You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

People<br />

www.tradersonline-mag.com 04.2014<br />

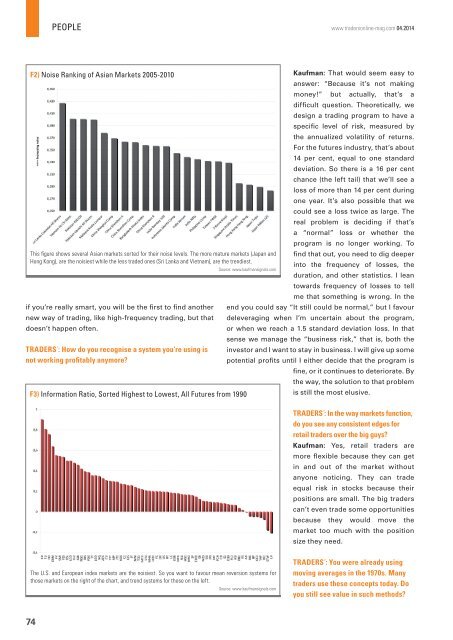

F2) Noise Ranking of Asian Markets 2005-2010<br />

Kaufman: That would seem easy to<br />

answer: “Because it’s not making<br />

money!” but actually, that’s a<br />

difficult question. Theoretically, we<br />

design a trading program to have a<br />

specific level of risk, measured by<br />

the annualized volatility of returns.<br />

For the futures industry, that’s about<br />

14 per cent, equal to one standard<br />

deviation. So there is a 16 per cent<br />

chance (the left tail) that we’ll see a<br />

loss of more than 14 per cent during<br />

one year. It’s also possible that we<br />

could see a loss twice as large. The<br />

real problem is deciding if that’s<br />

a “normal” loss or whether the<br />

program is no longer working. To<br />

This figure shows several Asian markets sorted for their noise levels. The more mature markets (Japan and find that out, you need to dig deeper<br />

Hong Kong), are the noisiest while the less traded ones (Sri Lanka and Vietnam), are the trendiest.<br />

into the frequency of losses, the<br />

Source: www.kaufmansignals.com<br />

duration, and other statistics. I lean<br />

towards frequency of losses to tell<br />

me that something is wrong. In the<br />

if you’re really smart, you will be the first to find another end you could say “It still could be normal,” but I favour<br />

new way of trading, like high-frequency trading, but that deleveraging when I’m uncertain about the program,<br />

doesn’t happen often.<br />

or when we reach a 1.5 standard deviation loss. In that<br />

sense we manage the “business risk,” that is, both the<br />

TRADERS´: How do you recognise a system you’re using is investor and I want to stay in business. I will give up some<br />

not working profitably anymore<br />

potential profits until I either decide that the program is<br />

fine, or it continues to deteriorate. By<br />

the way, the solution to that problem<br />

F3) Information Ratio, Sorted Highest to Lowest, All Futures from 1990<br />

is still the most elusive.<br />

TRADERS´: In the way markets function,<br />

do you see any consistent edges for<br />

retail traders over the big guys<br />

Kaufman: Yes, retail traders are<br />

more flexible because they can get<br />

in and out of the market without<br />

anyone noticing. They can trade<br />

equal risk in stocks because their<br />

positions are small. The big traders<br />

can’t even trade some opportunities<br />

because they would move the<br />

market too much with the position<br />

size they need.<br />

The U.S. and European index markets are the noisiest. So you want to favour mean reversion systems for<br />

those markets on the right of the chart, and trend systems for those on the left.<br />

Source: www.kaufmansignals.com<br />

TRADERS´: You were already using<br />

moving averages in the 1970s. Many<br />

traders use these concepts today. Do<br />

you still see value in such methods<br />

74