ey-global-tax-policy-outlook-for-2015

ey-global-tax-policy-outlook-for-2015

ey-global-tax-policy-outlook-for-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

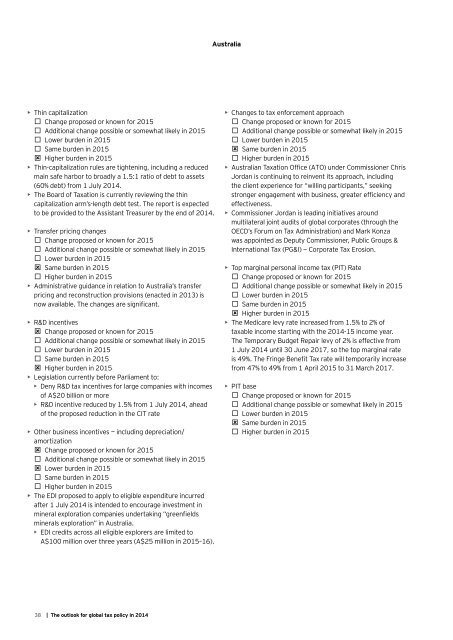

Australia<br />

• Thin capitalization<br />

<br />

<br />

<br />

<br />

<br />

• Thin-capitalization rules are tightening, including a reduced<br />

main safe harbor to broadly a 1.5:1 ratio of debt to assets<br />

(60% debt) from 1 July 2014.<br />

• The Board of Taxation is currently reviewing the thin<br />

capitalization arm’s-length debt test. The report is expected<br />

to be provided to the Assistant Treasurer by the end of 2014.<br />

• Transfer pricing changes<br />

<br />

<br />

<br />

<br />

Higher burden in <strong>2015</strong><br />

• Administrative guidance in relation to Australia’s transfer<br />

pricing and reconstruction provisions (enacted in 2013) is<br />

<br />

• <br />

<br />

<br />

<br />

<br />

Higher burden in <strong>2015</strong><br />

• Legislation currently be<strong>for</strong>e Parliament to:<br />

• <br />

of A$20 billion or more<br />

• <br />

of the proposed reduction in the CIT rate<br />

• <br />

amortization<br />

<br />

<br />

<br />

<br />

Higher burden in <strong>2015</strong><br />

• <br />

after 1 July 2014 is intended to encourage investment in<br />

<br />

minerals exploration” in Australia.<br />

• <br />

A$100 million over three years (A$25 million in <strong>2015</strong>–16).<br />

• Changes to <strong>tax</strong> en<strong>for</strong>cement approach<br />

<br />

<br />

<br />

<br />

Higher burden in <strong>2015</strong><br />

• <br />

Jordan is continuing to reinvent its approach, including<br />

the client experience <strong>for</strong> “willing participants,” seeking<br />

<br />

effectiveness.<br />

• Commissioner Jordan is leading initiatives around<br />

multilateral joint audits of <strong>global</strong> corporates (through the<br />

<br />

<br />

<br />

• Top marginal personal income <strong>tax</strong> (PIT) Rate<br />

<br />

<br />

<br />

<br />

Higher burden in <strong>2015</strong><br />

• The Medicare levy rate increased from 1.5% to 2% of<br />

<strong>tax</strong>able income starting with the 2014-15 income year.<br />

The Temporary Budget Repair levy of 2% is effective from<br />

1 July 2014 until 30 June 2017, so the top marginal rate<br />

<br />

<br />

• PIT base<br />

<br />

<br />

<br />

<br />

<br />

38 | The <strong>outlook</strong> <strong>for</strong> <strong>global</strong> <strong>tax</strong> <strong>policy</strong> in 2014