MCDA Final Report Malawi - Standards and Trade Development ...

MCDA Final Report Malawi - Standards and Trade Development ...

MCDA Final Report Malawi - Standards and Trade Development ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

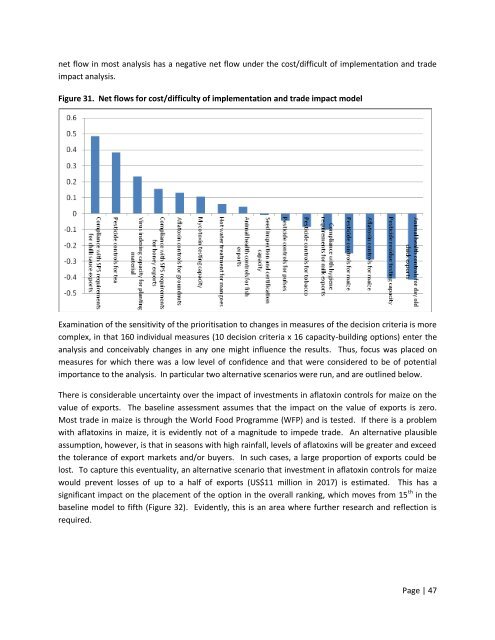

net flow in most analysis has a negative net flow under the cost/difficult of implementation <strong>and</strong> trade<br />

impact analysis.<br />

Figure 31. Net flows for cost/difficulty of implementation <strong>and</strong> trade impact model<br />

Examination of the sensitivity of the prioritisation to changes in measures of the decision criteria is more<br />

complex, in that 160 individual measures (10 decision criteria x 16 capacity-building options) enter the<br />

analysis <strong>and</strong> conceivably changes in any one might influence the results. Thus, focus was placed on<br />

measures for which there was a low level of confidence <strong>and</strong> that were considered to be of potential<br />

importance to the analysis. In particular two alternative scenarios were run, <strong>and</strong> are outlined below.<br />

There is considerable uncertainty over the impact of investments in aflatoxin controls for maize on the<br />

value of exports. The baseline assessment assumes that the impact on the value of exports is zero.<br />

Most trade in maize is through the World Food Programme (WFP) <strong>and</strong> is tested. If there is a problem<br />

with aflatoxins in maize, it is evidently not of a magnitude to impede trade. An alternative plausible<br />

assumption, however, is that in seasons with high rainfall, levels of aflatoxins will be greater <strong>and</strong> exceed<br />

the tolerance of export markets <strong>and</strong>/or buyers. In such cases, a large proportion of exports could be<br />

lost. To capture this eventuality, an alternative scenario that investment in aflatoxin controls for maize<br />

would prevent losses of up to a half of exports (US$11 million in 2017) is estimated. This has a<br />

significant impact on the placement of the option in the overall ranking, which moves from 15 th in the<br />

baseline model to fifth (Figure 32). Evidently, this is an area where further research <strong>and</strong> reflection is<br />

required.<br />

Page | 47