You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

People<br />

» TRADERS´: Financials markets are not exactly where your<br />

career started. When did you first hear about the markets<br />

and trading<br />

Kaufman: After leaving aerospace in 1970, I started<br />

my own computer company. We were automating<br />

government medical reimbursements (had I known, I<br />

should have stayed in that field!). Someone came to us<br />

and asked if we could research a way to hedge options.<br />

At that time there was really nothing done on a computer<br />

and the only options were London. IBM wasn’t interested,<br />

so they found someone with mathematical background.<br />

We did that and one thing led to another.<br />

TRADERS´: What was the reason to change your career and<br />

stay with financial markets<br />

Kaufman: After the options project we had a client who<br />

challenged us to beat him trading the market using<br />

mathematics. We were to get a large percentage of<br />

anything we could earn better than him. That was 1972.<br />

We did really well, hitting the Russian wheat deal in<br />

1973 that drove grains up 300 per cent. Unfortunately,<br />

we didn’t beat him because everyone does well in a bull<br />

market. But I was hooked on the markets by then and<br />

never looked anywhere else.<br />

TRADERS´: Over the years and with your growing expertise,<br />

what did you learn and how did you change in the way you<br />

approach the markets<br />

Kaufman: A big question. I’ve learned a lot about the markets<br />

but overall have come full circle. I’ve developed every type<br />

of system, fast and slow, done well<br />

with most, badly with a few, but in<br />

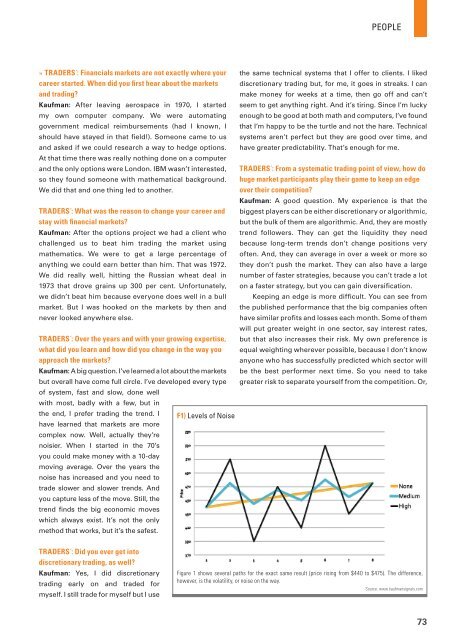

the end, I prefer trading the trend. I F1) Levels of Noise<br />

have learned that markets are more<br />

complex now. Well, actually they’re<br />

noisier. When I started in the 70’s<br />

you could make money with a 10-day<br />

moving average. Over the years the<br />

noise has increased and you need to<br />

trade slower and slower trends. And<br />

you capture less of the move. Still, the<br />

trend finds the big economic moves<br />

which always exist. It’s not the only<br />

method that works, but it’s the safest.<br />

the same technical systems that I offer to clients. I liked<br />

discretionary trading but, for me, it goes in streaks. I can<br />

make money for weeks at a time, then go off and can’t<br />

seem to get anything right. And it’s tiring. Since I’m lucky<br />

enough to be good at both math and computers, I’ve found<br />

that I’m happy to be the turtle and not the hare. Technical<br />

systems aren’t perfect but they are good over time, and<br />

have greater predictability. That’s enough for me.<br />

TRADERS´: From a systematic trading point of view, how do<br />

huge market participants play their game to keep an edge<br />

over their competition<br />

Kaufman: A good question. My experience is that the<br />

biggest players can be either discretionary or algorithmic,<br />

but the bulk of them are algorithmic. And, they are mostly<br />

trend followers. They can get the liquidity they need<br />

because long-term trends don’t change positions very<br />

often. And, they can average in over a week or more so<br />

they don’t push the market. They can also have a large<br />

number of faster strategies, because you can’t trade a lot<br />

on a faster strategy, but you can gain diversification.<br />

Keeping an edge is more difficult. You can see from<br />

the published performance that the big companies often<br />

have similar profits and losses each month. Some of them<br />

will put greater weight in one sector, say interest rates,<br />

but that also increases their risk. My own preference is<br />

equal weighting wherever possible, because I don’t know<br />

anyone who has successfully predicted which sector will<br />

be the best performer next time. So you need to take<br />

greater risk to separate yourself from the competition. Or,<br />

TRADERS´: Did you ever get into<br />

discretionary trading, as well<br />

Kaufman: Yes, I did discretionary<br />

trading early on and traded for<br />

myself. I still trade for myself but I use<br />

Figure 1 shows several paths for the exact same result (price rising from $440 to $475). The difference,<br />

however, is the volatility, or noise on the way.<br />

Source: www.kaufmansignals.com<br />

73