goals.<br />

Source: www.metaquotes.com<br />

Easy cum effective strategies are<br />

what can help traders. Therefore,<br />

there is always a need to stay with<br />

a short-term market propensity with deftness. You see, pullbacks in the market, but it would affirm the ‘going<br />

going with the lines of the least resistance is not only the up’ with further northwards push. The northward push<br />

best trading method; it is also the most helpful. There is has some factors behind it. Some speculators are<br />

no need to go back to methods that do not bring lasting afraid of missing the northward push, while some who<br />

success, although going with the current biases would are already in the market would long for continuous<br />

not be profitable if it is not done the right ways. The northward push. The northward push would stop only<br />

Snake Line helps us trade the current biases more in an when too many speculators feel like the price has gone<br />

easy way.<br />

too far and could reverse. That is when a southward<br />

push may begin.<br />

Principles behind the Snake Line<br />

The Cable (GBP/USD) is the favourable currency<br />

The Snake Line consists of the EMAs 60 and 100. It acts trading instrument for this strategy since it tends to trend<br />

as a support zone in an uptrend and a resistance zone in a significantly more than most popular majors (except the<br />

downtrend. The Cable is above it in an uptrend and below EUR/JPY and the GBP/JPY). Its spread is comparatively<br />

it in a downtrend. Likewise, in an uptrend, the EMA 60 low – a good bargain for intraday traders. The Cable<br />

would be above the EMA 100. In a downtrend, the EMA 60 moves by over 90 pips during the American session. It<br />

would be below the EMA 100. The<br />

premise is that when a support zone<br />

or a resistance zone is challenged F2) The Cable Loses Stamina<br />

and violated by the price, the price<br />

would move significantly after it has<br />

crossed it to the other side. When the<br />

price is within or around the Snake<br />

Line, it shows an equilibrium phase<br />

in the market, and no trades would<br />

be taken.<br />

When the price goes up after<br />

some equilibrium zone, there would<br />

be bullish engulfing pattern candles<br />

or consistent bullish candles (at<br />

times, gap-ups). The price normally There was a bullish bias on the Cable on January 24, 2014. But suddenly, the price dropped like a stone,<br />

crossing the Snake Line to the downside and closing below it. A short order was immediately initiated.<br />

breaks the Snake Line upwards,<br />

Source: www.metaquotes.com<br />

although there may be negligible<br />

51