non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Form M 2009 Guidebook<br />

Self Assessment System<br />

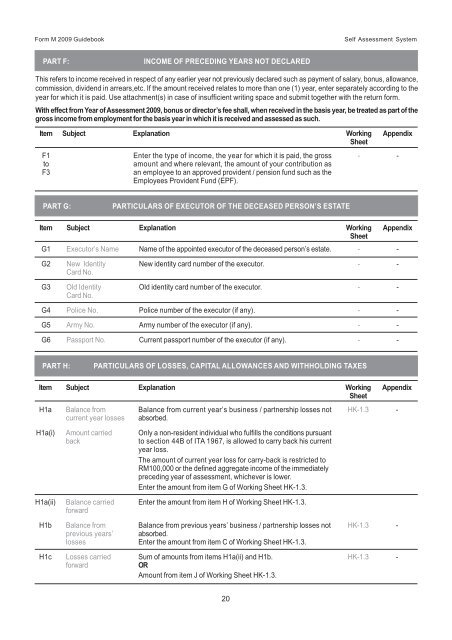

PART F:<br />

INCOME OF PRECEDING YEARS NOT DECLARED<br />

This refers to <strong>income</strong> received in respect of any earlier year not previously declared such as payment of salary, bonus, allowance,<br />

commission, dividend in arrears,etc. If the amount received relates to more than one (1) year, enter separately according to the<br />

year for which it is paid. Use attachment(s) in case of insufficient writing space and submit together with the return form.<br />

With effect from Year of Assessment 2009, bonus or director’s fee shall, when received in the basis year, be treated as part of the<br />

gross <strong>income</strong> from employment for the basis year in which it is received and assessed as such.<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

F1 Enter the type of <strong>income</strong>, the year for which it is paid, the gross - -<br />

to<br />

F3<br />

amount and where relevant, the amount of your contribution as<br />

an employee to an approved provident / pension fund such as the<br />

Employees Provident Fund (EPF).<br />

PART G: PARTICULARS OF EXECUTOR OF THE DECEASED PERSON’S ESTATE<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

G1 Executor’s Name Name of the appointed executor of the deceased person’s estate. - -<br />

G2 New Identity New identity card number of the executor. - -<br />

Card No.<br />

G3 Old Identity Old identity card number of the executor. - -<br />

Card No.<br />

G4 Police No. Police number of the executor (if any). - -<br />

G5 Army No. Army number of the executor (if any). - -<br />

G6 Passport No. Current passport number of the executor (if any). - -<br />

PART H: PARTICULARS OF LOSSES, CAPITAL ALLOWANCES AND WITHHOLDING TAXES<br />

Item Subject Explanation Working Appendix<br />

Sheet<br />

H1a Balance from Balance from current year’s business / partnership losses not HK-1.3 -<br />

current year losses absorbed.<br />

H1a(i) Amount carried Only a <strong>non</strong>-<strong>resident</strong> <strong>individual</strong> who fulfills the conditions pursuant<br />

back<br />

to section 44B of ITA 1967, is allowed to carry back his current<br />

year loss.<br />

The amount of current year loss for carry-back is restricted to<br />

RM100,000 or the defined aggregate <strong>income</strong> of the immediately<br />

preceding year of assessment, whichever is lower.<br />

Enter the amount from item G of Working Sheet HK-1.3.<br />

H1a(ii) Balance carried Enter the amount from item H of Working Sheet HK-1.3.<br />

forward<br />

H1b Balance from Balance from previous years’ business / partnership losses not HK-1.3 -<br />

previous years’ absorbed.<br />

losses<br />

Enter the amount from item C of Working Sheet HK-1.3.<br />

H1c Losses carried Sum of amounts from items H1a(ii) and H1b. HK-1.3 -<br />

forward<br />

OR<br />

Amount from item J of Working Sheet HK-1.3.<br />

20