You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

strategies<br />

www.tradersonline-mag.com 04.2014<br />

Strategy Snapshot<br />

Strategy Name:<br />

Strategy Type:<br />

Time Frame:<br />

Setup:<br />

Entry:<br />

Stop-Loss:<br />

Trailing Stop:<br />

Target:<br />

Risk- and Money<br />

Management:<br />

Average Number of<br />

Signals:<br />

Average Hit Rate &<br />

Profit to Loss:<br />

RSI Return Strategy<br />

Swing trading<br />

Hourly chart<br />

Entry after a downtrend or correction, RSI(21) is<br />

the signal generator<br />

Entry long as soon as the RSI(21) drops below<br />

40 and afterwards closes above this level on the<br />

1-hour close<br />

Double ATR(21) as initial stop<br />

As soon as the trade has earned its risk<br />

the ATR(21) stop is placed<br />

RSI reaches the upper extreme (80)<br />

on the 1-hour close<br />

0.5% to 1% per trade<br />

2-6 per month<br />

Hit rate about 45%, profit/loss about 2<br />

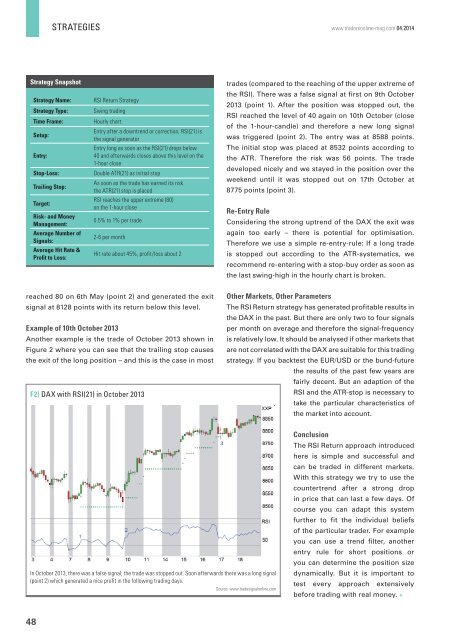

trades (compared to the reaching of the upper extreme of<br />

the RSI). There was a false signal at first on 9th October<br />

2013 (point 1). After the position was stopped out, the<br />

RSI reached the level of 40 again on 10th October (close<br />

of the 1-hour-candle) and therefore a new long signal<br />

was triggered (point 2). The entry was at 8588 points.<br />

The initial stop was placed at 8532 points according to<br />

the ATR. Therefore the risk was 56 points. The trade<br />

developed nicely and we stayed in the position over the<br />

weekend until it was stopped out on 17th October at<br />

8775 points (point 3).<br />

Re-Entry Rule<br />

Considering the strong uptrend of the DAX the exit was<br />

again too early – there is potential for optimisation.<br />

Therefore we use a simple re-entry-rule: If a long trade<br />

is stopped out according to the ATR-systematics, we<br />

recommend re-entering with a stop-buy order as soon as<br />

the last swing-high in the hourly chart is broken.<br />

reached 80 on 6th May (point 2) and generated the exit<br />

signal at 8128 points with its return below this level.<br />

Example of 10th October 2013<br />

Another example is the trade of October 2013 shown in<br />

Figure 2 where you can see that the trailing stop causes<br />

the exit of the long position – and this is the case in most<br />

F2) DAX with RSI(21) in October 2013<br />

Other Markets, Other Parameters<br />

The RSI Return strategy has generated profitable results in<br />

the DAX in the past. But there are only two to four signals<br />

per month on average and therefore the signal-frequency<br />

is relatively low. It should be analysed if other markets that<br />

are not correlated with the DAX are suitable for this trading<br />

strategy. If you backtest the EUR/USD or the bund-future<br />

the results of the past few years are<br />

fairly decent. But an adaption of the<br />

RSI and the ATR-stop is necessary to<br />

take the particular characteristics of<br />

the market into account.<br />

In October 2013, there was a false signal; the trade was stopped out. Soon afterwards there was a long signal<br />

(point 2) which generated a nice profit in the following trading days.<br />

Source: www.tradesignalonline.com<br />

Conclusion<br />

The RSI Return approach introduced<br />

here is simple and successful and<br />

can be traded in different markets.<br />

With this strategy we try to use the<br />

countertrend after a strong drop<br />

in price that can last a few days. Of<br />

course you can adapt this system<br />

further to fit the individual beliefs<br />

of the particular trader. For example<br />

you can use a trend filter, another<br />

entry rule for short positions or<br />

you can determine the position size<br />

dynamically. But it is important to<br />

test every approach extensively<br />

before trading with real money. «<br />

48