non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

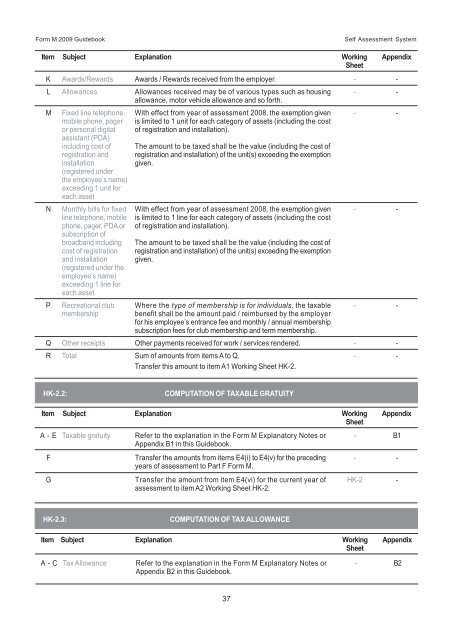

Form M 2009 Guidebook Self Assessment System<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

K Awards/Rewards Awards / Rewards received from the employer. - -<br />

L Allowances Allowances received may be of various types such as housing - -<br />

allowance, motor vehicle allowance and so forth.<br />

M Fixed line telephone, With effect from year of assessment 2008, the exemption given - -<br />

mobile phone, pager is limited to 1 unit for each category of assets (including the cost<br />

or personal digital of registration and installation).<br />

assistant (PDA)<br />

including cost of The amount to be <strong>tax</strong>ed shall be the value (including the cost of<br />

registration and registration and installation) of the unit(s) exceeding the exemption<br />

installation<br />

given.<br />

(registered under<br />

the employee’s name)<br />

exceeding 1 unit for<br />

each asset<br />

N Monthly bills for fixed With effect from year of assessment 2008, the exemption given - -<br />

line telephone, mobile is limited to 1 line for each category of assets (including the cost<br />

phone, pager, PDA or of registration and installation).<br />

subscription of<br />

broadband including The amount to be <strong>tax</strong>ed shall be the value (including the cost of<br />

cost of registration registration and installation) of the unit(s) exceeding the exemption<br />

and installation given.<br />

(registered under the<br />

employee’s name)<br />

exceeding 1 line for<br />

each asset<br />

P Recreational club Where the type of membership is for <strong>individual</strong>s, the <strong>tax</strong>able - -<br />

membership<br />

benefit shall be the amount paid / reimbursed by the employer<br />

for his employee’s entrance fee and monthly / annual membership<br />

subscription fees for club membership and term membership.<br />

Q Other receipts Other payments received for work / services rendered. - -<br />

R Total Sum of amounts from items A to Q. - -<br />

Transfer this amount to item A1 Working Sheet HK-2.<br />

HK-2.2: COMPUTATION OF TAXABLE GRATUITY<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

A - E Taxable gratuity Refer to the explanation in the Form M Explanatory Notes or - B1<br />

Appendix B1 in this Guidebook.<br />

F Transfer the amounts from items E4(i) to E4(v) for the preceding - -<br />

years of assessment to Part F Form M.<br />

G Transfer the amount from item E4(vi) for the current year of HK-2 -<br />

assessment to item A2 Working Sheet HK-2.<br />

HK-2.3: COMPUTATION OF TAX ALLOWANCE<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

A - C Tax Allowance Refer to the explanation in the Form M Explanatory Notes or - B2<br />

Appendix B2 in this Guidebook.<br />

37