non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

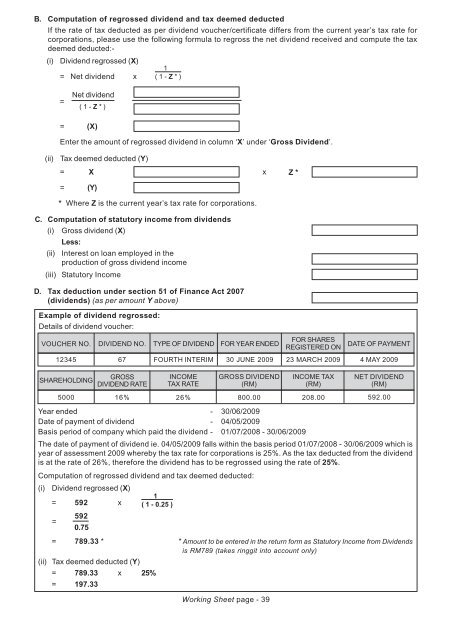

B. Computation of regrossed dividend and <strong>tax</strong> deemed deducted<br />

If the rate of <strong>tax</strong> deducted as per dividend voucher/certificate differs from the current year’s <strong>tax</strong> rate for<br />

corporations, please use the following formula to regross the net dividend received and compute the <strong>tax</strong><br />

deemed deducted:-<br />

(i) Dividend regrossed (X)<br />

1<br />

= Net dividend x ( 1 - Z * )<br />

=<br />

Net dividend<br />

( 1 - Z * )<br />

= (X)<br />

Enter the amount of regrossed dividend in column ‘X’ under ‘Gross Dividend’.<br />

(ii)<br />

Tax deemed deducted (Y)<br />

= X<br />

= (Y)<br />

* Where Z is the current year’s <strong>tax</strong> rate for corporations.<br />

C. Computation of statutory <strong>income</strong> from dividends<br />

(i) Gross dividend (X)<br />

Less:<br />

(ii) Interest on loan employed in the<br />

production of gross dividend <strong>income</strong><br />

(iii) Statutory Income<br />

D. Tax deduction under section 51 of Finance Act 2007<br />

(dividends) (as per amount Y above)<br />

Example of dividend regrossed:<br />

Details of dividend voucher:<br />

x<br />

Z *<br />

VOUCHER NO. DIVIDEND NO. TYPE OF DIVIDEND FOR YEAR ENDED<br />

FOR SHARES<br />

REGISTERED ON<br />

DATE OF PAYMENT<br />

12345 67 FOURTH INTERIM 30 JUNE 2009 23 MARCH 2009 4 MAY 2009<br />

SHAREHOLDING<br />

GROSS<br />

DIVIDEND RATE<br />

INCOME<br />

TAX RATE<br />

GROSS DIVIDEND<br />

(RM)<br />

INCOME TAX<br />

(RM)<br />

NET DIVIDEND<br />

(RM)<br />

5000 16%<br />

26%<br />

800.00 208.00 592.00<br />

Year ended - 30/06/2009<br />

Date of payment of dividend - 04/05/2009<br />

Basis period of company which paid the dividend - 01/07/2008 - 30/06/2009<br />

The date of payment of dividend ie. 04/05/2009 falls within the basis period 01/07/2008 - 30/06/2009 which is<br />

year of assessment 2009 whereby the <strong>tax</strong> rate for corporations is 25%. As the <strong>tax</strong> deducted from the dividend<br />

is at the rate of 26%, therefore the dividend has to be regrossed using the rate of 25%.<br />

Computation of regrossed dividend and <strong>tax</strong> deemed deducted:<br />

(i)<br />

Dividend regrossed (X)<br />

= 592 x<br />

=<br />

592<br />

0.75<br />

1<br />

( 1 - 0.25 )<br />

= 789.33 * * Amount to be entered in the return form as Statutory Income from Dividends<br />

is RM789 (takes ringgit into account only)<br />

(ii) Tax deemed deducted (Y)<br />

= 789.33 x 25%<br />

= 197.33<br />

Working Sheet page - 39