ey-global-tax-policy-outlook-for-2015

ey-global-tax-policy-outlook-for-2015

ey-global-tax-policy-outlook-for-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Poland<br />

Tax <strong>policy</strong><br />

Zbigniew Liptak<br />

zbigniew.liptak@pl.<strong>ey</strong>.com<br />

+48 22 557 7025<br />

1<br />

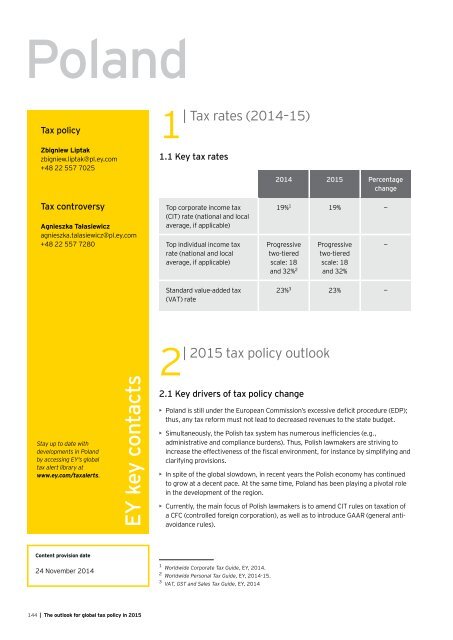

| Tax rates (2014–15)<br />

1.1 K<strong>ey</strong> <strong>tax</strong> rates<br />

2014 <strong>2015</strong> Percentage<br />

change<br />

Tax controversy<br />

<br />

agnieszka.talasiewicz@pl.<strong>ey</strong>.com<br />

+48 22 557 7280<br />

Top corporate income <strong>tax</strong><br />

(CIT) rate (national and local<br />

average, if applicable)<br />

Top individual income <strong>tax</strong><br />

rate (national and local<br />

average, if applicable)<br />

19% 1 19% —<br />

Progressive<br />

two-tiered<br />

scale: 18<br />

and 32% 2<br />

Progressive<br />

two-tiered<br />

scale: 18<br />

and 32%<br />

—<br />

Standard value-added <strong>tax</strong><br />

(VAT) rate<br />

23% 3 23% —<br />

Stay up to date with<br />

developments in Poland<br />

by accessing EY's <strong>global</strong><br />

<strong>tax</strong> alert library at<br />

www.<strong>ey</strong>.com/<strong>tax</strong>alerts.<br />

EY k<strong>ey</strong> contacts<br />

2<br />

| <strong>2015</strong> <strong>tax</strong> <strong>policy</strong> <strong>outlook</strong><br />

2.1 K<strong>ey</strong> drivers of <strong>tax</strong> <strong>policy</strong> change<br />

• <br />

thus, any <strong>tax</strong> re<strong>for</strong>m must not lead to decreased revenues to the state budget.<br />

• <br />

administrative and compliance burdens). Thus, Polish lawmakers are striving to<br />

<br />

clarifying provisions.<br />

• In spite of the <strong>global</strong> slowdown, in recent years the Polish economy has continued<br />

to grow at a decent pace. At the same time, Poland has been playing a pivotal role<br />

in the development of the region.<br />

• Currently, the main focus of Polish lawmakers is to amend CIT rules on <strong>tax</strong>ation of<br />

<br />

avoidance rules).<br />

Content provision date<br />

24 November 2014<br />

1 Worldwide Corporate Tax Guide, EY, 2014.<br />

2 Worldwide Personal Tax Guide, EY, 2014-15.<br />

3 VAT, GST and Sales Tax Guide, EY, 2014<br />

144 | The <strong>outlook</strong> <strong>for</strong> <strong>global</strong> <strong>tax</strong> <strong>policy</strong> in <strong>2015</strong>