You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BASICS<br />

Two days later I was able to hold<br />

through the volatility because I was using<br />

end of day stop losses.<br />

Scaling-In<br />

Two days later I was able to hold through the volatility<br />

because I was using end of day stop losses. My original<br />

stop was SPY closing below the 10 day moving average<br />

thus invalidating the break out. It sliced through but<br />

quickly recovered to close higher. Three days later SPY<br />

was able to close above the 50 day moving average with<br />

power. So I added the other half of my account ($130,000)<br />

to bring my position size to $260,000 total. I moved my<br />

end of day stop at this point to under the 50 day.<br />

I held as SPY gapped up and was in a price base for<br />

a few days. I then moved my end of day stop to the 5<br />

day exponential moving average. After a few days it<br />

then gapped up again to $170 and finished at the low of<br />

the day with a nasty black candle.<br />

I stayed in and kept my stop at the<br />

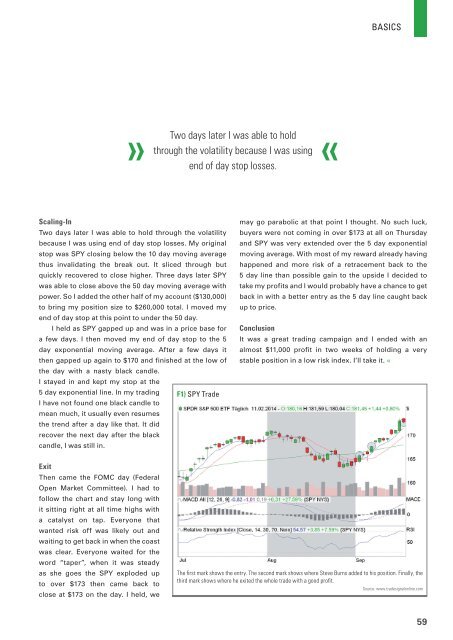

5 day exponential line. In my trading F1) SPY Trade<br />

I have not found one black candle to<br />

mean much, it usually even resumes<br />

the trend after a day like that. It did<br />

recover the next day after the black<br />

candle, I was still in.<br />

may go parabolic at that point I thought. No such luck,<br />

buyers were not coming in over $173 at all on Thursday<br />

and SPY was very extended over the 5 day exponential<br />

moving average. With most of my reward already having<br />

happened and more risk of a retracement back to the<br />

5 day line than possible gain to the upside I decided to<br />

take my profits and I would probably have a chance to get<br />

back in with a better entry as the 5 day line caught back<br />

up to price.<br />

Conclusion<br />

It was a great trading campaign and I ended with an<br />

almost $11,000 profit in two weeks of holding a very<br />

stable position in a low risk index. I’ll take it. «<br />

Exit<br />

Then came the FOMC day (Federal<br />

Open Market Committee). I had to<br />

follow the chart and stay long with<br />

it sitting right at all time highs with<br />

a catalyst on tap. Everyone that<br />

wanted risk off was likely out and<br />

waiting to get back in when the coast<br />

was clear. Everyone waited for the<br />

word “taper”, when it was steady<br />

as she goes the SPY exploded up<br />

to over $173 then came back to<br />

close at $173 on the day. I held, we<br />

The first mark shows the entry. The second mark shows where Steve Burns added to his position. Finally, the<br />

third mark shows where he exited the whole trade with a good profit.<br />

Source: www.tradesignalonline.com<br />

59