You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BASICS<br />

The strategy consists of waiting<br />

for the breakout of one of the box<br />

extremes and trade in this direction.<br />

» Darvas Boxes<br />

The Darvas Boxes study follows the basics of any<br />

other price channel patterns based study: While price<br />

remains inside the range, we assume that the price<br />

movement is going to follow its normal course for a<br />

while. However, if some of the extremes are broken by<br />

price action, the expected reaction will be a change in<br />

the price behaviour and probably the beginning of a<br />

new trend. In the following article we will explain the<br />

functioning of this tool and also the trading rules to be<br />

used with it.<br />

Calculating the Limits<br />

Before going into detail on the information provided by<br />

the Darvas boxes, we are going to explain their calculation<br />

procedures.<br />

The high and low levels formed by each of the boxes<br />

are obtained by following these<br />

steps:<br />

1. We establish the top price of the<br />

box at the high of the current<br />

session.<br />

2. Once this top has been obtained,<br />

we monitor price to see if this<br />

level is broken by the price<br />

action during the following two<br />

sessions. If this level is broken,<br />

we start again.<br />

3. If we find a top that has not<br />

been violated over the latest two<br />

sessions, we save it and store the<br />

low price of the current session<br />

as a base for the box.<br />

4. Now we note this base and<br />

monitor it over the following two<br />

sessions, in order to see if the<br />

base is violated or not. If the base<br />

is violated, we move back to step<br />

3, in other words, we update the<br />

base again. Likewise, if the top<br />

value of the box is violated by the price action, then<br />

we move back again to the beginning, this being step<br />

1.<br />

5. If step 5 is reached, a Darvas Box will be consolidated<br />

and will be formed by the duo TOP/BASE that has not<br />

been violated, at least, over the latest two sessions.<br />

After step 5 the process is repeated by keeping the<br />

last box until a new one appears.<br />

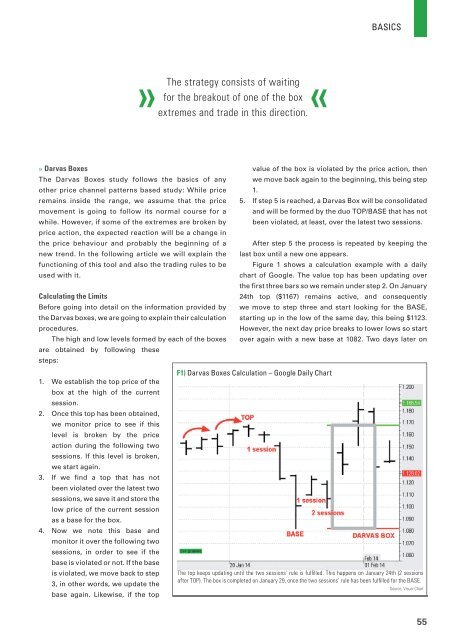

Figure 1 shows a calculation example with a daily<br />

chart of Google. The value top has been updating over<br />

the first three bars so we remain under step 2. On January<br />

24th top ($1167) remains active, and consequently<br />

we move to step three and start looking for the BASE,<br />

starting up in the low of the same day, this being $1123.<br />

However, the next day price breaks to lower lows so start<br />

over again with a new base at 1082. Two days later on<br />

F1) Darvas Boxes Calculation – Google Daily Chart<br />

The top keeps updating until the two sessions’ rule is fulfilled. This happens on January 24th (2 sessions<br />

after TOP). The box is completed on January 29, once the two sessions’ rule has been fulfilled for the BASE.<br />

Source: Visual Chart<br />

55