non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

non-resident individual income tax - Lembaga Hasil Dalam Negeri

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Form M 2009 Guidebook<br />

Self Assessment System<br />

APPENDIX B1:<br />

GRATUITY<br />

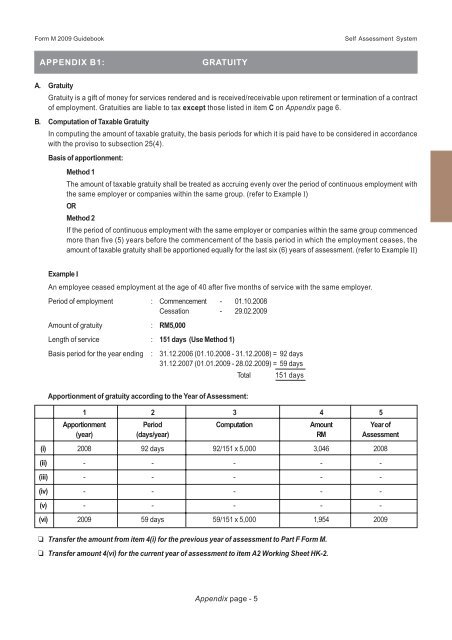

A. Gratuity<br />

Gratuity is a gift of money for services rendered and is received/receivable upon retirement or termination of a contract<br />

of employment. Gratuities are liable to <strong>tax</strong> except those listed in item C on Appendix page 6.<br />

B. Computation of Taxable Gratuity<br />

In computing the amount of <strong>tax</strong>able gratuity, the basis periods for which it is paid have to be considered in accordance<br />

with the proviso to subsection 25(4).<br />

Basis of apportionment:<br />

Method 1<br />

The amount of <strong>tax</strong>able gratuity shall be treated as accruing evenly over the period of continuous employment with<br />

the same employer or companies within the same group. (refer to Example I)<br />

OR<br />

Method 2<br />

If the period of continuous employment with the same employer or companies within the same group commenced<br />

more than five (5) years before the commencement of the basis period in which the employment ceases, the<br />

amount of <strong>tax</strong>able gratuity shall be apportioned equally for the last six (6) years of assessment. (refer to Example II)<br />

Example I<br />

An employee ceased employment at the age of 40 after five months of service with the same employer.<br />

Period of employment : Commencement - 01.10.2008<br />

Cessation - 29.02.2009<br />

Amount of gratuity : RM5,000<br />

Length of service : 151 days (Use Method 1)<br />

Basis period for the year ending : 31.12.2006 (01.10.2008 - 31.12.2008) = 92 days<br />

31.12.2007 (01.01.2009 - 28.02.2009) = 59 days<br />

Total 151 days<br />

Apportionment of gratuity according to the Year of Assessment:<br />

1 2 3 4 5<br />

Apportionment Period Computation Amount Year of<br />

(year) (days/year) RM Assessment<br />

(i) 2008 92 days 92/151 x 5,000 3,046 2008<br />

(ii) - - - - -<br />

(iii) - - - - -<br />

(iv) - - - - -<br />

(v) - - - - -<br />

(vi) 2009 59 days 59/151 x 5,000 1,954 2009<br />

Transfer the amount from item 4(i) for the previous year of assessment to Part F Form M.<br />

Transfer amount 4(vi) for the current year of assessment to item A2 Working Sheet HK-2.<br />

Appendix page - 5