non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Form M 2009 Guidebook<br />

Self Assessment System<br />

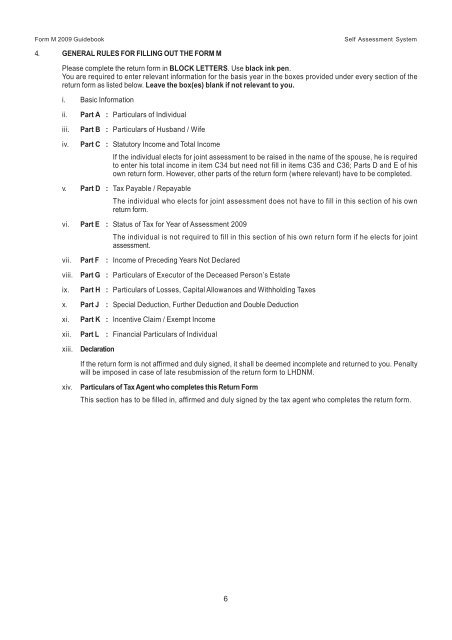

4. GENERAL RULES FOR FILLING OUT THE FORM M<br />

Please complete the return form in BLOCK LETTERS. Use black ink pen.<br />

You are required to enter relevant information for the basis year in the boxes provided under every section of the<br />

return form as listed below. Leave the box(es) blank if not relevant to you.<br />

i. Basic Information<br />

ii. Part A : Particulars of Individual<br />

iii. Part B : Particulars of Husband / Wife<br />

iv. Part C : Statutory Income and Total Income<br />

If the <strong>individual</strong> elects for joint assessment to be raised in the name of the spouse, he is required<br />

to enter his total <strong>income</strong> in item C34 but need not fill in items C35 and C36; Parts D and E of his<br />

own return form. However, other parts of the return form (where relevant) have to be completed.<br />

v. Part D : Tax Payable / Repayable<br />

The <strong>individual</strong> who elects for joint assessment does not have to fill in this section of his own<br />

return form.<br />

vi. Part E : Status of Tax for Year of Assessment 2009<br />

The <strong>individual</strong> is not required to fill in this section of his own return form if he elects for joint<br />

assessment.<br />

vii. Part F : Income of Preceding Years Not Declared<br />

viii. Part G : Particulars of Executor of the Deceased Person’s Estate<br />

ix. Part H : Particulars of Losses, Capital Allowances and Withholding Taxes<br />

x. Part J : Special Deduction, Further Deduction and Double Deduction<br />

xi. Part K : Incentive Claim / Exempt Income<br />

xii. Part L : Financial Particulars of Individual<br />

xiii.<br />

Declaration<br />

If the return form is not affirmed and duly signed, it shall be deemed incomplete and returned to you. Penalty<br />

will be imposed in case of late resubmission of the return form to LHDNM.<br />

xiv.<br />

Particulars of Tax Agent who completes this Return Form<br />

This section has to be filled in, affirmed and duly signed by the <strong>tax</strong> agent who completes the return form.<br />

6