ey-global-tax-policy-outlook-for-2015

ey-global-tax-policy-outlook-for-2015

ey-global-tax-policy-outlook-for-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Chile<br />

Tax <strong>policy</strong><br />

Pablo Greiber<br />

pablo.greiber@cl.<strong>ey</strong>.com<br />

+56 2 2676 1260<br />

1<br />

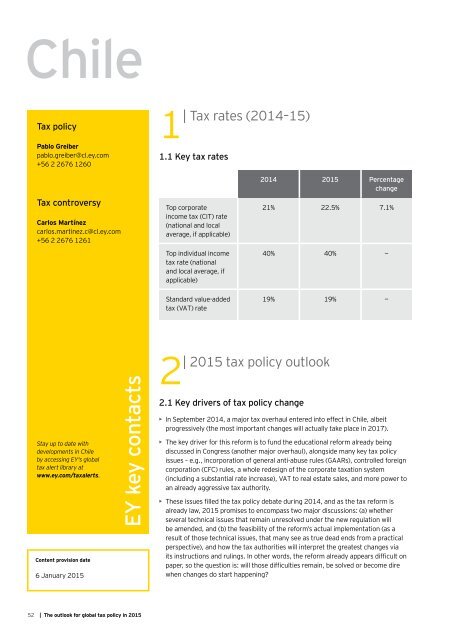

| Tax rates (2014–15)<br />

1.1 K<strong>ey</strong> <strong>tax</strong> rates<br />

Tax controversy<br />

Carlos Martínez<br />

carlos.martinez.c@cl.<strong>ey</strong>.com<br />

+56 2 2676 1261<br />

Top corporate<br />

income <strong>tax</strong> (CIT) rate<br />

(national and local<br />

average, if applicable)<br />

Top individual income<br />

<strong>tax</strong> rate (national<br />

and local average, if<br />

applicable)<br />

2014 <strong>2015</strong> Percentage<br />

change<br />

21% 22.5% 7.1%<br />

40% 40% —<br />

Standard value-added<br />

<strong>tax</strong> (VAT) rate<br />

19% 19% —<br />

Stay up to date with<br />

developments in Chile<br />

by accessing EY's <strong>global</strong><br />

<strong>tax</strong> alert library at<br />

www.<strong>ey</strong>.com/<strong>tax</strong>alerts.<br />

Content provision date<br />

6 January <strong>2015</strong><br />

EY k<strong>ey</strong> contacts<br />

2<br />

| <strong>2015</strong> <strong>tax</strong> <strong>policy</strong> <strong>outlook</strong><br />

2.1 K<strong>ey</strong> drivers of <strong>tax</strong> <strong>policy</strong> change<br />

• In September 2014, a major <strong>tax</strong> overhaul entered into effect in Chile, albeit<br />

progressively (the most important changes will actually take place in 2017).<br />

• The k<strong>ey</strong> driver <strong>for</strong> this re<strong>for</strong>m is to fund the educational re<strong>for</strong>m already being<br />

discussed in Congress (another major overhaul), alongside many k<strong>ey</strong> <strong>tax</strong> <strong>policy</strong><br />

<br />

corporation (CFC) rules, a whole redesign of the corporate <strong>tax</strong>ation system<br />

(including a substantial rate increase), VAT to real estate sales, and more power to<br />

an already aggressive <strong>tax</strong> authority.<br />

• <br />

already law, <strong>2015</strong> promises to encompass two major discussions: (a) whether<br />

several technical issues that remain unresolved under the new regulation will<br />

be amended, and (b) the feasibility of the re<strong>for</strong>m’s actual implementation (as a<br />

result of those technical issues, that many see as true dead ends from a practical<br />

perspective), and how the <strong>tax</strong> authorities will interpret the greatest changes via<br />

<br />

<br />

when changes do start happening<br />

52 | The <strong>outlook</strong> <strong>for</strong> <strong>global</strong> <strong>tax</strong> <strong>policy</strong> in <strong>2015</strong>