ey-global-tax-policy-outlook-for-2015

ey-global-tax-policy-outlook-for-2015

ey-global-tax-policy-outlook-for-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

South Korea<br />

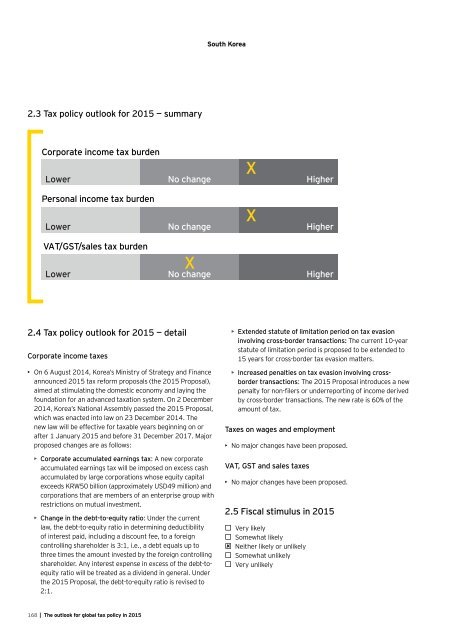

2.3 Tax <strong>policy</strong> <strong>outlook</strong> <strong>for</strong> <strong>2015</strong> — summary<br />

Corporate income <strong>tax</strong> burden<br />

Lower No change Higher<br />

Personal income <strong>tax</strong> burden<br />

Lower No change Higher<br />

VAT/GST/sales <strong>tax</strong> burden<br />

X<br />

Lower No change Higher<br />

X<br />

X<br />

2.4 Tax <strong>policy</strong> <strong>outlook</strong> <strong>for</strong> <strong>2015</strong> — detail<br />

Corporate income <strong>tax</strong>es<br />

• <br />

announced <strong>2015</strong> <strong>tax</strong> re<strong>for</strong>m proposals (the <strong>2015</strong> Proposal),<br />

aimed at stimulating the domestic economy and laying the<br />

<br />

2014, Korea’s National Assembly passed the <strong>2015</strong> Proposal,<br />

<br />

new law will be effective <strong>for</strong> <strong>tax</strong>able years beginning on or<br />

<br />

proposed changes are as follows:<br />

• Corporate accumulated earnings <strong>tax</strong>: A new corporate<br />

accumulated earnings <strong>tax</strong> will be imposed on excess cash<br />

accumulated by large corporations whose equity capital<br />

<br />

corporations that are members of an enterprise group with<br />

restrictions on mutual investment.<br />

• Change in the debt-to-equity ratio: Under the current<br />

law, the debt-to-equity ratio in determining deductibility<br />

of interest paid, including a discount fee, to a <strong>for</strong>eign<br />

controlling shareholder is 3:1, i.e., a debt equals up to<br />

three times the amount invested by the <strong>for</strong>eign controlling<br />

shareholder. Any interest expense in excess of the debt-toequity<br />

ratio will be treated as a dividend in general. Under<br />

the <strong>2015</strong> Proposal, the debt-to-equity ratio is revised to<br />

2:1.<br />

• Extended statute of limitation period on <strong>tax</strong> evasion<br />

involving cross-border transactions: The current 10-year<br />

statute of limitation period is proposed to be extended to<br />

15 years <strong>for</strong> cross-border <strong>tax</strong> evasion matters.<br />

• Increased penalties on <strong>tax</strong> evasion involving crossborder<br />

transactions: The <strong>2015</strong> Proposal introduces a new<br />

<br />

by cross-border transactions. The new rate is 60% of the<br />

amount of <strong>tax</strong>.<br />

Taxes on wages and employment<br />

• No major changes have been proposed.<br />

VAT, GST and sales <strong>tax</strong>es<br />

• No major changes have been proposed.<br />

2.5 Fiscal stimulus in <strong>2015</strong><br />

<br />

<br />

<br />

<br />

<br />

168 | The <strong>outlook</strong> <strong>for</strong> <strong>global</strong> <strong>tax</strong> <strong>policy</strong> in <strong>2015</strong>