ey-global-tax-policy-outlook-for-2015

ey-global-tax-policy-outlook-for-2015

ey-global-tax-policy-outlook-for-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The number of countries reporting an<br />

increase in the overall CIT burden <strong>for</strong> <strong>2015</strong> is<br />

accelerating slightly, from 26% in 2014 to 31%<br />

(10 of the 32 countries surv<strong>ey</strong>ed) in <strong>2015</strong>.<br />

The reductions are relatively marginal:<br />

Australia (–1.5 percentage points (pp));<br />

<br />

Portugal (–2pp); Spain (–2pp); and the<br />

<br />

reduction is a <strong>for</strong>ecast and is not based<br />

on a known proposal. The other 24<br />

countries all <strong>for</strong>ecast steady headline CIT<br />

rates, and Chile is alone in announcing a<br />

CIT rate increase in <strong>2015</strong>. Australia and<br />

Spain both stand out as unusual cases<br />

in <strong>2015</strong>, together <strong>for</strong>ecasting headline<br />

CIT rate reductions and a parallel overall<br />

increase in the CIT burden.<br />

While the incidence of CIT rate reductions<br />

seems to be slowing very slightly (22% of<br />

countries surv<strong>ey</strong>ed are <strong>for</strong>ecasting a rate<br />

reduction in <strong>2015</strong>, versus 26% in 2014),)<br />

the number of countries reporting an<br />

increase in the overall CIT burden <strong>for</strong><br />

<strong>2015</strong> is accelerating, albeit mildly — from<br />

26% in 2014 to 31% (10 of 32 countries)<br />

<br />

rate, broad-based trend continues to be<br />

<br />

<br />

Japan, Portugal and the United Kingdom)<br />

<strong>for</strong>ecast a decreased CIT burden <strong>for</strong><br />

<strong>2015</strong>, with the remaining 17 countries<br />

<strong>for</strong>ecasting a stable CIT burden in <strong>2015</strong>.<br />

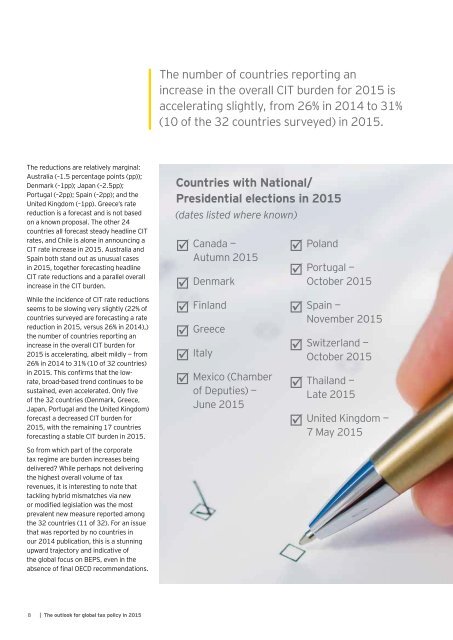

Countries with National/<br />

Presidential elections in <strong>2015</strong><br />

(dates listed where known)<br />

Canada —<br />

Autumn <strong>2015</strong><br />

<br />

Finland<br />

<br />

Italy<br />

<br />

Mexico (Chamber<br />

<br />

June <strong>2015</strong><br />

Poland<br />

Portugal —<br />

<br />

Spain —<br />

November <strong>2015</strong><br />

Switzerland —<br />

<br />

Thailand —<br />

Late <strong>2015</strong><br />

<br />

United Kingdom —<br />

7 May <strong>2015</strong><br />

So from which part of the corporate<br />

<strong>tax</strong> regime are burden increases being<br />

delivered While perhaps not delivering<br />

the highest overall volume of <strong>tax</strong><br />

revenues, it is interesting to note that<br />

tackling hybrid mismatches via new<br />

<br />

prevalent new measure reported among<br />

the 32 countries (11 of 32). For an issue<br />

that was reported by no countries in<br />

our 2014 publication, this is a stunning<br />

upward trajectory and indicative of<br />

the <strong>global</strong> focus on BEPS, even in the<br />

<br />

8 | The <strong>outlook</strong> <strong>for</strong> <strong>global</strong> <strong>tax</strong> <strong>policy</strong> in <strong>2015</strong>