ey-global-tax-policy-outlook-for-2015

ey-global-tax-policy-outlook-for-2015

ey-global-tax-policy-outlook-for-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Australia<br />

Tax <strong>policy</strong><br />

Alf Capito<br />

alf.capito@au.<strong>ey</strong>.com<br />

+61 2 8295 6473<br />

Tony Stolarek<br />

tony.stolarek@au.<strong>ey</strong>.com<br />

+61 3 8650 7654<br />

1<br />

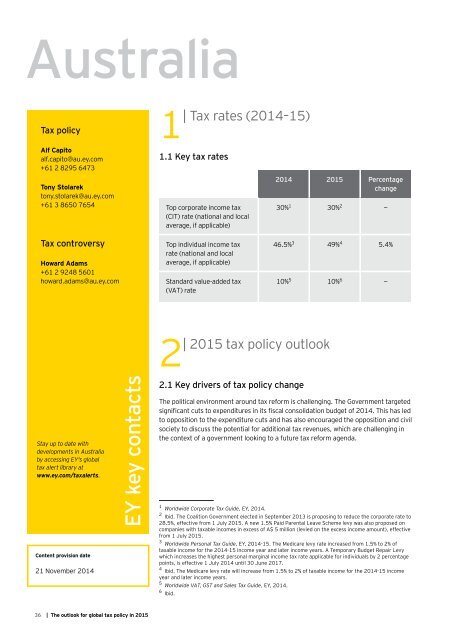

| Tax rates (2014–15)<br />

1.1 K<strong>ey</strong> <strong>tax</strong> rates<br />

Top corporate income <strong>tax</strong><br />

(CIT) rate (national and local<br />

average, if applicable)<br />

2014 <strong>2015</strong> Percentage<br />

change<br />

30% 1 30% 2 —<br />

Tax controversy<br />

Howard Adams<br />

+61 2 9248 5601<br />

howard.adams@au.<strong>ey</strong>.com<br />

Top individual income <strong>tax</strong><br />

rate (national and local<br />

average, if applicable)<br />

Standard value-added <strong>tax</strong><br />

(VAT) rate<br />

46.5% 3 49% 4 5.4%<br />

10% 5 10% 6 —<br />

Stay up to date with<br />

developments in Australia<br />

by accessing EY's <strong>global</strong><br />

<strong>tax</strong> alert library at<br />

www.<strong>ey</strong>.com/<strong>tax</strong>alerts.<br />

Content provision date<br />

21 November 2014<br />

EY k<strong>ey</strong> contacts<br />

2<br />

| <strong>2015</strong> <strong>tax</strong> <strong>policy</strong> <strong>outlook</strong><br />

2.1 K<strong>ey</strong> drivers of <strong>tax</strong> <strong>policy</strong> change<br />

<br />

<br />

to opposition to the expenditure cuts and has also encouraged the opposition and civil<br />

society to discuss the potential <strong>for</strong> additional <strong>tax</strong> revenues, which are challenging in<br />

the context of a government looking to a future <strong>tax</strong> re<strong>for</strong>m agenda.<br />

1 Worldwide Corporate Tax Guide, EY, 2014.<br />

2 <br />

28.5%, effective from 1 July <strong>2015</strong>. A new 1.5% Paid Parental Leave Scheme levy was also proposed on<br />

companies with <strong>tax</strong>able incomes in excess of A$ 5 million (levied on the excess income amount), effective<br />

from 1 July <strong>2015</strong>.<br />

3 Worldwide Personal Tax Guide, EY, 2014-15. The Medicare levy rate increased from 1.5% to 2% of<br />

<strong>tax</strong>able income <strong>for</strong> the 2014-15 income year and later income years. A Temporary Budget Repair Levy<br />

which increases the highest personal marginal income <strong>tax</strong> rate applicable <strong>for</strong> individuals by 2 percentage<br />

points, is effective 1 July 2014 until 30 June 2017.<br />

4 Ibid. The Medicare levy rate will increase from 1.5% to 2% of <strong>tax</strong>able income <strong>for</strong> the 2014-15 income<br />

year and later income years.<br />

5 Worldwide VAT, GST and Sales Tax Guide, EY, 2014.<br />

6 Ibid.<br />

36 | The <strong>outlook</strong> <strong>for</strong> <strong>global</strong> <strong>tax</strong> <strong>policy</strong> in <strong>2015</strong>